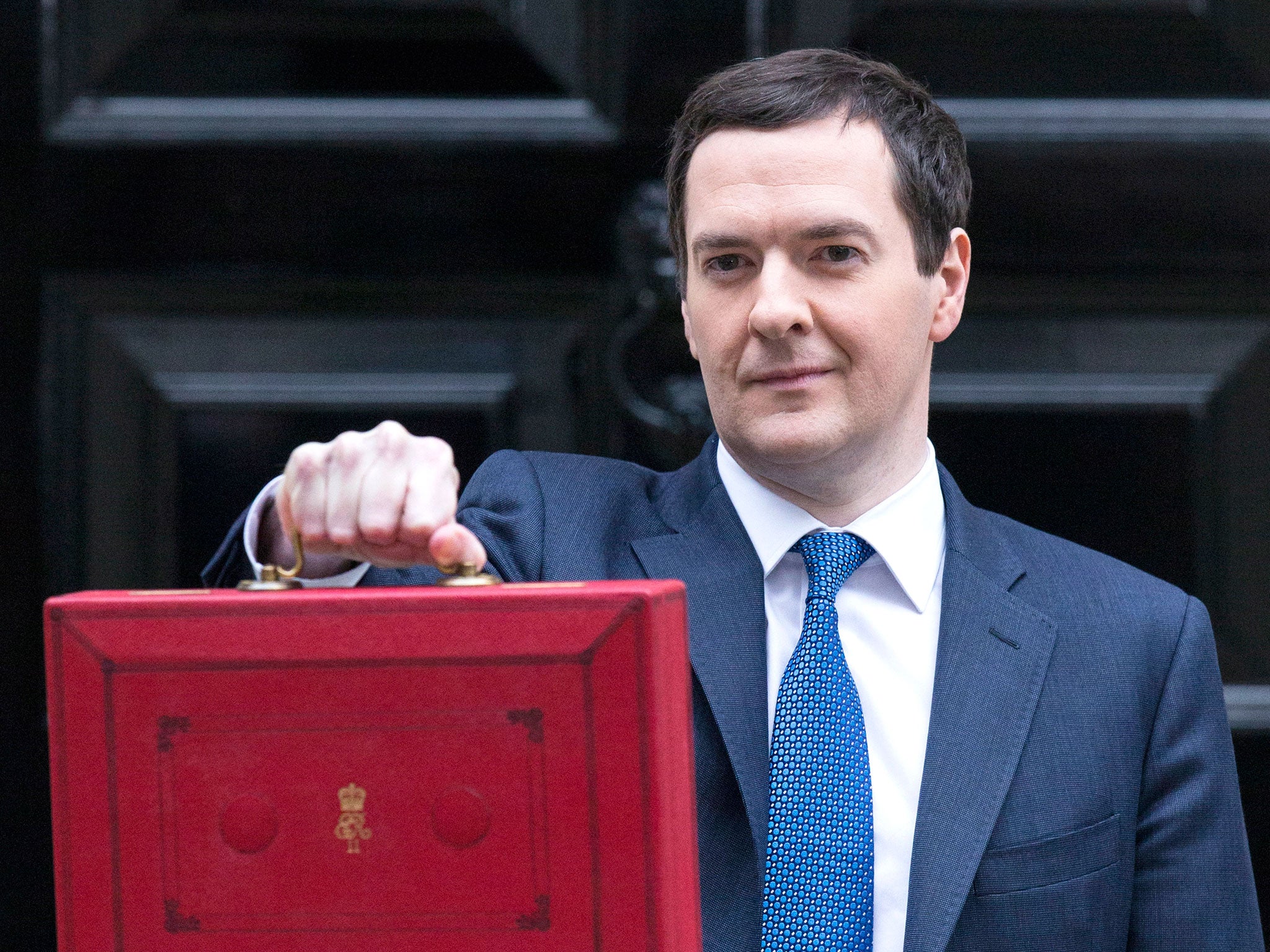

Budget 2015: George Osborne is set to get tough with further cuts in public spending

From pension relief to property charges and even the 'lock' on tax rises, everything could be up for grabs this Wednesday. Simon Read reports

This Wednesday, the Chancellor George Osborne will present his second Budget of 2015. This time it's been billed as an "Emergency Budget", coming as soon as possible after the election so that the new Government can start working on cleaning up the mess left by the last one. Free of whatever shackles the coalition with the Liberal Democrats involved, what should you expect from the first totally Tory Budget for 18 years?

One thing we can be pretty sure of is that Mr Osborne will use that freedom to get tough. There will be no giveaways or good news, as there was in March's pre-election Budget. Instead, expect some Conservative attempts to balance the books with further cuts in public spending.

How will your personal finances fare? First, there are fears of further tinkering with the pension system, with could hit us all in our pockets.

Pensions

A possible clue to the next big overhaul of pensions was the publication on Thursday on the Parliament website of a briefing paper entitled "restricting pension tax relief".

"Cutting the tax relief on pension contributions could mean huge savings for the Government," points out Maike Currie of Fidelity Personal Investing. At present, anyone earning more than £150,000 a year can pay up to £40,000 into a pension and benefit from full tax relief.

However the Conservative manifesto promised to reduce that limit progressively to just £10,000 a year for anyone earning between £150,000 and £210,000.

Tom McPhail, head of pensions research at the adviser Hargreaves Lansdown, says: "Our great concern is that the Government will simply cap tax beaks for high earners. That would do nothing for the vast majority of the population except make the pension system marginally more complicated than it already is."

Income tax

The income tax threshold – the amount you can earn before you pay any tax – was increased to £10,600 in April and is set to climb again next April to £11,000. There's also a lock on rises to income tax during the current parliament. So will the Chancellor steer clear?

Probably not, reckons Alex Henderson, a tax partner at the accountancy firm PwC. "Don't assume the tax-lock commitment means no changes to income tax, national insurance or VAT. There's scope to raise more revenue, without increasing tax rates, by widening the definitions of what's taxed – or withdrawing tax reliefs."

The Chancellor could redefine short-term capital gains as income, as some other countries do. This would hit those selling at a profit through eBay and other online sites.

Budget 2015: Sunday trading hours to go round-the-clock

Greek tragedy casts a cloud over Osborne's Budget

Osborne will touch on social reform – but he’s no Lloyd George

What George Osborne won’t do in the Budget next week

Property

Fears of a so-called mansion tax have receded, at least for the life of the current parliament, but property could yet be the focus of some revenue-raising opportunities.

For a start Mr Osborne could increase the council tax charge on high-end residential property, reckons Alan Pearce, a partner at the accountants Blick Rothenberg. "He could introduce an upper band for very expensive houses, or simply increase the current levels of council tax so they are more in line with the old rating system had it kept pace with inflation."

There could also be moves to restrict or abolish relief on main residences for properties worth over £2m, which would help generate extra capital gains tax revenue when high-value homes are sold.

Inheritance tax

The Tories have promised to raise the inheritance tax threshold from its current level of £325,000 per person, to the point where most family homes won't end up being hit by the tax. In the run-up to the election, they pledged to change it so that properties worth up to £1m would be exempt.

Next week Mr Osborne is likely to sketch out more details, but plans will involve an additional transferable allowance of £175,000 per person for main residences, taking the total inheritance tax threshold per individual to £500,000 and therefore up to £1m for couples.

Salary sacrifice: a scheme in jeopardy

Rumours persist that the Chancellor could cut, or even axe, "salary sacrifice" – the scheme that allows employees to maximise their tax-free contributions to their pension savings by trading in some of their pay.

Andy James, head of retirement planning at the financial adviser Towry, reckons it's a real possibility that salary sacrifice may be culled or reduced in the Budget.

"As it stands at present, salary sacrifice is an extremely useful scheme to boost not only pension contributions but also things such as child benefit – by reducing income below the threshold for reductions in benefits.

"If, as is widely predicted, pensions tax relief is reduced to an arbitrary amount [say to 30 per cent – a reduction on the 45 per cent relief now enjoyed by those earning more than £150,000), then something would likely be done to stop workers getting around this reduction by sacrificing more of their salary directly into their pension funds instead.

"If salary sacrifice were blocked, and higher earners also had either pension tax relief or their annual allowance restricted, then they would be unable to gain the advantages they currently enjoy."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments