Time is running out for holiday home tax relief

Allowances are set to change, bringing to an end a way of offsetting costs against properties that are let to tourists. Chiara Cavaglieri reports

Landlords are being urged to make the most of a little-known tax relief on their holiday homes before it's too late.

Imminent changes to valuable tax allowances on holiday lettings mean that they should act now to offset losses potentially worth hundreds of thousands pounds against their income.

Favourable tax rules for furnished holiday lettings (FHL) survived by the skin of their teeth after the previous Labour government's plans to withdraw all tax relief were scrapped. Under these rules, if you rent out your holiday property as short-term lettings, you are treated as if you are trading, rather than investing, for some specific tax purposes. As long as you meet the criteria and let on a commercial basis, you can deduct various expenses and allowances from your rental income to work out your taxable profit.

Instead of scrapping this relief altogether, the coalition has decided to restrict the use of loss relief for FHLs as of this April. Now holiday home trading losses can be offset only against future profits from that specific lettings business. Previously, owners could offset the cost of running and maintaining the holiday home against other personal income to produce a tax refund.

"In the past the loss was treated as a trading loss and was available to offset against other income, but now you can carry this forward only against future profits. Capital allowances themselves haven't changed and you may well still generate a loss, but you won't be able to offset this against your salary or pension," says Matthew Brown, a technical officer at the Chartered Institute of Taxation.

The other big change is the raising of the eligibility criteria so that, from 2012, qualifying properties must be let for at least 105 days in the year, up from 70 days. You must also advertise the holiday home as being available for at least 210 days of the year instead of 140 days and you cannot let the property to an individual for longer than 31 continuous days.

There's no giving your friends and family cheap rent either – you must charge the market rate. Anyone who owns a number of FHLs will be able to average out the days they are let for across their properties. And, to make the transition easier, there is a "period of grace" to allow businesses that meet the threshold in only one year to use that to qualify for the following two years whether they meet the threshold in those years or not.

As a business, FHL properties qualify for capital allowance tax relief on the costs associated with providing plant and machinery, which you must claim in your annual tax return. This covers bathroom fittings, white goods, central heating, fitted carpets, pools, furniture and curtains. Typically, you can claim 50 per cent of the cost when you buy it and 25 per cent of what is left each year after that.

Tax experts estimate that capital allowances can be worth between 20 and 30 per cent of the purchase price of a property, equating to a tax saving of between £15,000 and £37,500 on a home worth £250,000. In many instances, once you've taken these allowances it is easy for many landlords to fall into red. Under the old rules this meant you could potentially generate a big tax rebate by setting it against other taxable income such as your salary. So for every £1 of loss, that's £1 of your salary you don't have to pay income tax on.

The crucial message, however, is that these rules still apply for the 2010/2011 tax year, so you must make the most of the last opportunity to offset any losses while you still can. There is also still time to amend previously submitted tax returns to HMRC to take advantage of the reliefs under the old rules; for the 2009/2010 tax return you have until 31 January 2012 to include a claim.

"There are still opportunities for the owners of FHLs to offset losses sideways against any income for two tax years provided they owned a qualifying FHL in the year ending April 2010. The normal time limit for amending income tax returns is one year. As such, until 31 January 2012 clients may amend their April 2009/2010 tax return and offset the allowances against 'other' income," says Dave Collier, a director of specialist tax firm CA Tax Solutions.

Anyone letting property abroad should also make the effort to check and amend previous returns, as it was only in 2009/2010 that the FHL legislation was extended to qualifying property in the European Economic Area (EAA) as well as the UK. The final deadline for claiming capital allowances that would qualify for the 2010/11 tax year is 31 January 2013.

Furnished holiday lettings will continue to qualify for capital gains tax (CGT) reliefs so there is no CGT to pay providing you invest in another holiday let (known as rollover relief). You can enjoy entrepreneurs' relief of business rates at 10 per cent rather than the personal rate of 18 per cent. Also, unlike private rentals, you can include income from an FHL for pension contributions.

"From the risky position of 2010 when it was feared furnished holiday lettings relief would be lost completely, the revised system is a welcome compromise. There is a concern surrounding new entrants to the marketplace, but there is an inherent challenge too," says Kate Stinchcombe-Gillies, a spokeswoman for HolidayLettings.co.uk. "Location, existing tourism demand, effective marketing and positive word of mouth are key to the success of any tourism business, and new entrants will do best if they heed that approach."

Case Study

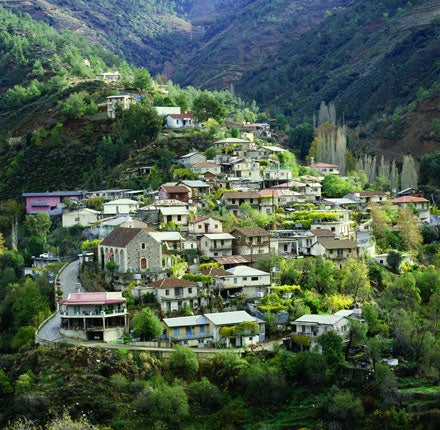

Stephen Kyprianou: Owns a villa in Cyprus

Stephen was in for a welcome surprise when he discovered his furnished holiday let in Protaras could be eligible for tax relief. He purchased the villa in November 2007 for £302,305 and immediately set to work adding substantial improvements to get it ready to let.

"It came pretty naked, just a villa built on a plot, so I spent somewhere in the region of £100,000 on a heated swimming pool, air conditioning, a hot tub and fitted solar panels," he says.

After his accountant in London went to a seminar on capital allowances, Stephen was referred to specialist firm CA Tax Solutions which sent an operative to Cyprus to draw up a report.

"I ended up with a breakdown of what I can claim against capital allowances and my figure was about £80,000," says Stephen. "It's incredible how few people know about capital allowances on holiday lets. I've spoken to so many people and they think I'm pulling their leg!"

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments