Savers struggling to stand still against march of inflation

With interest rates expected to stay low for years, there are few places to park your cash where it won't be steadily eroded. By Chiara Cavaglieri

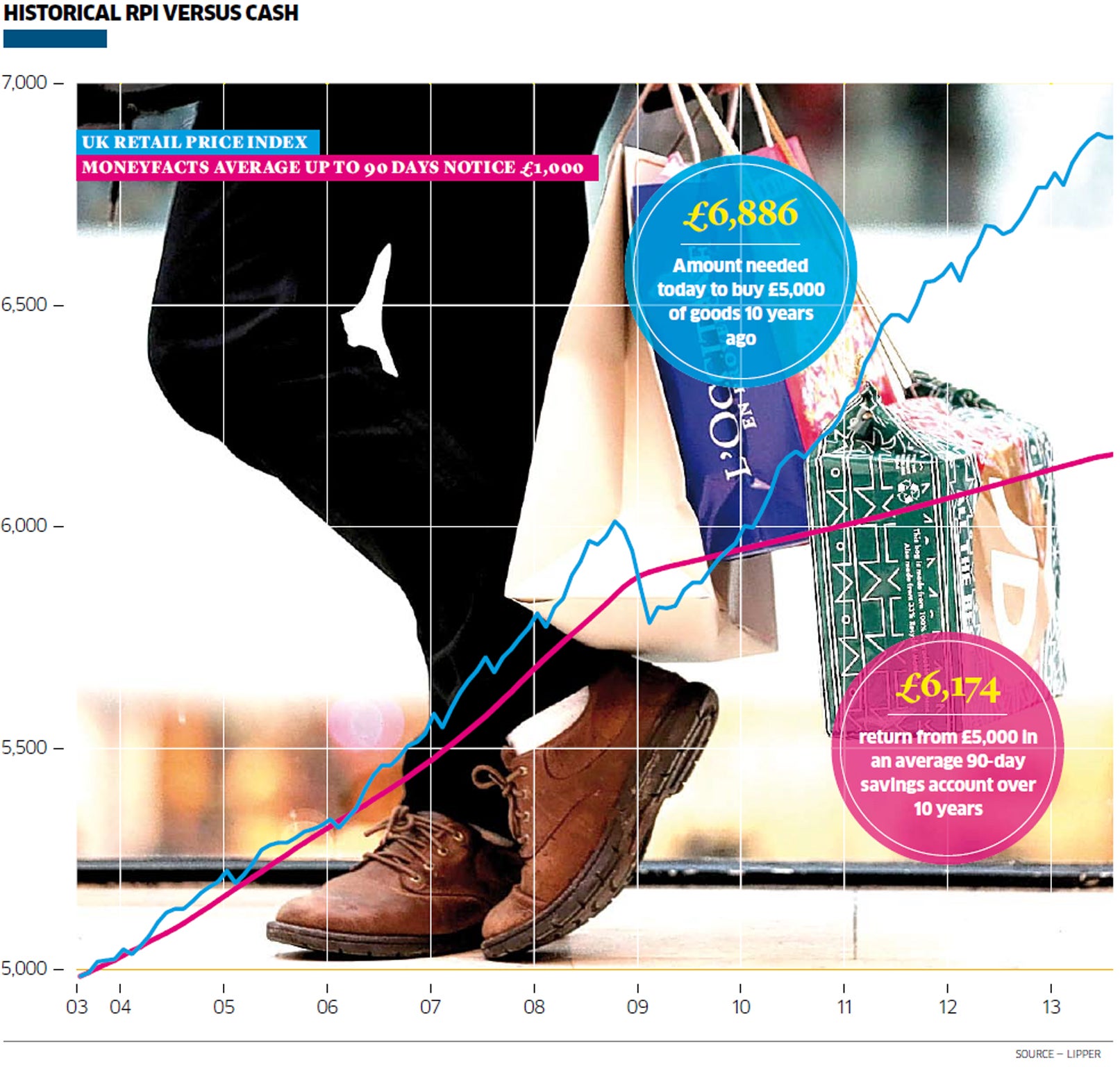

Long-suffering savers and retirees must feel as though they can't catch a break, faced with news that they face continued low interest rates and climbing inflation. The bells of doom were already ringing after the Bank of England's latest Inflation Report, but with experts revealing this week that current levels of inflation could halve the real value of cash savings over 25 years, where can beleaguered savers turn?

Ever since interest rates were cut to just 0.5 per cent in 2009, savers have been scrabbling to find above-inflation returns on their deposits. Borrowers may have welcomed the Funding for Lending scheme, which sparked record low mortgage rates, but for anyone relying on cash savings it made a difficult situation even worse. Last week, the Bank's new governor, Mark Carney, warned that the base rate would not rise until UK unemployment fell below 7 per cent – which is expected to take another three years – and at the same time inflation was likely to remain above the Government's 2 per cent target for at least the next two.

The long-term effects of inflation on the spending power of your money can be catastrophic – since 2009 the consumer prices index (CPI) has risen by 14.87 per cent, while cash has risen by only 3.39 per cent. Annual CPI has now edged down to 2.8 per cent, but Adrian Lowcock at Hargreaves Lansdown explained that inflation at this level would still halve the value of your savings in 25 years.

"The Bank of England has forecast interest rates may remain low until 2016. If this is the case, savers can expect interest on their savings to remain below inflation for another three years," he said. "Inflation also affects our real income. With wages frozen, household incomes are being eaten away by inflation. Inflation matters to all of us, whether we are working or retired, savers or investors, as it measures the rate at which the costs of goods and services rise."

A basic-rate taxpayer would need to earn 3.5 per cent on their savings to beat the current level of inflation yet there is only one lonely account offering any respite, according to Moneyfacts – Skipton Building Society's Limited Edition Fixed Rate Branch Bond – a seven-year bond – paying 3.5 per cent. There isn't a single account paying the 4.66 per cent that higher-rate taxpayers would need to beat inflation.

If you don't want to lock your money away for such a long time, make the most of your annual individual savings account (Isa) allowance. Isa rates tend to be lower than standard savings but as returns have plummeted across the board, it is a struggle to find anything that matches the tax-free benefits. The Nationwide Flexclusive Isa is currently paying 2.25 per cent (including a 0.85 per cent bonus until December 2014) and can be opened with just £1, although you must hold a current account with the building society to apply. The Newcastle Big Home Saver Isa pays a slightly more generous 3 per cent AER, but you must pay in and make no withdrawals to get that rate, otherwise it falls to 2 per cent for that month.

Regular savers and even current account holders can find slightly more acceptable returns. The Santander 123 current account offers both cashback of up to 3 per cent on bills, and interest of up to 3 per cent on balances of more than £3,000 – beating any rival Isa on the market. First Direct also offers its current account customers a regular saver account paying a generous 6 per cent, fixed for one year. You can drip-feed £25-£300 a month but withdrawals are not permitted.

Even if you do manage to snap up a best buy, inflation cannot be ignored, particularly if you are approaching retirement. Annuity rates are already at an all-time low and inflation is compounding the problem for pensioners living on a fixed income and watching the value of their income fall away.

"Everyone will tell you buying an annuity is the safe thing to do but when you think about it, buying an annuity is a huge gamble," pensions specialist Dr Ros Altmann said. "In many ways it is the highest risk option that you will ever take, because you might lose all your capital. The income may have some kind of guarantee but that doesn't protect your capital and that income only lasts as long as you survive."

The stark reality is that with an annuity, you're putting all your eggs in one basket and if it's not right for you, there's no recourse and nowhere to go. If you have a small pension pot the first alternative to taking an annuity is to keep working, even if it's part time, so that you can earn more money, top up your state pension and keep economically active.

Downsizing your house could be another consideration but the real question is whether you're happy to simply put up with the fact that your spending power is taking a nosedive, or take on some investment risk in the hope of generating better returns.

"Cash simply isn't king in the current environment of low rates and above target inflation," said Jason Hollands at the financial adviser BestInvest. "While we all need some cash reserves for short term needs and emergencies, investors with a reasonable time horizon should look to shift some of this into riskier assets where there is a prospect of a real return after inflation."

Equities are volatile but they can offer some inflation-proofing if companies are able to grow their business and raise dividends. Global brands paying high dividends can offer a better chance of keeping up with inflation, and gold is still seen as a hedge against inflation, although its price has seen a sharp fall recently.

Hargreaves Lansdown recommends both Troy Trojan (which has exposure to gold and gold mining equities, inflation-linked US and UK government bonds, and cash) and Threadneedle UK Equity Alpha Income, which yields 3.6 per cent.

A financial adviser can help you build up a diverse portfolio of different asset classes to suit your personal circumstances and attitude to risk.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies