Warning over bonds' 'risky' 6% promise

Investors are being tempted by high returns, but new products are not as safe as they seem.

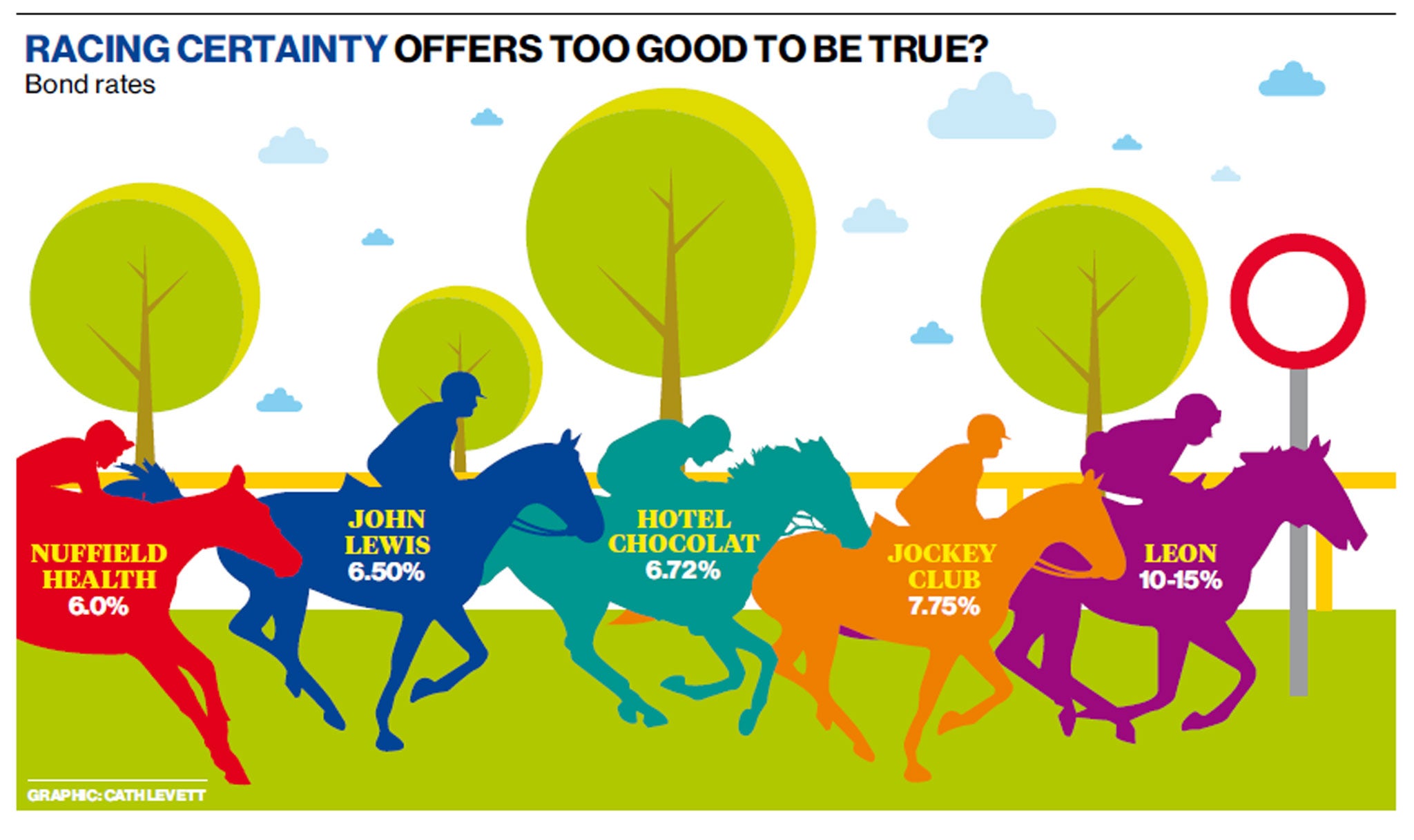

Nuffield Health this week became the latest British organisation to offer fed-up savers attractive rates on bonds. The charity is inviting people to invest between £1,000 to £250,000 in its bond and get a fixed annual return of 6 per cent for five years.

It follows a similar launch by the Jockey Club last month. Its Racecourse Bond pays a total 7.75 per cent in cash and benefits for five years. The latest moves have prompted Capita Registrars to calculate that the minibond market will reach £1bn this year and £8bn by 2017 as companies look for alternative ways to raise finance.

Justin Cooper, chief executive of Capita Registrars said: "There is a growing interest in this new asset class. Brands are able to raise capital at a time when lending from banks is challenging and connect with their client base and involve them in the development of their business."

Indeed, the Jockey Club bond includes Rewards4Racing Points – worth 3 per cent a year – which can be used to buy discount tickets or food and drink at racecourses.

But the bonds have come under criticism from a number of sources as experts warn that the companies issuing them don't make clear the risks to investors.

Kevin Doran, senior fund manager at private bank Brown Shipley, said: "The Nuffield issue underlines the importance of investors understanding what they are buying because there are important differences between it and some recent retail bond launches."

True, retail bonds are listed on the Stock Exchange, which means that can be bought and sold. Investors, therefore, don't have to lock their cash away. With the minibonds, which have also been issued by John Lewis, Hotel Chocolat and Leon, among others, there is no market for ther bonds.Investors must simply sit tight for the length of the term.

Adrian Lowcock, senior investment manager at Hargreaves Lansdown, said: "I do not think unlisted investments are appropriate for the majority of retail investors. There's no liquidity or secondary market where investors can get transparent pricing to determine the value of their investment."

Brian Dennehy, managing director of Fund Expert, fears the perks offered by some bonds are also only of interest to a relatively few people. "We looked at the Jockey Club bond but I got the impression that it was just for hobbyists."

But Mr Dennehy is also concerned about the risks of investing in retail or minibonds issued by just one company. "Some of the bonds launched in the last six months are very opportunistic," he said. "They have been sold on yield compared to deposits, which is very misleading.

"Investors need to be careful. The bonds are issued directly by the company to raise money, so when you buy a bond of one company, rather than a fund invested into bonds issued by many firms, there are many risks."

The key risk is that they are not covered by the statutory safety net, the Financial Services Compensation Scheme, so investors risk losing their money if the company goes bust.

Caspar Rock, chief investment officer of Architas, warned: "Single company-specific risk is only suitable as part of a diversified portfolio.

"An alternative option for retail investors is to consider active corporate bond funds from the likes of M&G, Invesco Perpetual or Kames Capital," he said. Mr Rock added that a cheaper option could be a tracker fund from BlackRock.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies