Are the big fund names worth the fees?

Kate Hughes weighs the pros and cons of star managers against index-trackers

The big names in fund management have their faces splashed across billboards nationwide, but whether those individuals deserve their high status, salary and above all your money is the cause of increasingly heated debate.

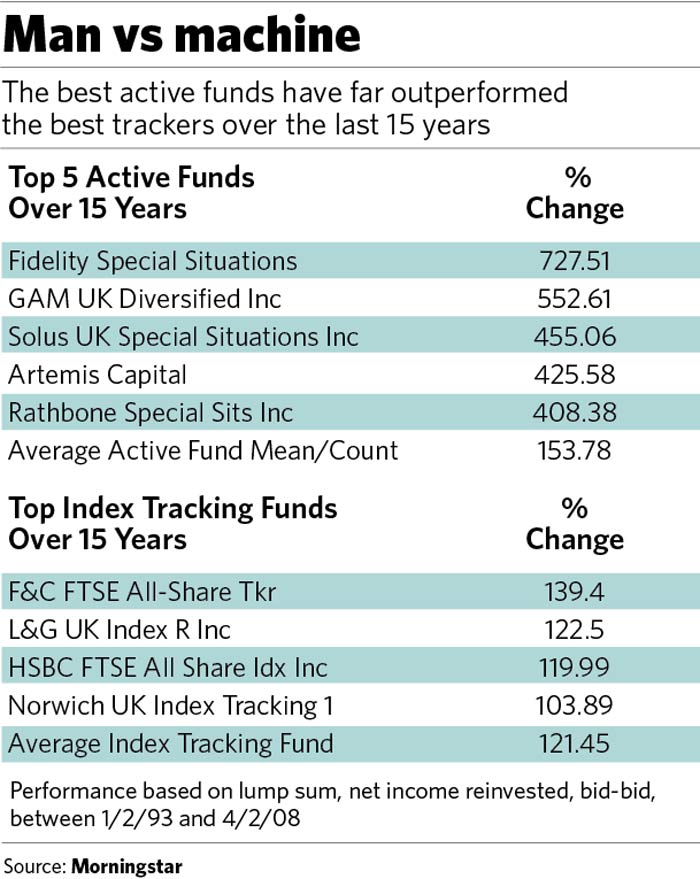

There is little doubt that a golden few have produced some astonishing investment returns over the years, but these star fund managers make up a small percentage of the total number of managers out there.

The alternative is to opt for passive investments – funds that track the movement of an index, and leave no room for human error. They are much cheaper, and don't rely on the judgement of one individual or a small team, but they also can't hope to offer you the exciting returns that a select few of the active managers deliver.

Flight from safety: active management

Most active fund managers aim to seek out individual companies that they feel are undervalued, in the hope that over time their intrinsic value will be understood by the wider market and their value will rise. However, some take a more "top-down" approach, looking at the broader macroeconomic situation, and picking out certain sectors that they believe are most likely to benefit.

The depth of research and the strategy involved in determining that value is what fund managers charge us for. Meanwhile, they hope it will help them find the superior stocks that will outperform the index and boost fund performance, prominence and their personal reputation. Good fund managers and their employers often purposefully align the manager's priorities with those of the fund and investor by putting their own money or benefits into the fund. Then all they have to do is keep doing it, and keep getting it right.

"In reality, decisions rarely come down to just one person, and most have strict structure criteria," says James Davies of Chartwell, the independent financial advisers. "Managers are supported by a close team, and a number of researchers. It is almost like having your own team working for you."

When it comes to value for money, he advises that an equity fund manager, for example, should not demand more than 1.5 per cent annual management fee, and any performance fees charged on top of that should not be more than 1 per cent. "The performance figures are always quoted net of fees, so it is clear when a manager is doing a good job or not," he adds. Individual managers he recommends are Neil Woodford of Invesco Perpetual, Richard Plackett of Black Rock and Adrian Frost of Artemis.

Critics of active fund management, however, question the reliability of one individual's opinion. "It is like guessing the weight of a cow," says Ian Shipway of Thinc Group. "The aggregate opinion of a large number is far more likely to be accurate than the opinion of one individual."

Even John Duffield, the chairman and founder of New Star Asset Management, admits that stars can fade out. Duffield famously sacked his long-time friend and colleague Alan Miller from heading up his UK equities desk a few years ago, due to a period of poor performance. Last month, another of his stars, James Ridgewell, saw his fund axed for the same reason. Managers who have outperformed for many years, such as Warren Buffet and Neil Woodford, are in a small minority.

The numbers game: passive management

"The star fund-manager culture is marketing with a lot of momentum," says Shipway. He says that a manager's choices are "simply opinion based on facts. A manager will come to the same conclusion as the index – which is a much better indicator as the aggregate of all opinion. You are paying a manager simply to replicate the index.

"Only a very small percentage of the managers outperform the index on a yearly basis, and around 33 per cent of funds change their manager every year. How can you realistically select a manager who is going to be there, and have performed well, for 20 years? It is almost impossible."

An alternative is to opt for an index-tracking fund or an exchange-traded fund (ETF), which will mirror the activity of a particular index, subject to a small tracking error. The advantage of ETFs over regular tracker funds is that they are traded like individual stocks and tend to be cheaper. Colin Tipping of Barclays Global Investors, whose iShares stable accounts for most of the UK-based ETFs, says: "ETFs have the same investment strategy as other tracking funds by reflecting what the index comprises of, but the value of ETFs are more transparent as you buy them directly through a stockbroker, you know exactly what they are worth, and they can be bought and sold much more quickly."

Whatever type of passive investment vehicle you choose, the decision-making process is largely automated, making them much cheaper than active funds. Most trackers charge around 0.5 per cent in annual management charges, versus the 1.5 per cent demanded by active funds – and ETFs can be even cheaper. As such, they typically offer more reliable returns after fees and expenses than the average active fund. Index tracking funds can take the guesswork – but unfortunately not the risk – out of investing, and often provide a good foundation for a portfolio or broad exposure to a particular sector or index.

The non-conformers

Some funds don't fall neatly into either camp. An active manager will often have strict criteria about suitable stocks for the fund. Others can only pick stocks from within a parameter of the benchmark; some people argue that this makes them tracker funds. There is certainly the potential for paying active fees for not very active management without realising it; doing your research is critical.

The number of both active and tracker funds in which you can choose to park your hard-earned cash is vast – almost as vast as the sources of information about picking the right strategy and fund for you. Some of the most reliable and objective of these are Morningstar (www.morningstar.com) and Defaqto (www.defaqto.co.uk), large independent investment research companies that offer comprehensive performance information on funds and indices, as well as guides, factsheets and glossaries on a variety of strategies and options. The websites of some of the larger firms of independent financial advisers and brokers, such as Hargreaves Lansdown (www.h-l.co.uk), or Torquil Clark ( www.torquilclark.com), also have factsheets, glossaries and guides to investments.

The experts pick their favourite funds

To Marcel Porcheron of Bestinvest, a few names stand out as consistent performers in the active-managed arena. "Identifying the quality fund managers depends on their track record, long-term," he says. "Derek Stuart, managing the Artemis Special Situations fund, has outperformed the UK All Companies index by over 120 per cent over eight years. In Asia, Hugh Young's Aberdeen Asia Pacific fund has added 150 per cent above the index over 20 years. Even the top managers underperform from time to time, so long-term performance is the key to getting your money's worth."

Porcheron also rates highly Philip Wolstencroft of the Artemis European Growth Fund, who over the past seven years has returned more than three times what the average European fund has. In emerging markets, Porcheron singles out Mark Mobius's Templeton Emerging Markets Investment Trust, which has returned more than 330 per cent over the past decade, compared to a rise in the index of around 220 per cent.

In the passive, index-tracking world, Anna Bowes of AWD Chase de Vere says that the key to choosing the best funds is cost. "Because there are no active management decisions being made and they are tracking indices, the decision should be firmly based on the cheapest option, offering the lowest fees and charges," she says. In addition to most ETFs with straightforward dealing costs, Bowes likes the Fidelity MoneyBuilder UK Index Fund, and notes that it has a very low annual management charge, around 0.1 per cent. She also feels that the trackers offered by Legal & General, such as their UK, European and US index trackers, and Liontrust's Top 100 fund should be serious contenders for investors' money.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies