Samsung Pay launches in the UK: Everything you need to know

It works on public transport services in London, but be careful to avoid a fine

Samsung Pay has launched in the UK, almost exactly a year after the arrival of Android Pay.

The service allows you to pay for goods with a Samsung smartphone, though it’s only available on a selection of the South Korean firm’s current and former flagship smartphones at the moment.

Unfortunately, the UK version is also missing some key features that are on offer in other markets.

Compatible devices

It’s currently available on the S8, S8+, S7, S7 Edge, S6 and S6 Edge, but Samsung has promised to roll it out to additional devices, including the A Series and Gear smartwatches, “in the coming months”.

If you own one of the compatible handsets, you can now make purchases through Samsung Pay, a service that lets you add credit, debit and loyalty cards to your phone.

How to use it

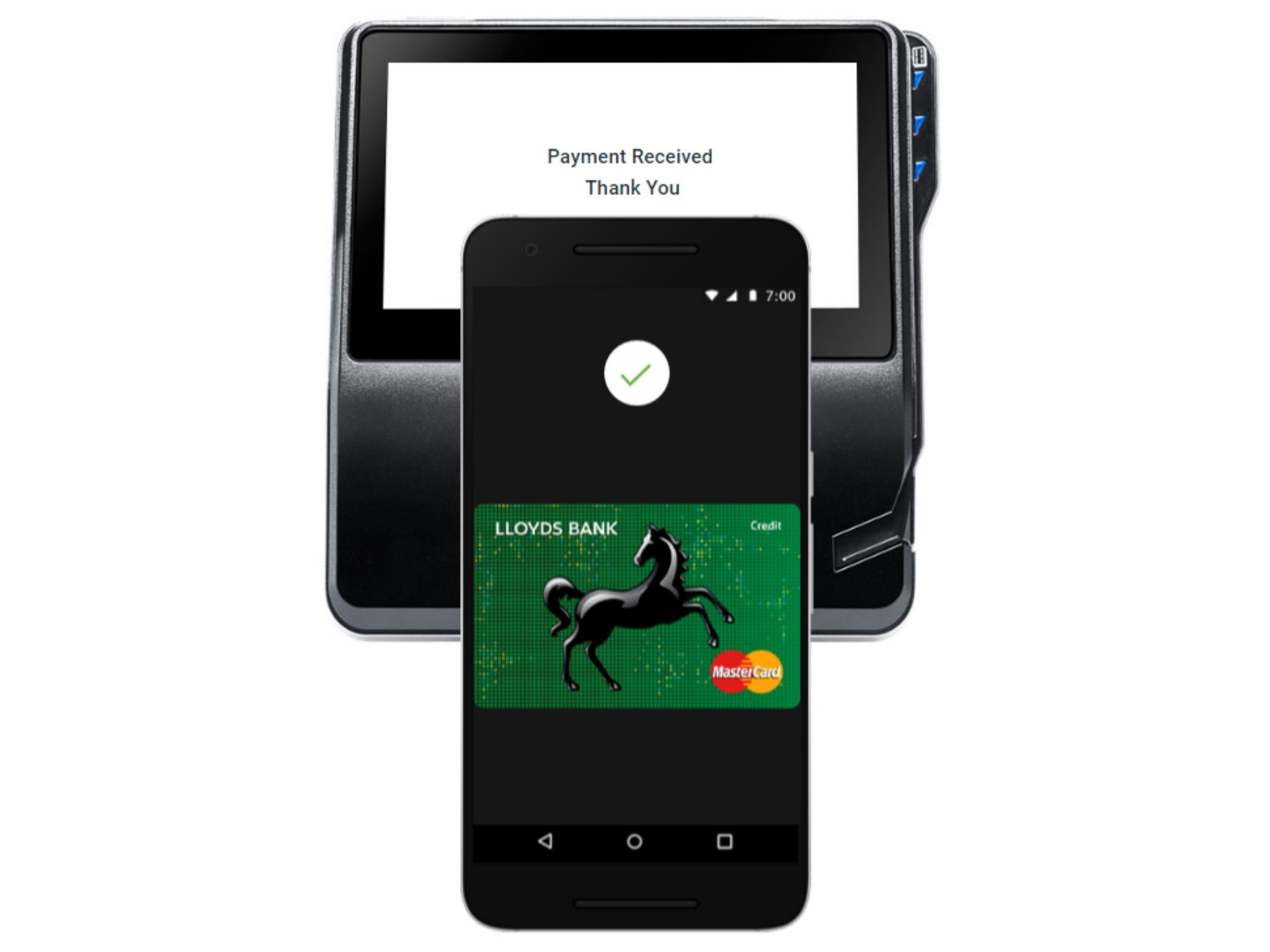

It works using near-field communication (NFC) technology, and Samsung says you can use Pay “almost anywhere” contactless debit cards or credit cards are accepted.

Just swipe up from the bottom of your phone, tap on the card you want to use, and hold it to a compatible payment terminal.

It currently supports payment networks including Visa and MasterCard, and cards issued by Santander, Nationwide and MBNA, with HSBC, First Direct, M&S Bank and American Express said to be joining soon.

Security

Samsung won’t store any payment card information on your phone, as a precaution against thieves.

Samsung Pay is protected by Knox, and the company says each separate transaction uses an encrypted digital token to replace card information to prevent fraud.

Missing feature

Disappointingly, Samsung says Pay doesn’t yet use Magnetic Secure Transmission (MST), the technology used by magnetic strip cards and older payment terminals.

The functionality is available on Samsung Pay in other markets, and could have given it a key advantage over Android Pay in the UK.

“For the UK launch, we’re going to focus on NFC and then we’ll look for opportunities to bring MST later on,” Kyle Brown, Samsung’s head of technology, content and launch management for the UK and Ireland, told The Independent.

“The UK market is very much trending towards NFC, which is why we’re focusing on that for Samsung Pay. Right now, we’re looking at whether we can use MST for loyalty cards or something like that in the future.”

Fierce competition

Asked how Samsung expects its service to compete with Google’s Android Pay, Mr Brown said, “We can complement [Android Pay], but Samsung Pay is also fully integrated with everything we’re doing.

“We think it’s the easiest way to make a mobile payment. Samsung has clear differentiation to Android Pay.”

The S8 allows you to authenticate a payment through Samsung Pay with a PIN, a fingerprint or – on the S8 and S8+ – an iris scan.

Mr Brown say it will work “seamlessly” with Bixby too, but the new voice assistant still doesn’t work to its full potential in the UK.

Unfortunately for Samsung, iris-scan aside, Android Pay works in much the same manner and is compatible with a lot more devices – anything with NFC and Android 4.4 and higher.

Google has also had more time to get more banks on board with Android Pay, which works with MasterCard and Visa cards from the likes of Bank of Scotland, First Direct, Halifax, HSBC, ISle of Man Bank, Lloyds Bank, M&S Bank, MBNA, Metro Bank, Nationwide, NatWest, Royal Bank of Scotland, Santander, TSB and Ulster Bank.

London transport

Samsung has partnered with TfL to let you use Samsung Pay on all TfL services and “most” National Rail services in the capital.

As you can with an Oyster or contactless bank card, you can now check in and out of the Underground and pay for journeys on buses by tapping your Samsung phone against the reader, and there’s no need to wake your phone's screen up beforehand.

However, there are a couple of really important points to consider.

“Your phone must be switched on to use it to travel,” warns TfL. “You should also check that you have enough battery on your phone to complete your journey.”

If your battery runs out during a journey before you touch out, you won’t be able to and could be charged a maximum fare as a result.

You could also be liable for a penalty fare of up to £1,000 if you run out of battery and an inspector asks you to touch your phone on their reader.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks