Qatar, the tiny gulf state that bought the world

The new owner of Harrods has used its huge gas reserves to finance a global spending spree. Cahal Milmo reports

For more than 120 years, Harrods has traded under its suitably select Latin motto "Omnia Omnibus Ubique": "All Things for All People, Everywhere". As global aspirations go, such a logo was always perhaps a little overstated for a retail empire with just one, admittedly eye-catching, outlet in Knightsbridge.

Now, after a century or so of peddling consumer durables – from Ceylon tea to ruby-encrusted shoes guarded by a cobra – to a clientele that encompasses Oscar Wilde, A A Milne, Russian plutocrats and visiting VIPs, it seems that the Harrods brand may finally be about to live up to its slogan thanks to the rise and rise of an Arabian emirate the size of Yorkshire which has £43bn burning a hole in its very deep pockets.

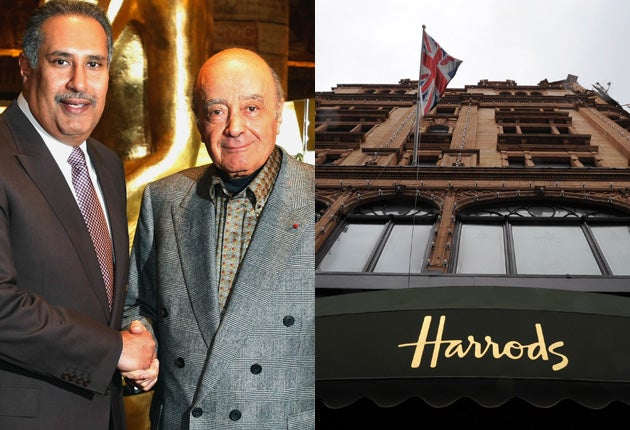

Qatar Holding, one of the investment arms of the hugely-wealthy Qatar state and royal family, signalled yesterday that it is considering opening a new flagship Harrods shop in China after it completed a £1.5bn deal on Saturday to buy London's department store from Mohamed al-Fayed.

After flying to Britain to close the deal, the Qatari Prime Minister, Sheikh Hamad bin Jassim bin Jabr al-Thani, who is also chairman of Qatar Holding, completed a tour of his latest purchase, which boasts no fewer than 330 departments as well as 28 restaurants, and made what is becoming a very familiar statement about a further acquisition for his nation's vast sovereign wealth fund.

Sheikh Thani said: "I can assure you that Qatar Holding will do their best to upgrade this monument to make it even better for tourism and also for the British people. Harrods will add much value to our international portfolio of investments."

In 2005, the Qatar Investment Authority (QIA), the parent company of Qatar Holding and its $65bn (£44bn) spending fund, was set up with a view to maximising the country's return from a vast carbon-driven windfall. Already respectably wealthy on the back its oil reserves, Qatar struck gold in the late 1990s when technology was perfected allowing large quantities of natural gas to be liquified and transported by tanker ship to grateful clients.

By an accident of geography, this one-time impoverished British protectorate, whose earnings once came largely from pearl fishing, now finds itself sitting on 26 trillion cubic metres of gas – the world's third largest reserve – and, as a consequence, a per capita income of $83,000 that is second on the planet only to the banking enclave of Liechtenstein.

The advent of sovereign wealth funds – those seemingly bottomless reserves of state-owned money available for investment by cash-rich countries – has been one of the more dramatic developments on the world's stock exchanges in recent years. But none can match the speed and scale with which Qatar has set about spending its surplus cash to acquire, either in whole or in part, some of the oldest and biggest companies in markets from Britain and France to Morocco, Sudan, the Seychelles and Indonesia.

After securing a sizable stake in the London Stock Exchange three years ago, the QIA has moved with almost breathtaking speed to buy shares in the Sainsbury's supermarket chain, the Barclays and Credit Suisse banks and the third-largest stake in Volkswagen. There has even been a deal between the country and Fidel Castro's Communist Cuba to build a 250-bedroom luxury hotel on the island's Cayo Largo. Altogether, the spending spree so far is estimated to have reached £45bn.

One City analyst told The Independent: "The Qataris are not frittering away their cash. They have a well thought-out strategy aimed at securing stable and long-term returns. But there should be no doubt that they are also looking to buy and buy big."

With global stock markets still trying to shrug off the effects of a brutal recession, Qatar and other sovereign wealth funds have increased their assets by nearly 20 per cent in the last nine months. And nowhere has Qatar's "buy big" strategy been more in evidence than in the UK.

The Thani family, who have traditionally kept a lower profile than the equestrian-obsessed Maktoums of Dubai or Saudi Arabia's House of Fahd, have close personal links to Britain. Qatar's ruler, Emir Hamad bin Khalifa al-Thani, was trained at Sandhurst and, such was his admiration for Dorset's Sherborne public school, where his son was educated, that a branch was set up in the desert sands of Doha, the Qatari capital.

The fact that the pound had fallen by nearly 10 per cent against the dollar in recent weeks and the FTSE index of retailers dipped by 5 per cent this year also helped to persuade the doges of Doha that the time was right for a spot of shopping in London – in the shape of the million square feet of Brompton Road real estate occupied by Harrods.

Qatar Holding and its advisers are thought to have driven a hard bargain, pushing down Mr Fayed's initial asking price from £2bn. The Egyptian tycoon, whose 25-year tenure as owner of Harrods was one of the more colourful in the shop's history, had initially insisted his most prized asset was not up for sale. Just two weeks ago, Mr Fayed, 77, said: "People approach us from Kuwait, Saudi Arabia, Qatar. Fair enough. But I put two fingers up to them. It is not for sale. This is not Marks and Spencer or Sainsbury's. It is a special place that gives people pleasure. There is only one Mecca."

In the end it seems that the offer was too good to refuse for a shop that has bucked retail trends by increasing its 2009 revenues to £752m, but only turned in a relatively modest profit of £56m. With its swirling Art Nouveau windows, baroque domes and terracotta tile-clad brickwork, Harrods has changed from being the grandiose store-of-choice for Britain's Edwardian aristocracy to being as much of a fixture on London's tourist itinerary as the Tower of London.

Certainly, the Qataris are hoping to take that allure to a wider audience. The Financial Times reported yesterday that Harrods' new owners are considering opening a "branch" in Shanghai.

A source said: "Conventional wisdom is that it would be unwise to open in Paris, New York or Madrid, because people there are close enough to be drawn to London. There have been significant discussions about whether to open in Shanghai. But will it be sufficiently far away and different from London not to cannibalise the brand?"

It is unclear quite what Qatar Holding – which has pledged to keep in place Harrods' current management and has appointed Mr Fayed as an honorary chairman – will do in the long term with the company's smorgasbord of additional activities, which include an aircraft-leasing business and a bank selling "off-the-shelf" gold bullion. Whether the Egyptian room in Harrods, which is adorned with several busts of Mr Fayed, will remain untouched is unknown.

But it is likely the Thani dynasty, whose determination not to upset the House of Windsor recently saw another of their investment vehicles tear up plans for the £3bn redesign of Chelsea Barracks after Prince Charles criticised the design as too modern, will seek to restore one of the department store's previous attributes – the long row of royal warrants that once adorned its shopfront.

In 2000, the Duke of Edinburgh announced he was withdrawing his patronage from Harrods because of a "significant decline in the trading relationship" between Buckingham Palace and the store. Privately, the royal household made it known that the duke had been angered by Mr Fayed's oft-repeated allegation that he had masterminded the 1997 crash in Paris which killed Princess Diana and the tycoon's son, Dodi.

Soon afterwards, Mr Fayed decided not to renew his three other remaining warrants, saying the Queen's husband was "perfectly entitled" to buy his shirts elsewhere. Yesterday, a source close to Qatar Holding let it be known that it would be "keen to renegotiate with the Royal Family" over regaining the Windsors' stamp of approval.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks