The eBay treatment: Homebuying online

Buyers are drawn in by six-figure discounts. Sellers are tempted by the sheer speed of the sales. But would you do business on a property-auction website? Toby Green reports

Property auctions are big business – last year over 30,000 homes were put under the hammer in the UK. For sellers, they offer a quick cash sale, invaluable at a time when negative equity is predicted to hit over a million homeowners. For the buyers, mainly investors looking for a bargain, they offer the chance to save thousands of pounds on a property.

Such auctions have barely changed over the decades, but two property investors from north London, Danny Nieberg and Melvyn Defriend, have decided to move the auction room into the 21st century. The result is DiscountPropertyAuction.co.uk – a website where you can bid for your next house from the comfort of your living room.

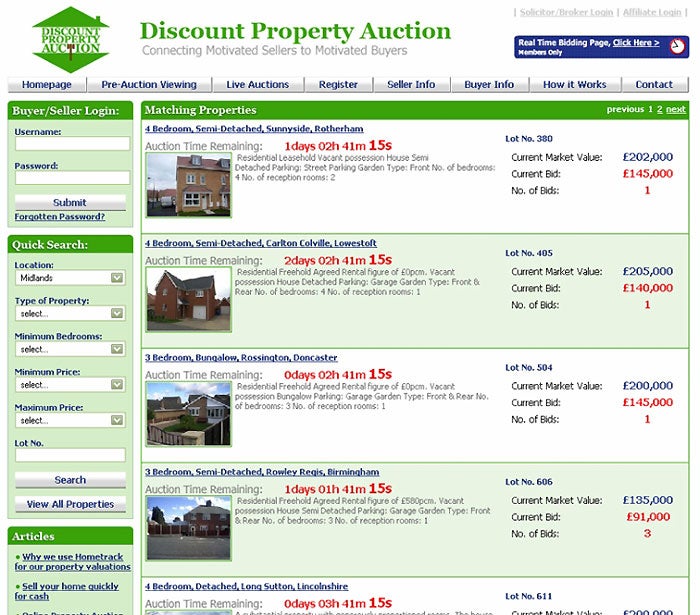

If you think of eBay, but imagine that all the lots are flats and houses, you're not far from the reality. Beneath photographs of the houses, visitors to the site can see each property's market value (which is set by independent valuation from the specialist company Hometrack), the highest current bid, and how much time the auction has left.

"I've been in property for a number of years now and even I find going to an auction house daunting," says Nieberg. "With our site, sellers can sell and buyers can buy, all from their own home. It's a much more comforting way of doing it."

The idea for the site came as a result of Nieberg and Defriend's own experience in the property market. "We were buying and selling properties and had a large influx of people who wanted to sell their houses quickly at a guaranteed cash price. To help them we decided to send on the deals to other investors – and the best way of doing that was through an online auction."

The website has started slowly but surely, helped no doubt by the recent property crisis. Since the site went online in August, 143 houses have already been sold and its proprietors claim around 25 new buyers are signing up every day, each paying £9.99 plus VAT per month.

The idea is relatively simple – sellers have to pay a fee of £50 and are not charged commission, although there are plans for this to be introduced. Their page on the site is created for them, and an independent valuation of the house from Hometrack is included in the price. Although valuers do not visit each property, their calculations are based on Land Registry records of sales prices combined with other recent valuations in the area and statistics such as local growth trends.

The sellers then choose their reserve price – the lowest amount they are willing to sell for – which the site says should be set at 80 per cent of the valuation in order to attract investors. The properties are showcased before the auction starts. This stage usually lasts between eight and 10 days, but can be quicker, and is intended to give buyers time to visit the property. The duration of the auction itself also varies (as it does on eBay), but it's certainly possible to go from sign-up to the end of bidding in a fortnight. The winning bidder then has £1,000 deducted from a credit card, and at this stage contracts are legally exchanged. The buyer has 20 working days to complete the transfer of funds, as they would at any standard auction.

Nieberg believes that although sellers have to take a discounted price, they may actually be saving money compared to selling their property through an estate agent. The website was conceived last year, when sealed bids were pushing prices up past their valuations, and online estate agents were cashing in on a seller's market, where people were finding it so easy to attract buyers that estate agency fees seemed pointless. Now, with the arrival of the credit crunch, the site has perhaps found a greater relevance. "It's bad out there at the moment. If you've got mortgage arrears, you may need to sell up fast – and even if you drop your asking price, you may not get your hands on the money for six months if you sell through a regular estate agent."

However, he feels that even if the current crisis abates, the site will continue to be popular. "People will use it because traditional auctions have done well whatever the state of the market."

The rest of the auction world isn't standing still. Auction specialists The Essential Information Group are hoping to run their own online auctions in the near future, although unlike DiscountPropertyAuction.co.uk, these will be run in conjunction with auction houses. The group's managing director, David Sandeman, believes that online property auctions will take off but won't replace the traditional auction. "The history of auctions is all about relationships, and it's difficult to build that up online."

He also notes that other sites have tried similar ventures and failed. "The rules are the same for an online auction as a conventional auction. You've got to have the right stock, properly priced, and widely circulated to a receptive market."

Chris Glenn, the divisional managing director of Barnard Marcus Property Auctions UK, is more negative about its chances. "The whole thing about an auction is to allow people to bid against each other in an open and competitive environment. Is an online auction open? Is it transparent? No.

"As an auctioneer, it is our responsibility to get the best price for a seller and you can have a discussion and a relationship with them that you can't have online."

He also thinks there are questions hanging over the legal aspects of an online auction, something Nieberg denies: "We have tweaked the existing auction rules to apply to the internet – all the solicitors involved have been happy that the legal side has been sorted."

He remains confident that the site will continue to develop successfully. "I feel that the day when the site fails is the day when no one wants to sell houses, and the internet is growing more and more every year."

Property auctions – the figures

*In February, 3,055 residential lots were put up for auction, 68 per cent of which were sold.

*These properties went for a total of £351,447,602.

*In 2007, 30,551 residential properties were available at auction – a 14.2 per cent increase on 2006.

n "Distressed sales", such as repossessions, constitute on average 22 per cent of properties up for auction – in 2004 this figure was less than 5 per cent.

*Last year, 27,100 homes were repossessed. The Council of Mortgage Lenders says that will rise significantly.

(Source: The Essential Information Group)

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments