No Pain, No Gain: I'm moving back into Myhome. Let me explain...

I have re-recruited Myhome International, the franchise group that was once the star of the No Pain, No Gain portfolio. The shares have returned to the fold in spite of the fact that year's figures and the accompanying statement were disappointing.

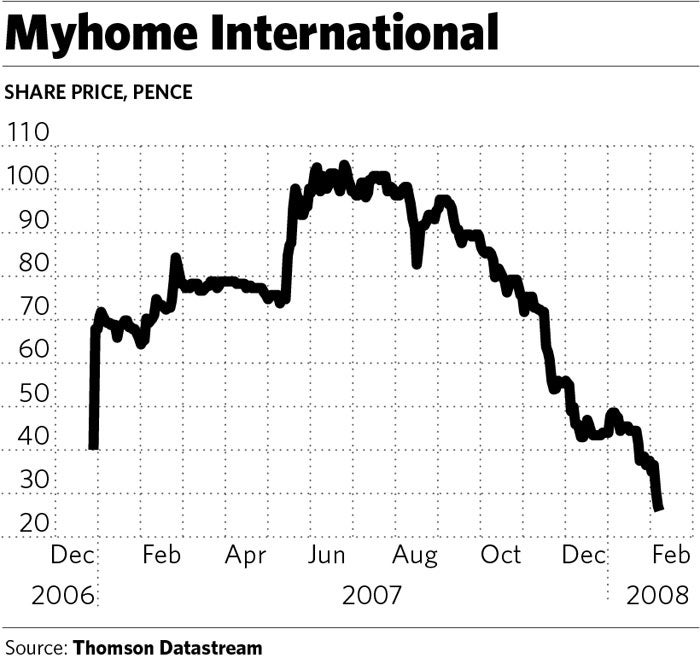

At the time of writing, they are 27p. Last year, the price hit a 106p peak but fell back sharply in the microcap sell-off, and the shares were despatched from the portfolio when they went below my 50p reserve price.

The trading revelations further damaged the shares. Against hopes of nearly £1.9m at the pre-tax level, the group managed just £1.46m, although debt provisions and the tax charge distorted the outcome. And paid-for researcher Equity Development (ED) added to the gloom; it greatly reduced its forecast for this year from nearly £5.9m to £3.6m. Next year, it is looking for £6.4m against earlier hopes of £7.7m.

Although, by some measure, the group fell short, the shares have, I believe, overreacted. The stock market can be an unforgiving place, but the calamitous retreat Myhome has endured seems unjustified. There is no doubt that the group has damaged its City reputation but, at 27p, the shares of what is still a rapidly growing company are selling at around eight times this year's expected earnings and not much more than five times next year's forecast figure. So, even in these depressed times, they are looking remarkably cheap.

I first alighted on Myhome at 15.5p in the summer of 2005. The shares were then traded on the fringe Plus market. They moved upmarket to AIM at the start of last year. Then the group embarked on what can only be described as a takeover binge, which culminated in its biggest acquisition, the £16m takeover of ChipsAway, a franchise group undertaking minor car-repairs and also car valeting.

But the deal did not go smoothly. It took longer than expected, extending into the current year, and it is a major factor behind ED's reduced profit estimate. It seems that management was distracted, prompting a trading slowdown. Whether the group will manage to recover the shortfall in the rest of the year is an open question.

With 12 franchise brands spreading over residential cleaning, gardening, oven and carpet cleaning and plumbing – as well as car repairs and valeting – Myhome relies heavily on the "time poor, cash rich" fraternity. Whether such people will be big players as consumer spending is cut back remains to be seen. Some will no doubt be forced to draw in their horns.

But Myhome's franchisees have not experienced any slowdown. Like-for-like sales are still ahead. The more sedate first-quarter performance stemmed from a lower rate of franchisee recruitment as management wrestled with the ChipsAway acquisition and its integration.

As part of last year's takeover spree, Myhome raised £7.5m, placing shares at 85p and 72p. Institutional investors who took up shares will no doubt be feeling peeved by the subsequent slump. They could be a drag on sentiment. There is, of course, always the danger that a fast-growing company will overreach itself and stumble.

But I remain hopeful that chairman Russell O'Connell has the right formula. And this year's profits will be on target. The group's computer back-up, designed by the Unilever food and soap behemoth when it had a short-lived flirtation with home cleaning, has stood the test of time. After all, last year's profits may, on the surface, appear disappointing but the £1.46m outturn compares with £734,000 the previous year.

The group appears to be having no difficulty stepping up its franchise recruitment programme. It already has more than 800 franchisees, and it is operating, through master franchises, in 14 countries.

Myhome, which is expected to pay a maiden dividend this year, is unlikely to indulge in any significant deals for some time, although the possibility of bolt-ons cannot be ignored.

My U-turn over the shares may cause some surprise. But I do rate the company (although deferred takeover payments could be a worry), and I was a reluctant seller when my 50p limit was breached.

I am not banking on the shares returning to the heady 100p-plus level for some time yet. Indeed, ED now has an 80p target against an earlier 147p. But I – and also, I bet, the institutions that took part in last year's placings – would settle for 80p.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies