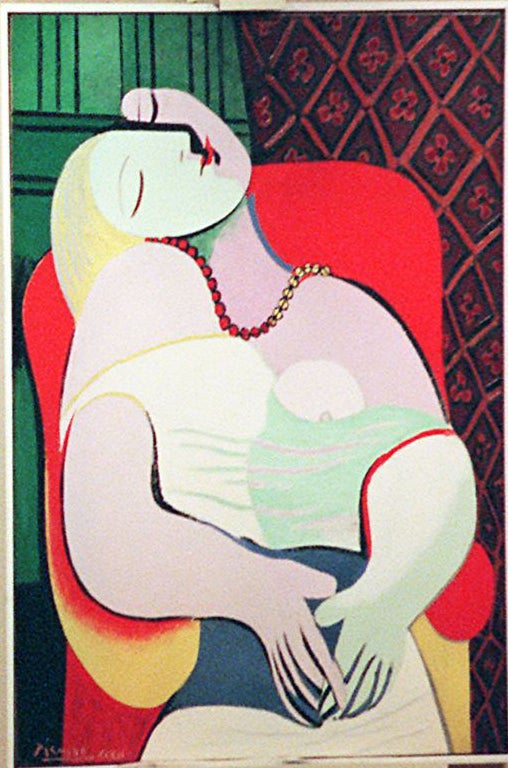

Sold for $155m to American hedge fund manager Steven A. Cohen: Picasso that was worth $16m less before it got ripped

Casino magnate who tore masterpiece with his elbow sets record price for artist with deal

Steve Wynn’s failure to tell his art from his elbow seven years ago left a six-inch tear in a Picasso masterpiece he owned- and derailed its sale for $139m.

But the Las Vegas casino magnate finally closed the deal this week, selling the painting Le Rêve to the same buyer, and charging an extra $16m on top of the original asking price to take the total to $155m (£103m).

Le Rêve, a portrait of the Spanish artist’s 22-year-old mistress Marie-Thérèse Walter, is said to have been painted in one afternoon in 1932, when Picasso was 50. Mr Wynn, right, has sold it to Steven Cohen, a hedge fund manager reputedly worth $9.3bn, according to The New York Post. The $155m price is believed to make Le Rêve the most expensive Picasso ever, and the second costliest painting of all time, before adjustments for inflation.

Gijs Van Hensbergen, a Picasso expert, said he believed the artist was “without doubt the creative genius of the 20th century” and still relevant to collectors today. “These paintings are pretty amazing. There is something magical about them,” he said. “He is recent enough for us to feel we have something to do with him. You are still tapping into something you recognise from your own culture.”

Le Rêve is the third Picasso to fetch more than $100m. Another 1932 portrait of Marie-Thérèse Walter, Nude, Green Leaves and Bust, went for $106.5m at Christie’s in May 2010. Garçon à la Pipe sold for $104.2m in 2004.

Ben Street, an art historian, said Picasso was still popular because “he is totally endorsed by all major modern art museums [and] will never not be important”. He added that Picassos from the 1930s were particularly sought-after because they were “very sensual and attractive”. “It was a really good period for him,” said Mr Street. “They are also easily readable. Le Rêve … ticks a lot of the boxes and I can understand why it would go for this much.”

The most money paid for a painting was for Paul Cezanne’s 1892 work The Card Players, which was sold to the royal family of Qatar for a reported $259m in April 2011.

Mr Cohen, 56, is the founder of SAC Capital Advisors, based in Stamford, Connecticut. He has a large art collection and has long coveted Le Rêve. Mr Wynn, who has a disease that affects his peripheral vision, bought the work at auction for $48.4m in 1997. He agreed to sell it to Mr Cohen in 2006 but the deal collapsed after it was damaged.

Mr Wynn was showing the painting to guests in his Las Vegas office when he accidentally tore a six-inch hole in it with his elbow. “With a lot of old paintings there is wear and tear,” Mr Van Hensbergen said. “This one just has a bit more tear.”

However, after a $90,000 restoration the damage is now invisible to the naked eye.

Art breakers: record-beating sales

The Card Players

The Qatari royal family broke all records when they bought The Card Players by Paul Cezanne in May 2010. As with many private sales the exact price is not known, although it is believed to be just shy of $260m (£170m).

No.5, 1948

David Geffen sold Jackson Pollock’s No 5, 1948 for an estimated $140m (£92m), in a deal supposedly brokered by Tobias Meyer of Sotheby’s. The work is referenced in “Going Down” by The Stone Roses.

Woman III

Another work sold by Geffen in 2006 was abstract expressionist Willem de Kooning’s Woman III, painted in 1953. The work was bought by Cohen for $135m (£89m), making it the third most expensive of the time.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks