Students’ concern over finances is affecting their mental health, says poll

Government urged to step in as respondents reveal they are considering work in the sex industry to cope with money pressures

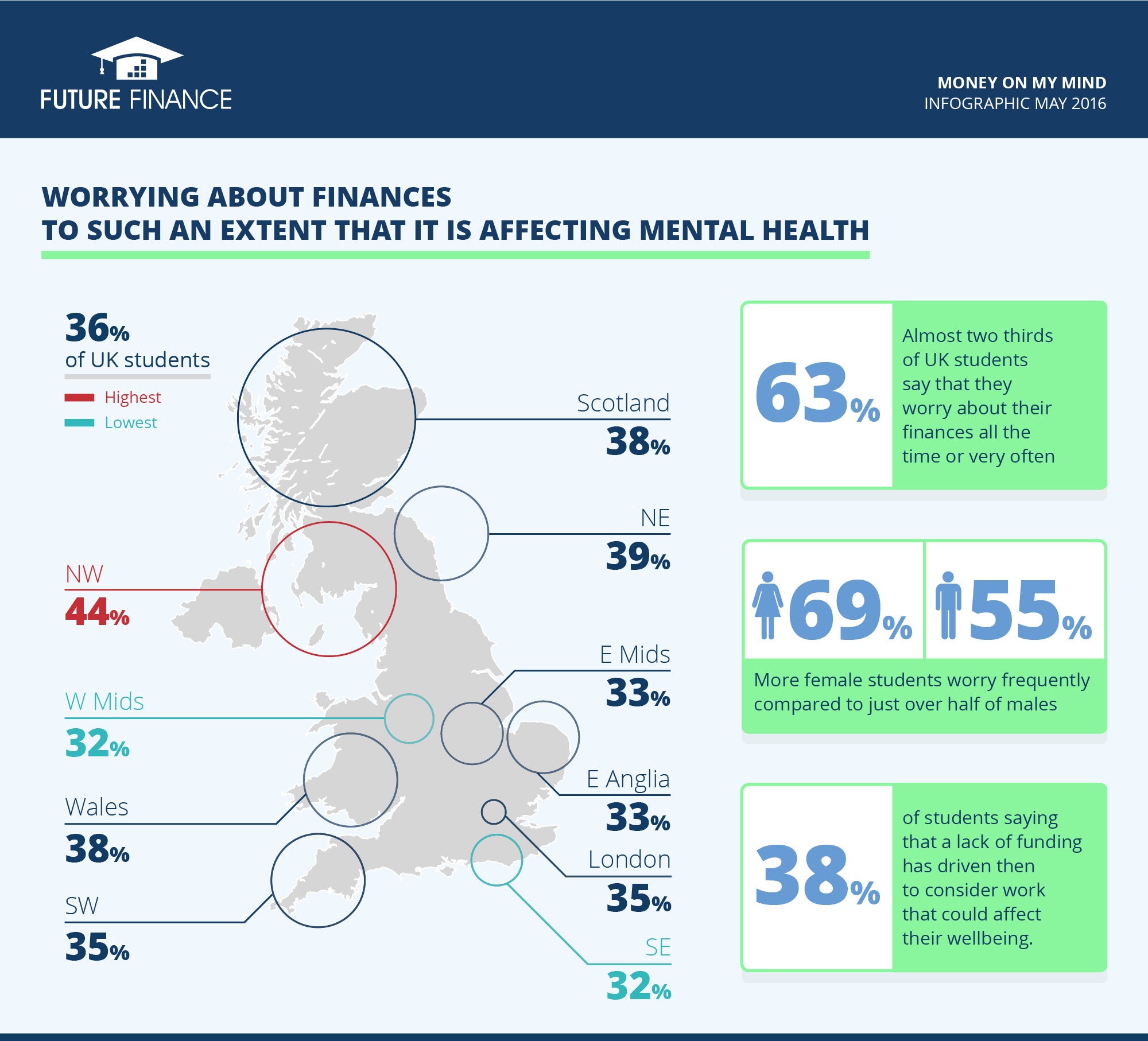

More than a third of students are worrying about their finances to such an extent that it is affecting their mental health, according to an alarming new survey.

In a poll of just over 2,050 students, key findings have shown that, overall, 63 per cent of students from across the UK are worrying about their finances all the time or very often.

As well as this, the survey revealed how 38 per cent are considering work that could affect their wellbeing, including shift or night work, and medical trials.

Other work cited has been that related to the sex industry, including pornographic webcam shows, nude modelling, escorting, stripping, or working on chat lines.

The north west has emerged as being the worst area in the UK when it comes to students and their debt concerns, with 46 per cent reporting an impact on their mental health, while 74 per cent in the region say they worry about finances all the time or very often.

On the whole, female students (38 per cent) are more likely to be affected by money-related worries than males (33 per cent), while more females (70 per cent) admitting to worrying frequently, compared to just over half of males (55 per cent).

The poll has been carried out on behalf of private student loan lender, Future Finance, by the National Union of Students (NUS) Insight market research team.

Chief executive of Future Finance, Brian Norton, described the statistics as “truly shocking” and highlighted how everyone deserves the chance to “fulfil their dreams” through higher education.

Mr Norton said: “Every student should have a sensible financial platform to help them do just that. But, sadly, credit cards and payday loans - with their extortionate rates - are being used as the ‘get-out solution’ all too often which is, not just hitting their wallets, but also damaging their health.

“Students are unaware of the full range of finance solutions available to them. Many are in meltdown simply because they don’t know there is another way.

“We urgently need the Government and the universities to help inform students about their lending options, and give them the support framework they so desperately need through their education journey.”

However, despite facing challenges, UK students have been described by the study as “a resilient bunch.” When asked if they are likely to drop out of university due to a lack of funding, a significant majority of 75 per cent disagreed, while 58 per cent agreed that “a good education is worth the cost and sets you up for life.”

If you’re a student worried about your finances, your university’s student services or students’ union advice service will be able to give you advice and support. You can also find out more about mental health support at Student Minds

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks