Hipgnosis fails to attract offer above £360m for music catalogues

Shares in Hipgnosis Songs Fund dropped on Tuesday morning following the announcement.

Hipgnosis has said would-be bidders for its proposed music catalogue sale are not willing to match the price of an original 440 million US dollar (£360 million) offer.

Shares in Hipgnosis Songs Fund dropped on Tuesday morning following the announcement.

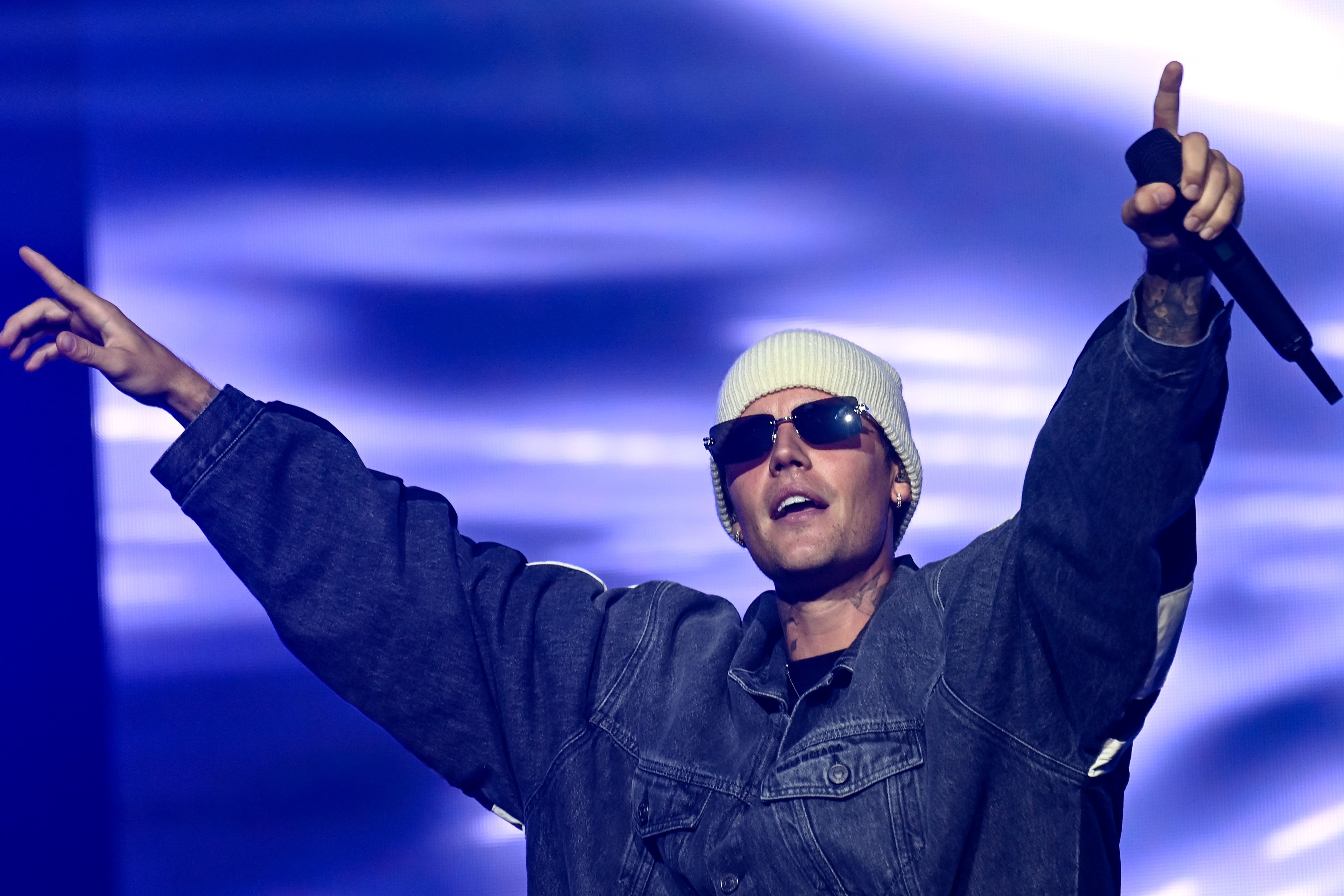

Last month, the investment firm which buys property rights for music, including songs by Justin Bieber, Shakira and 50 Cent, agreed the sale of 29 catalogues to a private sister fund backed by investment giant Blackstone.

The London-listed business launched a 40-day “go-shop” provision after agreeing the deal, giving other suitors the opportunity to put forward their own offers.

However, on Tuesday, Hipgnosis confirmed it did not receive a superior offer following the process.

A number of the parties assessed that they could not justify paying a higher price than the offer

It said it had been in contact with 17 interested parties and saw eight of those sign non-disclosure agreements (NDAs) but received only one first-round non-binding offer and this did not result in a binding bid.

Hipgnosis told shareholders “a number of the parties assessed that they could not justify paying a higher price than the offer” already on the table.

It will therefore continue to recommend the current offer to shareholders at its annual general meeting later this week.

This comes days after the fund launched a strategic review which could overhaul its management team.

Last week, it also decided to scrap its shareholder dividend payout, which could otherwise have seen it breach the terms of its loan agreements. Its share price plunged as a result.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.