Austerity’s foundations have crumbled – and advocates have blood on their hands

Political mismanagement of financial crises has resulted in a grim array of human tragedies, from suicides to HIV infections to West Nile Virus

Last week was a busy one for us data hounds. We had the latest official labour market report from the Office for National Statistics, the new Inflation Report from the Bank of England and GDP data for the euro area. Plus there was a speech from Slasher Osborne to the CBI.

Let’s start with the labour market data, which showed a rise in the number of unemployed to 2,518,000. Most worryingly, there was a rise in the number of long-term unemployed, which really hurts. There are now 900,000 people who have been unemployed for more than a year – 35.8 per cent of the total. This includes over half a million youngsters under the age of 25.

When the Coalition took office in May 2010 there were 800,000 long-term unemployed, or 32.3 per cent of the total. The last time we saw the proportion of long-term unemployed as high as this was in May 1997, at 36.3 per cent, under the last Tory government. Tony Blair took office on 2 May 1997. It was lower than this during the entire period that Labour was in power. Same old Tories.

The concern about long-term unemployment is that the longer the spell of unemployment, the more likely it is to harm people and the harder it is for them eventually to find a job. The concern is that many of them will never find a job ever again. Of particular concern also is the fact that average weekly earnings fell by 0.7 per cent on the month for the economy as a whole, driven by a big decline in bonuses. Underemployment looks as though it’s on the rise again, with an increase of 26,000 in the number of part-timers who would like full-time jobs. So the labour market is loosening again, as I suspected it would. No evidence here that the economy is recovering.

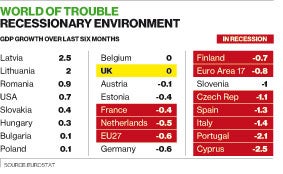

According to the Monetary Policy Committee’s latest Inflation Report, business investment is falling again and there is no evidence that consumption or exports are rising, which are the only other components of growth other than government spending. The latest data on GDP growth shows that the euro area remains in recession, with France, Italy, the Netherlands, Spain and Portugal all having had two quarters of negative growth in a row.

The table above shows how much growth there has been over the last six months. The UK, of course, has no growth at all. Not much sign of a recovery in Britain’s main export market. Also the European Union’s Economic Sentiment Index, which is the definitive source of data on business, and consumer confidence, now stands at 96.2, down from 100.6 in November and 102.9 in May 2010 when the Coalition took office. Not much sign there either of the recovery that Mervyn King again claimed was on its way in his valedictory press conference. He has claimed growth was going to emerge at every press conference for roughly the past five years, so we shouldn’t have a lot of faith in what he says.

Despite the flat-lining economy and weakening labour market, our part-time, downgraded chancellor, Slasher Osborne, made a speech to the CBI where he again sneered at those of us who oppose his failed policies. Indeed, he went so far as to pronounce: “So we will stick with our approach.”

It’s most unlikely the IMF will buy that nonsense. It will probably call for a relaxation of austerity, especially given that the very foundations of austerity have been torn apart. The famous Reinhart and Rogoff (RR) finding, that if the debt to GDP ratio hits 90 per cent growth collapses, has been shown to be totally incorrect by the world’s most famous graduate student, Thomas Herndon. He came to talk with my class last week and is a very charming young man. He explained clearly the long list of basic errors he had found. The numbers simply don’t add up, so the paper is toast. The very foundations of austerity are dead and buried. I wonder why RR continue to refuse to make their error-ridden spreadsheet publicly available? My students are looking at RR’s other papers.

A fascinating new book by the epidemiologists David Stuckler and Sanjay Basu shows that political mismanagement of financial crises has resulted in a grim array of human tragedies, from suicides to HIV infections to West Nile Virus and tuberculosis epidemics. It shows how government policy becomes a matter of life and death during financial crises. The price of austerity is counted in human lives. Austerians such as Osborne and Cameron have blood on their hands.

They argue that the real danger to public health is not recession per se, but austerity: “When social safety nets are slashed, economic shocks like losing a job or a home turn into a health crisis.” The authors note that Greece, the European guinea pig for austerity, has seen a 52 per cent rise in HIV infections, a doubling of suicides, rising homicides and a return of malaria, all as critical health care was cut. Iceland, which has a strong safety net, didn’t experience rising deaths in the Great Recession.

In the UK, Stuckler and Basu note that antidepressant use rose by 22 per cent between 2007 and 2009. Doctors gave out 3.1 million more antidepressant prescriptions in 2010 than they had two years earlier. Between 2007 and 2010, suicides rose by more than 1,000 above pre-existing trends, although the numbers started slowing in 2009 under the Darling boom, as employment rose. Scarily, the authors note that suicides are the tip of the iceberg. For each suicide there are an estimated 10 suicide attempts and between 100 and 1,000 new cases of depression.

Stuckler and Basu conclude as follows: “Had the austerity experiments been governed by the same rigorous standards as clinical trials they would have been discontinued long ago by a board of medical ethics. The side effects of the austerity treatment have been severe and often deadly. The benefits of the treatment have failed to materialise … austerity is a choice and we don’t have to choose it”.

I always thought Slasher was bad for everyone’s health.

David Stuckler & Sanjay Basu, 'The Body Economic: Why Austerity Kills', Basic Books, 2013

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks