A recession may be on the horizon but speculators see a ray of light

With storm clouds gathering over the economy, it might seem that only the bravest investors would be tempted by UK markets. But who dares could just win, says Julian Knight

It's an old investment maxim that you sell on good news and buy on bad. If you hold to this theory, then the current UK stock market may well be the one for you.

The news emanating from the Government, the Bank of England, independent forecasters and – increasingly – from the balance sheets of some of Britain's biggest companies is almost all bad. Inflation is expected to be well above the Bank's target for the rest of the year, and economic growth is coming to a halt and may soon go into reverse. Meanwhile, the housing market – upon which so much consumer confidence is built – is at best correcting and may even be crashing. And against this backdrop, many believe interest rates will go up soon.

However, the FTSE 100 index is down only around 5 per cent since the start of the year – bad but nowhere near the falls recorded when the dot-com bubble burst at the start of the millennium. This headline FTSE 100 figure is being hugely inflated, though, by the stellar performance of mining and oil shares. Look outside these two sectors and doom and gloom is the order of the day.

"Banks and construction firms have had a terrible time," says Rob Harley, an analyst from the independent financial adviser Bestinvest. "Banks used to make up 22 per cent of the FTSE; they now account for just 12 per cent. Only those banks such as HSBC and Standard Chartered with wide international exposure have stood up to the storm.

"Meanwhile," Mr Harley adds, "the falls in shares of construction companies is even more dramatic. Some have completely tanked, losing 80 or 90 per cent of their value. These are falls of a magnitude last seen at the bursting of the dot-com bubble, when many technology companies lost a similar percentage of their share price."

Other commentators point out that retailers and companies in the pubs and leisure trade are also suffering. "Any firm that relies on the British consumer is taking a battering," says Mark Dampier from independent financial adviser Hargreaves Lansdown. "The economy is going to get worse before it gets better. The troubles in the housing market are having a huge effect across the economy as well as on consumer confidence. In short, I can't see any way we can avoid recession – and the market agrees."

With such cheery pronouncements, it would take a brave soul to decide to invest in the UK stock market right now. But Mr Dampier reckons that a lot of the very worst news is already factored into the price of shares. In other words, it could soon be time to mutter another "r" word when it comes to UK shares – meaning recovery rather than recession.

"I see things getting worse in the short term," he says, "but remember that there is a lag between the stock market and the real economy – jobs, inflation and growth. Generally, you start to see share prices recovering about nine months to a year ahead of the real economy. Now if you reckon that 2009 is going to be worse than 2008 in terms of economic performance, there is a case to be made that, come the final quarter of this year, we could see some strength returning to the stock market."

Mr Dampier cites a belief that interest rates won't rise by 0.75 per cent, as some analysts predict. "I don't see how the Bank will raise rates by as much as is being factored in at the moment. If I am right, this will mean some optimism returning to the market. As for the prices of shares in relation to earnings, these are as cheap as at any time for 15 years, and that should indicate a rally down the road."

He adds that less than 40 per cent of FTSE-listed firms do most of their business in the UK, meaning the majority rely on overseas markets. This should protect them, at least in part, from the effects of a recession in this country.

Others are a little more cautious and find it hard to see any light at the end of the tunnel. Darius McDermott, managing director at Chelsea Financial Services, says: "At best I can see the FTSE trading between the 5,000 to 6,000 range for the next couple of years [as of Friday it was 5621]. We will see some dramatic falls and rises but generally it will stay within these markers.

"This isn't an attractive scenario if you consider that there are savings accounts out there paying close to 7 per cent interest. But it must be remembered that, over the long term, shares generally outperform money put into a savings account or other safe investments such as bonds or government gilts."

If you're feeling brave even after such words of caution, then how should you invest in the UK and how much should you risk? The most dangerous but also potentially lucrative course is to buy individual company shares through a stockbroker. However, in such volatile times as these, you're just as likely to lose your shirt as make a killing.

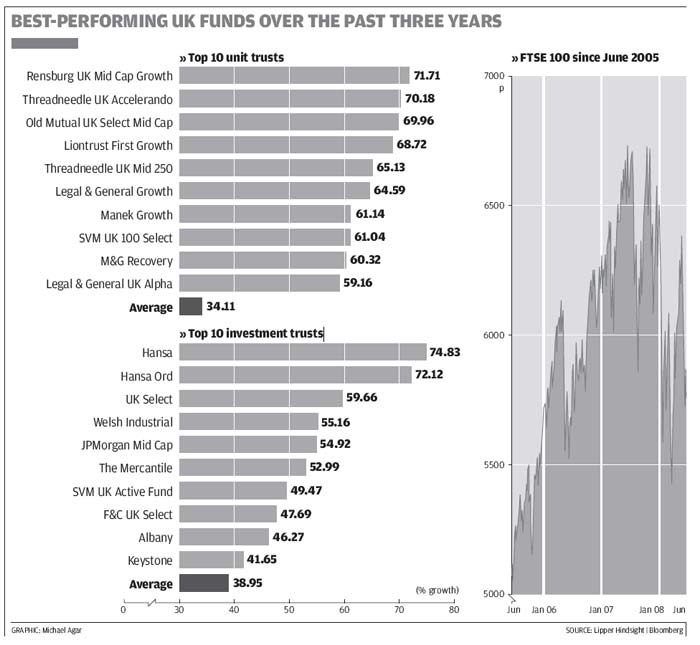

Most people prefer to invest through a stock market fund, such as a unit or investment trust, which pool investors' cash and buy shares in lots of different companies. The idea is to spread risk and obtain returns that are at least equal to, if not better than the performance of the FTSE. The shares the funds buy are selected by a management team or, in the case of tracker funds, chosen in order that the fund can closely replicate the performance of a particular stock market index. For example, a FTSE 100 tracker will buy shares in all the UK's 100 biggest companies.

But in such choppy financial waters, the experts say that instead of going down the tracker route, investors should try to find a good fund management team with clear objectives and a proven track record.

"This is the time for active management, as it's called," says Mr McDermott. "You are looking for a fund that can outperform the FTSE 100." His own choices include the BlackRock UK Absolute Alpha fund, which has beaten the FTSE consistently over the past couple of years. Mr Harley of Bestinvest opts for the AXA Framlington Select Opportunities fund, run by Nigel Thomas, a long-established star of the fund management universe. Meanwhile, Mr Dampier of Hargreaves Lansdown is a fan of Neal Woodford's Invesco UK equity income fund, as well as BlackRock.

In a volatile market, timing a purchase is crucial, but often impossible to get right. "Calling the bottom of the market is very difficult indeed," says Mr Harley. "One way to take the stress out of it is to invest small amounts regularly, instead of all in one go."

However, for some, the UK stock market in its current state may be a game that's not worth the candle.

"It depends very much on your circumstances," says Mr McDermott. "People approaching retirement do not have the time to ride out any peaks and troughs and would be best off with safer investments, such as bonds and savings accounts. Younger people, though, should generally look to have around half their total portfolio invested in the UK stock market. After all, investing in Blighty has one major advantage, in that you do not run a currency risk. When you invest overseas, you may find your returns are hit by movements between the pound and the currency of the country that the fund invests in."

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies