The moral case on tax avoidance is overwhelming - and we all know Google wants to do the right thing

There is nothing law-breaking about tax avoidance and this is of course the point. The law is rigged in favour of the wealthy and the state is at the service of the rich

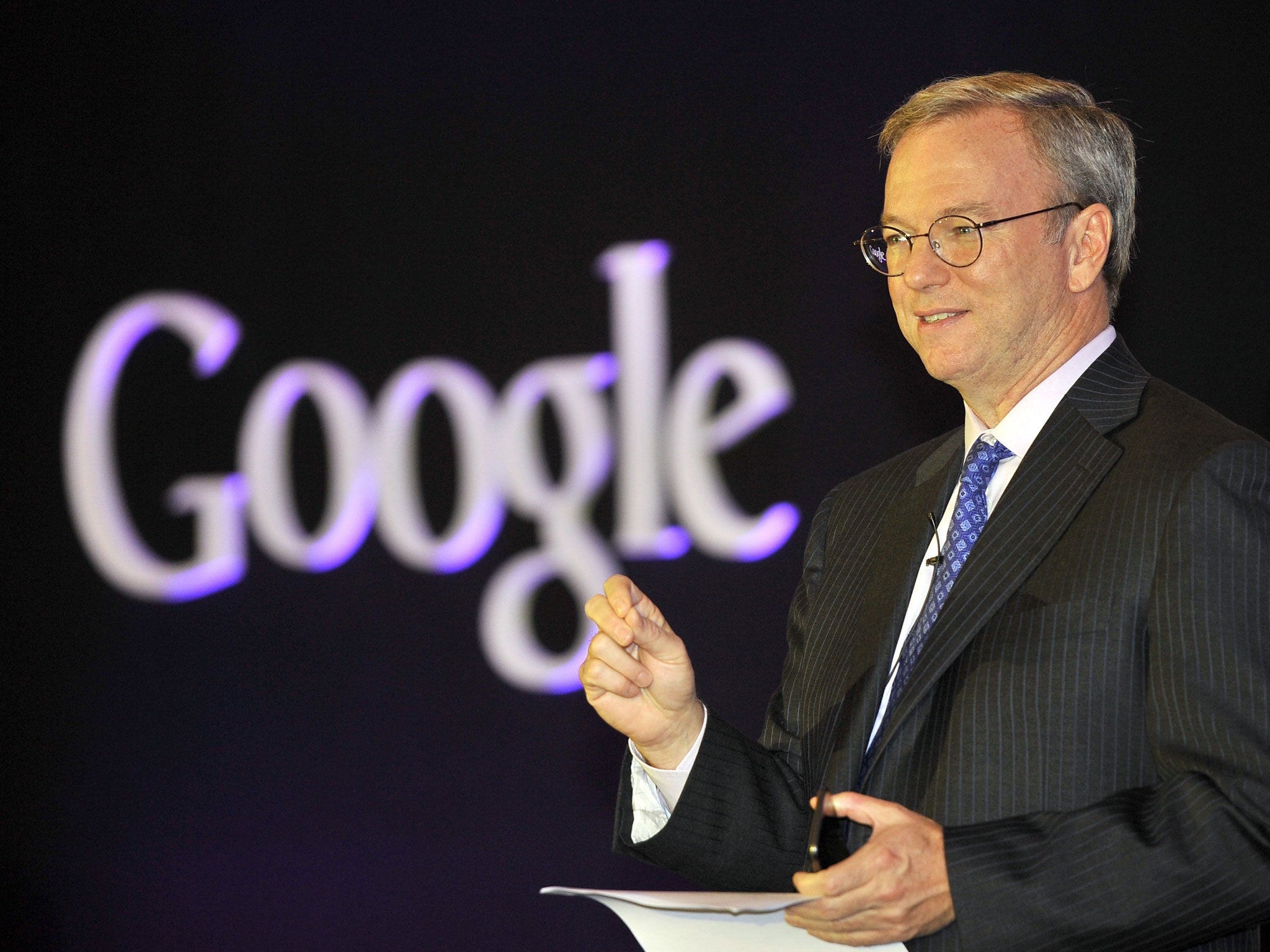

Eric Schmidt is an ambitious sort of bloke. The chairman of Google says his tax-avoiding company “has always aspired to do the right thing.” Well, I’ve always aspired to go the gym three times a week, learn Spanish and play the guitar. None of these things are going to happen, of course.

This is the scandal that currently happens in modern Britain. While low-paid and disabled people are having their state support shredded – no money left, you see – corporate giants like Google are allowed to get away with paying a pittance. From 2007 onwards, the company made £11.9bn worth of revenues in Britain, but gave the taxman only around £10m in corporation tax. Here’s their entirely legal scam: their British sales are registered in Ireland, meaning they technically don’t have to cough up here. Clever, eh?

Google aren’t the only company gifted with an infinite supply of smugness courtesy of a slick team of accountants and lawyers. Amazon.co.uk is British: the clue is in the name. Yet because it directs its sales through Luxembourg, it has paid just £2.4m tax on sales worth £4.2bn. Starbucks use all sort of clever tricks: routing profits through Switzerland, using foreign entities to make it look as if they’re not making any profits in Britain. Ingenious, really. Or, as Margaret Hodge, the crusading chair of the Public Accounts Committee, might put it, “devious” and “unethical”.

The truth is, life becomes a lot cheaper when you are rich. The average taxpayer or small business cannot afford an army of accountants to systematically exploit every possible loophole to divert their profits to Bermuda or Ireland.

And while the 0.7 per cent of social security spending lost to fraud costs the taxpayer £1.2bn, tax justice pioneer and chartered accountant Richard Murphy estimates avoidance is worth £25bn a year. Guess which one the state cracks down on without mercy or hesitation?

Ah – an objector might say – but benefit fraud is illegal, and there is nothing law-breaking about tax avoidance. This is of course the point. The law is rigged in favour of the wealthy: the state is at the service of rich types who don’t fancy paying their taxes. Accountancy firms like PricewaterhouseCooper and Deloitte get their teams seconded to the Treasury, help draw up tax laws, then go off and give advice to multinational companies on how to get around legislation they’ve helped create. Multimillion-pound lobbyists put pressure on policy makers. No such assistance for the poor, though. Get 50 quid cash in hand when you’re claiming benefits, and it’s game over.

A few years ago, the issue of tax avoidance languished on the fringes: it was something wonks and geeks worried about. Everyone is now talking about it because an inspirational motley crew of activists called UK Uncut started occupying shops and banks who were guilty of scamming the taxpayer. They stand in Britain’s fine tradition of peaceful civil disobedience, and show it is not just right-wing fronts like the Taxpayers’ Alliance who can create political space – the left can do it, too, with a bit of nous. They helped draw attention to the likes of Richard Murphy, who has drawn up suggested detailed legislation to crack down on the avoiders. Ed Miliband is now pledging an offensive against tax avoidance. Protest works.

This month, UK Uncut’s legal team dragged HMRC to court over a sweetheart deal with Goldman Sachs. It was unlikely they would ever have won – a ruling against HMRC’s legal responsibility for collecting taxes would have been stunning – but the case was damning and revealing. It was “not a glorious episode in the history of the Revenue”, the judge ruled, because it was shrouded in secrecy and lacked proper legal approval. Dave Hartnett, then the permanent secretary for tax, took the “potential embarrassment” to George Osborne into account. UK Uncut have helped expose the murky relationship between corporate titans and the British state.

The arrogance of wealth tax avoiders comes from being drunk on three decades of free market triumphalism. “They will all flee if they are taxed properly”, or so the blackmail goes. But research suggests that wealthy individuals do not emigrate en masse when they pay a fairer share. Tax flight “is almost entirely bogus – it’s a myth,” says Jon Shure, the director of state fiscal studies at Washington’s Center on Budget and Policy Priorities. “I don’t hear about many billionaires moving to Moscow,” says former US Federal Reserve economist of low-tax Russia. And it is laughable to think big companies will abandon a lucrative market like Britain if they have to pay taxes: and if the likes of Starbucks do, other taxpaying competitors will fill the vacuum.

Then there is an arrogant attitude of “well, we employ people, don’t we?” Large companies appear to regard themselves as charities, and paying tax is an act of corporate generosity. But large companies are dependent on the state. As economist Ha-Joon Chang points out, their property rights are defended by the state, capping the downside risk for investors and stopping their ideas and products being ripped off. They depend on government-funded research and development. The internet itself was a public sector creation, invented at taxpayers’ expense: you’d think Google might be a bit more grateful.

There is the infrastructure all companies depend on: like having roads and railways. They need a workforce educated by state-provided schools and universities, and kept healthy by the health service. The banks they rely on were rescued by the taxpayer. Because companies are unwilling to pay their workers proper wages, the state steps in to subsidise them through tax credits, housing benefit, and so on. Tax avoiders expect to benefit from corporate welfare but pay nothing in, yet no one calls them “scroungers”.

Perhaps we should take Schmidt’s “aspiration” to do the right thing at face value. But if Mr Schmidt is anything like me, he might need a bit of outside assistance to achieve his aspirations. So, how about we legislate to crack down on all forms of tax avoidance: like passing the General Anti-Tax Avoidance Bill, drawn up by Richard Murphy and introduced by Labour MP Michael Meacher. It’s for your own good, Mr Schmidt. And who knows. Those undoubted occasional pangs of guilt at benefiting from state largesse and paying so little back may even subside.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks