Hipgnosis considers management shake-up ahead of crunch vote on future

The company said it was initiating a strategic review, which could lead to the replacement of its founder and chief executive Merck Mercuriadis.

Hipgnosis Songs Fund has announced plans for a shake-up that could see a new management team in charge of running the troubled music fund set up by Nile Rodgers and the former manager of Sir Elton John and Beyonce.

The London-listed company said it was initiating a strategic review ahead of a crunch vote by shareholders over its future.

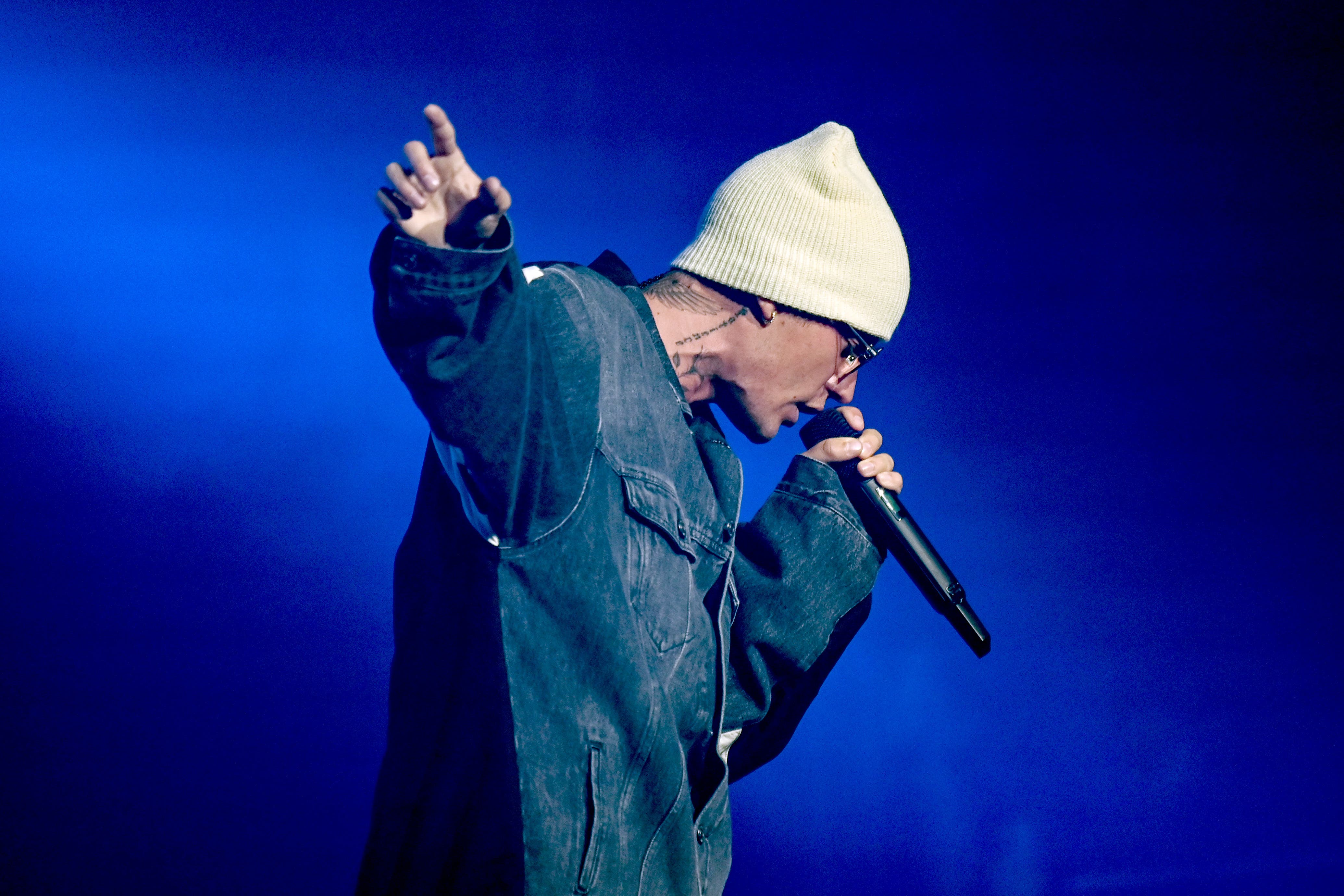

Hipgnosis, which owns the rights to the back catalogues of musicians including Justin Bieber, Shakira and 50 Cent, said it will be considering all options for the future of the company with the aim of returning more cash to shareholders.

That could include changing the management team, which could lead to the replacement of its founder and chief executive Merck Mercuriadis.

It comes after the firm earlier this week said it had decided to scrap its shareholder dividend pay-out, which could otherwise have seen it breach the terms of its loan agreements.

It led its share price to plunge to an all-time low during the day after slashing its earnings forecast.

The business had been impacted by a US ruling affecting royalties paid to songwriters or rights-holders for music streamed between 2018 and 2022, which it said means the firm will receive “significantly lower” payments.

Nile Rodgers of Chic and Mr Mercuriadis launched the fund on the London Stock Exchange in 2018. Mr Mercuriadis is the chief executive of Hipgnosis Songs Management (HSM), which advises the fund.

The board of Hipgnosis said it was also considering serving notice to axe its agreement with HSM, which advises on the fund’s portfolio of songs. But it said it had decided it would not currently be in shareholders’ interests to do so.

Hipgnosis said its strategic review comes ahead of a key vote next Thursday where shareholders will be asked to approve the continuation of the fund for another five years.

It is urging investors to vote in favour of its continuation.

Meetings with shareholders have “highlighted a continued belief in the company’s portfolio and growth prospects” as well as a need for a leadership shake-up, the firm said.

It added that the strategic view will not involve the consideration of any offer for the company.

A spokesman on behalf of HSM, the investment adviser to the Hipgnosis fund, said: “We fully recognise that the board needs to act as they see fit.

“We continue to believe that HSM is uniquely positioned to deliver value to Hipgnosis Songs Fund shareholders as a result of our deep relationship with the songwriters that make up the catalogue and our song management expertise. We intend to continue to demonstrate this through our actions.”

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.