How to keep your cash safe from politicians

Conference season is over, but what did the parties propose for your money? Here's our guide to protecting yourself ahead of next year's election.

No matter who wins the general election next year, there are likely to be both cuts to benefits and higher taxes on the way. Brian Dennehy, managing director of Kent-based independent financial adviser Dennehy Weller, says: "Whoever gets in, we will see less government spending and more tax. There is no doubt that there are tough times to come, and it might make sense to bring some of your financial planning moves forward."

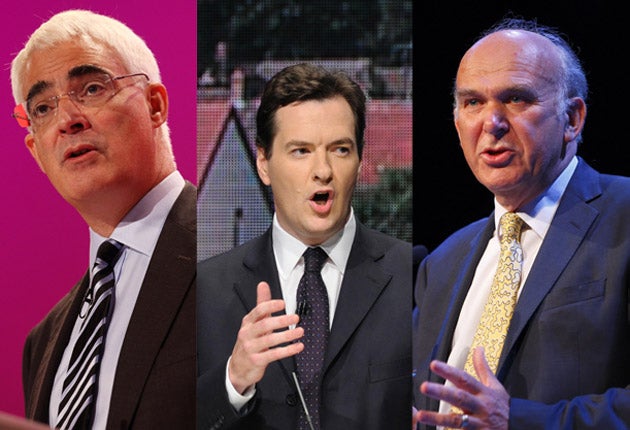

Now the three main parties have completed their annual conferences, we examine their proposals to find out what action you need to take to "politician-proof" your finances.

Pay

Labour says it will tell the independent pay-review bodies that set public-sector pay that 750,000 workers, including doctors, prison officers, dentists and civil servants, should see their pay increased by no more than 1 per cent. The top 40,000 most-senior civil servants, judges, GPs and NHS managers should get no pay rise at all. Nurses and teachers are not affected because they are in the middle of a three-year pay deal.

Conservatives have pledged a total public-sector pay freeze, with only front-line members of the armed forces and those earning less than £18,000 a year getting rises. MPs will see their pay cut by 5 per cent, then frozen. Anyone who wants to pay an employee more than the Prime Minister earns will have to get the salary approved by the Chancellor.

The Lib Dems have vowed to crack down on the bonus culture in the civil service and will freeze pay rather than cut services. They also want to axe a raft of quangos.

Action: Don't enter into extended or expensive financial commitments in the expectation of a pay rise. Put extra money aside for emergency spending.

Tax

Labour is raising the top rate of income tax from 40 per cent to 50 per cent in April for those earning more than £150,000. Pension tax relief for those earning more than £150,000 a year will be axed from April 2011. George Osborne said he did not think of this higher tax rate as "permanent" but he added that he "could not even think" of removing it while public-sector workers were being asked to accept a pay freeze.

The Lib Dems will raise the basic tax allowance to £10,000 from £6,475, "providing an incentive to work and to save". Vince Cable, the Liberal Democrat Treasury spokesman, says: "It is wrong that people on the minimum wage should be dragged into tax".

Action: Brian Dennehy recommends bringing forward the sale of personal investments and even your business if you would be hit by higher taxes later, but take professional advice.

Property tax

Labour stole the Tories' thunder by making inheritance tax allowances transferable between married couples and civil partners.

The Conservatives will probably delay the raising of the IHT threshold from £325,000 to £1m, which they promised in 2007, and could also levy capital gains tax at 40 per cent, rather than the newly introduced rate of 18 per cent.

The Lib Dems are proposing a 0.5 per cent tax on property worth more than £1m, but have not spelt out how this would be collected and how the valuation would be done.

Action: It could be worth selling assets to crystallise capital gains now. Take advice on inheritance planning.

Benefits

The Conservatives will force those on incapacity benefit to face more-stringent tests, which could see them put on to jobseekers' allowance, and cut their weekly payments by £25. Private firms would receive government contracts to get the unemployed into work, in a scheme to replace the New Deal.

Action: Saving can be hard for those unable to take demanding jobs to cushion the blow of coming off higher-rate benefits. Check out charities that help vulnerable people get back to work.

Pensions

Labour has already pledged to restore the link between state pensions and increases in average earnings, but when it comes to paying for it, it has flunked committing itself to reining in public-sector pension entitlement by saying that cuts will be restricted to high-earning council chiefs, and also left the way open for high earners to continue to benefit if they contributed more themselves.

It was the Conservatives who came up with one of the most startling proposals of the conference season: to raise the state pension age to 66 in 2016 – a full 10 years earlier than Labour had planned to do so, as part of its scheme to increase the retirement age to 68 over several decades. The Tory proposal would affect every citizen under the age of 58 and allegedly save a massive £13bn a year.

Among other pension cost savings, the Conservatives will close MPs' generous final-salary scheme to new members and "find a way" to cap public-sector pensions at £50,000 a year.

The Lib Dems are also committed to reforming public-sector pensions, particularly the large payments made to senior civil servants and MPs.

Action: Brian Dennehy recommends you start saving now, either in a pension scheme or in a long-term savings plan such as an ISA. If you are already saving, keep it up.

Long-term care

Labour has pledged to found a National Care Service, offering everyone with a "high need" free care in their home. "High need" is defined as requiring more than 16 hours of personal care – such as help with washing and dressing – a week. Around 350,000 people current pay for that level of care at home.

The Tories say they will allow people to pay a one-off charge of £8,000 to a private insurer at age 65 to waive the cost of long-term care, currently borne by the person needing care if they have assets exceeding £23,000. The Lib Dems this year scrapped their pledge to offer free care to the elderly. Vince Cable said, however, that free care for the elderly in England was still an "aspiration" for the party, but claimed that under the current financial circumstances it was "unrealistic".

Action: It is unclear how the Labour and Conservative proposals would work. More clarity is needed before action can be taken to plan.

Finance for children

Child Trust Funds are one of Gordon Brown's flagship policies, so likely to continue under a future Labour administration. No mention has been made by Labour of changes to child benefit.

Contrary to expectation, the Conservatives have pledged to retain child benefit as a universal benefit but will scrap child trust funds for all but the poorest third of the population. The right-leaning Institute for Fiscal Studies says that abolishing CTFs altogether would save about £500m a year.

The Lib Dems will scrap the child trust fund, claiming that the £20bn spent on it is wasteful – one in five vouchers is going uninvested by parents and has to be invested for the child by the Government – and there are better ways of helping children.

Action: Parents are likely to have to continue to help their children to save for higher education and set up home. If wealthier parents lose the child trust fund perk, they could divert child benefit into a similar savings scheme, if they are not already doing so.

Childcare vouchers

Labour is planning to provide low- and middle-income parents with free childcare places for two-year-olds. However, the price is the phasing-out of childcare vouchers provided by employers. Tax relief on them will be withdrawn in 2011, making them less attractive for firms to provide. Existing users, and those who sign up for the vouchers before the withdrawal date, will be able to continue to benefit for a further five years.

The Lib Dems pledged earlier this year to offer 20 hours of free child care each week for children over the age of 18 months, and said they would retain Labour's Sure Start scheme for low-income families.

Action: Child care is becoming an expensive "luxury" for the Government to provide. Unless you are on a very low income, make plans for funding it yourself.

Students

Both Labour and the Conservatives are under pressure from universities and the Confederation of British Industry to raise student fees to bridge the funding gap.

The Lib Dems have been forced to drop a pledge to scrap university tuition fees in England. The Conservatives, meanwhile, are proposing to offer students a 10 per cent discount on fees if pay off their loan early.

Action: Prepare for very steep rises in the cost of higher education. Use the child trust fund to save, or set up a similar plan. Children over the age of 16 can save tax-free in a cash individual savings account.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments