Is it time to back a Romney rally?

US presidential election will be key to the fortunes of equities.

The storm that ravaged the US east coast this week, won't hit the country's economic revival. Not only has growth returned – the American economy expanded 1.3 per cent in the second quarter – but it has also been one of the best performing stock markets over the last year, with investors enjoying a strong recovery in equity prices.

Double-digit returns have become the norm for US equity investors once again, as its globally dominant companies help its markets outstrip all-comers, including the volatile but high-growth regions of Brazil and China.

According to the Investment Management Association, the average fund in the North America sector delivered more than 15 per cent in the last year, making it the third-best performer of all UK-domiciled funds.

The indices themselves are up nearly as much, with the Dow Jones Industrial Average and the S&P 500 ahead more than 10 per cent.

However, after such a strong performance, there are some big clouds on the horizon. The last few weeks have seen the start of a weak third-quarter earnings season, with some of the key US companies – including Google – starting to show signs of strain as the wider global economy slows down.

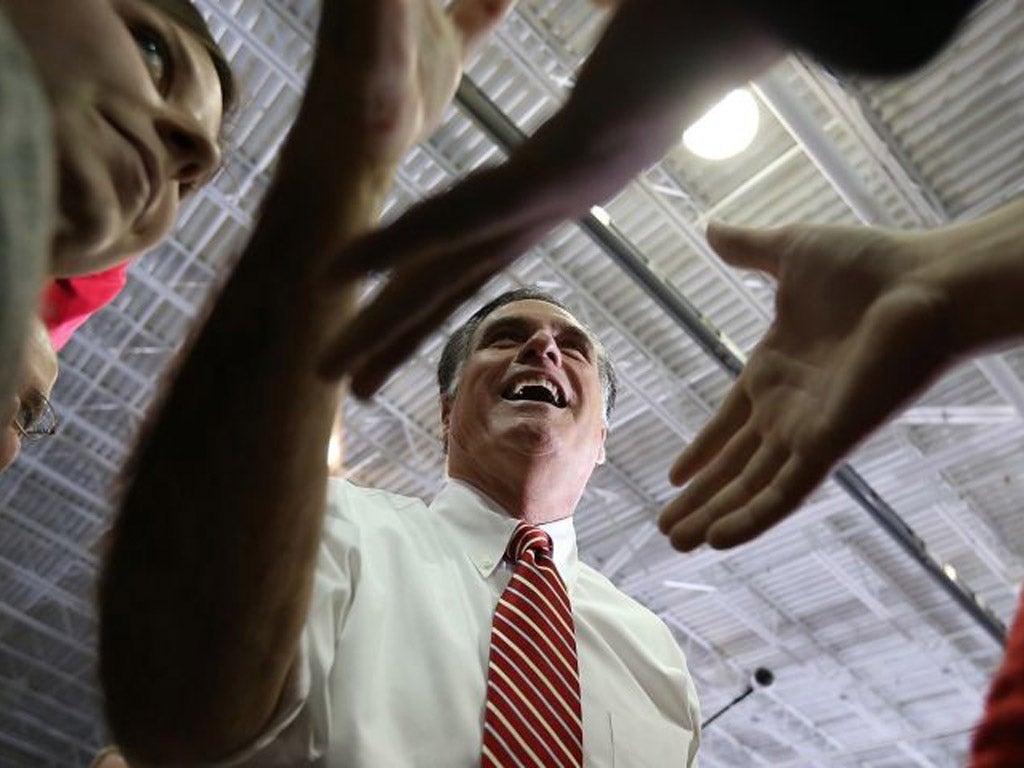

Political uncertainty has also caused investors to pull back and take some profits as the US election heats up. The 2012 election is being fiercely contested by the incumbent President Barack Obama and the Republican nominee Mitt Romney. Now, with the lines clearly drawn in the sand and the election just a few days away – polls open on Tuesday – experts are very clear: the result matters for the markets.

The opinion polls are currently close, with the election likely to come down to a few major 'swing' states, which are as yet undecided over the candidate to support.

But which party would deliver the goods for investors? "A Romney win will be viewed and cheered as a real positive for markets," says Nancy Curtin, chief investment officer of Close Brothers Asset Management.

"He is talking about cutting corporate tax rates, as well as maintaining the Bush-era tax cuts, and that would be a huge boom for investors. The knee-jerk reaction would be positive for stocks."

An Obama win will by no means be a disaster for markets, but investors argue the return of a Republican back to the White House come January could really put a rocket under equities – particularly in some of the more unloved sectors like financials if the party follows through on plans to cut down on regulations and red tape.

The make-up of the government after the election will also have a bearing on another major headwind facing investors – the US fiscal cliff.

Essentially a series of attractive tax cuts made when George W Bush was in power, these are due to expire at the end of this year as the US moves to bring its budget deficit down. It has been cited by many investors as the biggest threat to the US economy.

Estimates predict the fiscal cliff could cost the economy as much as 5% of gross domestic product if the tax cuts are allowed to expire – something that would plunge the US back into recession – and it is therefore attracting more attention than the election itself among investors.

Jeremy Batstone-Carr, chief strategist and economist at wealth manager Charles Stanley, said that while it remains unlikely the parties will fail to come to some agreement to put off the fiscal cliff – and thus prevent the series of damaging tax hikes coming in – one thing investors will not put up with for long is uncertainty.

"Financial markets hate uncertainty and there is a chance they will not reach an agreement," says Mr Batstone-Carr.

Ms Curtin adds that the fiscal cliff has also put a stop to companies' expansion plans, and kept valuations under control.

"What has been missing is corporate confidence, and a solution is necessary to tackle US debt levels," she says.

So with markets having had a decent run – far outstripping the 1% rise the UK's FTSE 100 has seen – and with so many risks facing the US, those looking to invest now need to take extra care buying in.

But is now the right moment to invest, or should you hold back?

Mr Batstone-Carr and others are cautious on US equities at present, with so much uncertainty around.

"I would be wary of chasing the market at these levels," he says. "There is a risk that investors who have made decent profits up to now opt to lock-in gains, and the performance we have had in 2012 up to this point could be as good as it gets this year."

Ralph Bassett, deputy head of North American equities at Aberdeen Asset Management, agrees that while the US equity market is not expensive at these levels, it is certainly sensible to be cautious in the near term.

"The market is not overly expensive, but the earnings power of companies is a worry," he says. "There are still a lot of opportunities in the US, but you have to be careful, and we are finding more value in economically-sensitive areas like energy, and financials now, rather than the more defensive sectors like utilities which have been bid up a lot."

Adam Temple, investment management director at wealth manager Brooks Macdonald, is even more bearish, and has been reducing clients' exposure recently.

"While we remain comfortable with the US over the longer term, we feel that there are some short-term issues which will require attention, not least the looming fiscal cliff and the results of the election itself," he said. "Given the above, we have opted to take some profits from our US exposure."

Others, however, are finding more opportunities in the last few weeks now that some of the froth has come off US equity markets.

While it remains up by more than 10 per cent for the year, the Dow Jones Average has come off about 5 per cent in a matter of weeks, and some investors say buying in around these dips is a viable strategy.

Tom Stevenson, investment director at Fidelity Worldwide Investment, says the next 10 weeks could throw out some even more attractive entry points for investors, as speculation about upcoming policy changes move markets around more than normal.

"There will be volatility over the next 10 weeks and I think therefore there may be some good opportunities to get into the market," he says. "The market is not expensive, and valuations are definitely not stretched."

Cormac Weldon, manager of the successful Threadneedle American fund, is also positive US equities have more to give. "We continue to believe that the US equity market is attractively valued and the US economy is in better shape than its developed world counterparts," he says.

Another reason to be upbeat is the fiscal cliff itself. It has acted as a drag on markets so far, effectively putting a cap on how high they could go, but if it is tackled by politicians, it could remove another reason not to invest.

With so much at stake, investors think it is feasible politicians come up with a solution, rather than spook markets by simply allowing the tax breaks which have eased the burden on consumers in the US to be reversed.

"It is largely understood that a complete lapse in income tax cuts and, subsequently the economy at large, will have a negative impact, as consumer spending comprises 70 per cent of GDP," Mr Bassett says. "Therefore we feel that such an extreme event is unlikely to take place.

"Indeed, there is a growing sense among the bosses of US companies that they are less concerned about what changes may have to be made to tackle the fiscal cliff, as long as they get some certainty on policy."

For all the worries over a lack of an agreement on how to tackle the America's vast debt pile, other experts agree with so much at stake, a bipartisan agreement will be struck regardless of who wins.

"The expiry of the Bush tax cuts and the forced spending cuts could hurt GDP by 3-4 per cent," notes Darius McDermott, managing director of independent investment broker Chelsea Financial Services.

"Ultimately, the threat of being forced into recession should focus politicians' minds and mean an agreement is eventually reached."

If the fiscal cliff is sorted, and the Republicans – or the Democrats – get in, Mr McDermott says the underlying picture remains rosy for American companies.

"First, there is a manufacturing renaissance. 500,000 jobs have been created in the sector since the recession and while recovery has stalled over the summer the 're-shoring' trend may continue. Ford and Caterpillar, for example, have both begun to re-shore plants and facilities after salary, energy and property inflation have eroded China's competitive advantage.

"The housing market has already started showing signs of recovery and this may further improve once the election and fiscal cliff are resolved."

Mr Batstone-Carr agrees that if an investor has the nerve for it, buying in now could pay off handsomely if the fiscal cliff is resolved swiftly.

"We have been raising our weighting to the US all year, but we don't want to go overboard because of the political uncertainty," he says.

"If someone was brave, and the fiscal cliff was solved satisfactorily, then I think they could do extremely well if they invested now."

Banks' bill for PPI scandal could top £15bn

With Lloyds Banking Group forced to make a further £1bn provision for repaying mis-sold PPI this week, experts predict the total could soon soar higher than £15bn, writes Simon Read.

The current total amount officially set aside by the banks has climbed to £12.3bn, including Barclays' recent announcement of an additional £700m. But with RBS expected to increase PPI payout commitments by £400m and HSBC by a smaller amount when it reports on Monday, the figure is ever-growing.

However, if current pay-out rates continue, PPI provisions would run out in a matter of months. If they continue at the current rate, Lloyds' provisions would only last until the end of March 2013, for instance.

Which? chief executive Peter Vicary-Smith said: "The banks have been in denial about the true scale of this scandal. Their piecemeal approach to topping up provisions is an inadequate response to what is now the biggest financial mis- selling scandal of all time.

"The banks must now come clean about how many more complaints they're expecting, publish monthly updates on the amounts that have been paid back, and claw back bonuses from executives who presided over the mis-selling travesty."

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies