Don't get left out in the tax cold

Britain's workers are facing a new big freeze, which will hit them where it hurts – in their pay packet. Simon Read explains why you should act on tax now

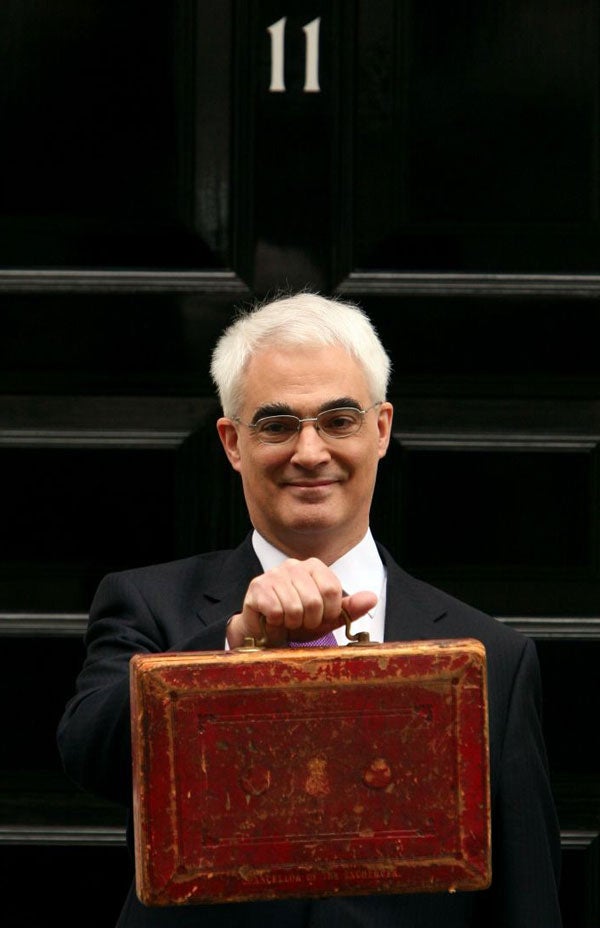

The Government says it will freeze personal allowances next April, scrapping the tradition of increasing income tax allowances each year. The news, announced by the Chancellor, Alistair Darling, in his pre-Budget report on Wednesday, means the current 2009-10 tax levels will continue for another year, until April 2011. For millions of workers used to rising allowances, the freeze will come as a shock when it strikes. The net effect will be that anyone who pays tax will end up paying more. The move is expected to yield an extra £2.2bn for government coffers.

"This is effectively a stealth tax, because any modest increases in pay will not be matched by increases in allowances and tax breaks," says Toby Ryland, tax partner at the chartered accountants Blick Rothenberg. With the level at which you become a 40 per cent taxpayer planned to be frozen for 2012-13 as well, it means that the level will remain the same for three years. Even with small pay rises, it will mean more people than ever fall into the higher-rate taxpayer bracket.

That move is reckoned to net the Government a further £400m a year, with an estimated 70,000 people forced to pay 40 per cent tax on some part of their income. But it's not just middle-earners that will be hit by the allowance freeze, warns Philippa Gee of T Bailey Asset Management.

"It will hurt many people, particularly those who are retired," says Gee. "Pensioners, already suffering from low interest rates, are concerned not only by the increase in certain costs, such as council tax and petrol, but the threat of inflation. But while those who are retired may well feel the most pressure, it will also hurt workers. They will be faced with rises in many costs yet their allowances will be frozen. It's a win-win for the Government and a lose-lose for the public."

Gee adds. "The scale of the problem will take time to hit home, but it will."

Time to take action

The Chancellor's move means it is more essential than ever to understand the effect that tax has on your finances and take legal steps to cut your tax bill however you can. But a study just published shows that many people need to be educated about just how much tax they pay. The report, from Fidelity International, reveals that one in seven doesn't have the faintest idea which tax band they are in.

Fidelity calls this "tax illiteracy" and estimates that 33m people in Britain suffer from it in one way or another. Even people who claim to know which tax band they are in are confused. More than a quarter – 26 per cent – of people with taxable income of £50,000 think they only pay the basic 20 per cent rate of tax. Meanwhile nine out of 10 people have no idea what the current income tax threshold for higher rate tax is. In fact, the 40 per cent rate of tax kicks in at £37,400.

The personal allowance that we are entitled to (which, thanks to Mr Darling, below) will now remain at £6,475) represents the amount of money you can earn before having to pay tax on your income. There are also age-related allowances: those aged between 65 and 74 can earn £9,490 without paying tax; and those aged 75 and over £9,640.

But with tax hitting at 20 per cent on everything you earn above the allowance (rising to 40 per cent on anything you earn above £37,400), failing to take advantage of the many tax breaks around means handing over even more money to the government. "Everyone should have some level of understanding about their own tax position and the opportunities available. Otherwise they could simply be throwing money away," warns Paul Kennedy, head of tax and trust planning at Fidelity.

Cut your tax bill

In 2009, UK taxpayers wasted £349m by not making effective use of their allowances or reclaiming tax to which they are entitled.

"With allowances now frozen until the 2011-12 tax year, tax planning is becoming more important than ever and consumers need to manage their tax bill efficiently to ensure they are not giving more to the taxman than they should," advises Karen Barrett of Unbiased.co.uk.

The main focus should be on your savings and investments. You are allowed to stash cash away in an individual savings account (ISA) with the gains free of any income tax. An ISA is simply a name for an account where you can put cash or investments, such as funds or shares.

The ISA allowance for this tax year is £7,200, of which up to £3,600 can be put in a cash ISA. The good news is the limit is set to rise from next April to £10,200, up to £5,100 of which can be in cash. (Those aged 50 and over have been able to take advantage of the higher amount since October.)

A basic-rate taxpayer would keep 31 per cent more of their returns if they invested using an ISA, points out Fidelity. A higher-rate taxpayer would benefit still further, keeping 84 per cent more. Those to be hit by the new 50 per cent rate next April would see the ISA produce 126 per cent more.

Adrian Lowcock, a senior investment adviser at Bestinvest, says savers should look at other tax-free opportunities too. As well as ISAs, he points out that National Savings Certificates offer tax-free returns. "However rates are low and your money is tied up for two or five years. Investors with some capital gains in their portfolios should make use of the annual CGT allowance of £10,100 and take capital withdrawals instead of income where possible as this is currently taxed at a maximum of 18 per cent, not 50 per cent. However this is likely to be reviewed under the next Government."

Put into pensions, too

Pensions should also be a focus, advises Mike Morrison, head of pensions development at AXA Wealth. "If you pay higher rate tax then any pension contributions paid will get tax relief at 40 per cent, subject to the rules for those earning over £130,000. So this might be an opportunity for individuals to pay larger pension contributions and get higher rate relief."

Even non-taxpayers need to be wary, warns Justine Fearns, head of investments research at AWD Chase de Vere. "Returns have been strong from bonds and equities this year. If interest rates rise towards the end of 2010, as most commentators are predicting, non-tax payers could quickly find themselves pushed into the basic rate category."

One for you, one for me: Why the Government will get half your income in 2011

It is not just the wealthy or the middle classes who now face high total tax rates, says Nigel May, tax principal at accountants MacIntyre Hudson. He says there is an effective total tax rate of almost 50 per cent for even the lowest income earners.

"Consider an employer who has £100, which he wants to give to his receptionist Kirsty so that she can buy a new dress for the Christmas party in 2011. As employers' national insurance contributions (NICs) will by then be 13.8 per cent, he can only pay Kirsty a gross bonus of £87.87, with the remaining £12.13 paid as employers' NICs," May explains.

"Kirsty has to pay 20 per cent (£17.57) income tax and 12 per cent (£10.54) employees' NICs, leaving her with an after-tax bonus of £59.76. When Kirsty buys her dress, she will pay a further 17.5 per cent VAT. So the actual price of the dress she buys, before VAT, is in fact only £50.86.

"This example shows that for every £100 of payroll cost to the employer, where the employee is taxed at the standard rate of income tax and the net income is spent on goods or services subject to the standard rate of VAT, the Government will from 2011 claim £49 of this."

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies