Bumi: the whole rotten saga (so far)

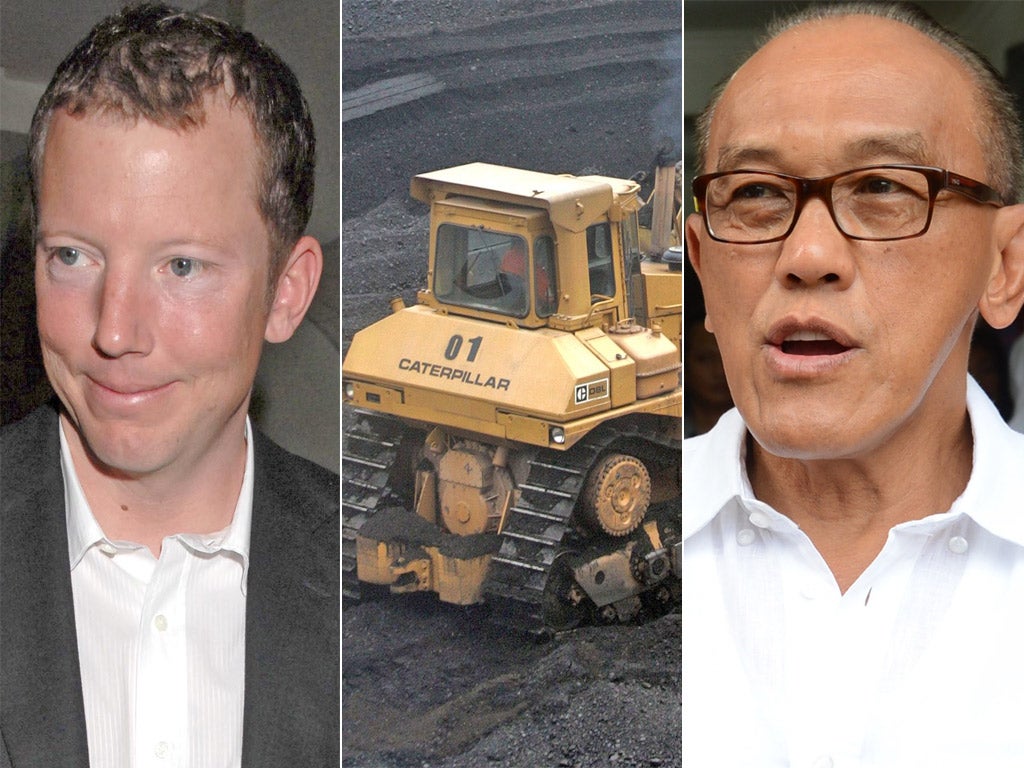

Complicated and racy, the fall-out between the coal-mining business' co-founders – banking scion Nat Rothschild and Indonesia's Bakrie brothers – has a plot worthy of Dickens

The Bumi affair? Sounds like something out of Dickens

Good guess, but you're thinking of Jarndyce and Jarndyce, the complicated and interminable court case at the centre of Bleak House. It certainly bears a striking resemblance to the interminable "Bumi affair" that's given its primary author, the banking scion Nathaniel Rothschild, more press coverage than horsemeat of late and which nobody really understands.

Calling it the "Bumi affair" makes it sound racy rather than complicated though.

Well it's complicated and racy too. Feuding billionaires, whistleblowers, mass boardroom resignations, alleged computer hacking, claims that $1bn (£6.4m) has mysteriously gone missing, that kind of thing.

Break it down for me. Who or what is Bumi?

Bumi is listed on the London Stock Exchange and its business comprises two stakes in Indonesian coal-mining businesses. It owns 85 per cent of Berau Coal, a coal miner based in the Indonesian province of East Kalimantan, as well as 29 per cent of the similarly sounding Bumi Resources, a holding company with coal-mining interests across Indonesia.

Who is behind Bumi?

As you've probably guessed by now, Nat Rothschild, of the Rothschild banking dynasty, is one of the co-founders. Indonesia's Bakrie brothers are collectively the other co-founder. There are three of them and, although they're not well known here, they're big in Indonesia. In fact, the eldest, 66-year old Aburizal, is expected to win the Indonesian presidential election next year. The other brothers are Indra and Nirwan (the one who branded it the "Bumi affair").

So why are the co-founders locking horns?

Mr Rothschild feels a bit of a Charlie because in November 2010 he did a deal with the Bakrie brothers without a huge amount of scrutiny. This saw him merging the $1bn-plus cash mountain he had raised from trusting investors with some of the trio's Indonesian coal-mining interests to create a company called Bumi with a lot of cash to spend. The basic premise of the deal was that Mr Rothschild could get the assets cheaply because Indonesia's dubious reputation for corporate governance left them "undervalued". He would then confer respectability (and value) on them through a London listing and the Rothschild name.

Sounds good to me

It sounded good to a lot of people and initially Mr Rothschild, an 18 per cent shareholder in Bumi, was able to magically "unlock" the value of the coal businesses to the point where only last May his personal fortune was valued at £1bn. It seemed as if 41-year old Nat, the latest in a long line of Rothschild financiers, had transformed his image from a playboy to the most savvy mover and shaker of his lineage.

I have a good nose for a but – and I feel the mother of all buts coming

Bingo. It wasn't long before Mr Rothschild decided he'd bought a share in a corrupt business and suspected that about $1bn had gone missing from the Indonesian coal businesses in which Bumi has a stake. This has prompted a series of increasingly hostile exchanges between Mr Rothschild, the Bakrie brothers and the Bumi board, not to mention an investigation by the Takeover Panel. Meanwhile, Bumi is working with Britain's Serious Fraud Office and the Indonesian authorities to try to get the bottom of what happened.

What do the Bakries say to all this?

They have strongly denied any involvement in financial irregularities. However, Bumi has confirmed that a forensic audit carried out by PricewaterhouseCoopers determined that hundreds of millions of dollars of assets are unaccounted for.

So this thing could drag on for a while

Absolutely. Tomorrow promises to be the greatest showdown of all. Mr Rothschild has made a proposal that is audacious even by his standards. He wants to oust 12 of the 14 people on Bumi's board, including chairman Samin Tan, and put his own team in there, with "his truly" as one of the directors. The outcome of the vote is too close to call. But whatever it is, there are likely to be plenty more twists and turns. For a start, Mr Rothschild said that if he wins he will sue the the Bakries for $1.5bn, while the Bakries have said they will "commence litigation [and] immediately call a new extraordinary meeting to appoint new directors". If Mr Rothschild loses, he has pledged to continue his war.

OK, Mr Rothschild may have lost more than $1.5bn of investors' money but he's done well in business otherwise, right?

Yes and no. He does have some track record of making a profit, with the Atticus hedge fund of which he was co-chairman making stellar returns in the early years. But this success has been clouded by the fund's closure in 2009 as the financial crisis took its toll, as well as a share price fall of more than a fifth following the flotation of Genel, the oil company run by former BP chief executive Tony Hayward, in which he is a key backer.

So the Bumi affair is "make or break" for him?

Well not "make" as such, but certainly "break" – a point not lost on Mr Rothschild himself, whose PR machine has unleashed an unprecedented number of emails in recent weeks to further his cause. Whatever happens now, after his fall from grace in the past few months, he is unlikely ever to be able to command the same respect again. There are some who say he will never raise another dollar from anybody. But, if he can push his plan through and improve Bumi's fortunes, he may just claw back enough to carry on in business – but it's a big if.

It's good Mr Rothschild is determined to retrieve funds for his shareholders but isn't he going about it a bit like a bull in a china shop?

A bit, yes. Sir Julian Horn-Smith, the former Vodafone deputy chief executive who is now Bumi's senior independent director, lamented what he called Mr Rothschild's "extraordinary demonstration of a confrontational style which does not create value for shareholders". Also, his apparent ability to bear a grudge could further put off potential backers in the future.

Rothschild, Mandelson and yacht spring to mind

Yes they do. In 2008, Mr Rothschild famously invited the now Chancellor George Osborne to a party that he and Peter Mandelson were attending on Russian oligarch Oleg Deripaska's yacht in Corfu. That encounter ended in a glorious falling out after Mr Rothschild wrote a letter to The Times claiming that Mr Osborne tried to solicit a donation from Mr Deripaska while on the yacht – an accusation the latter vigorously denied. His letter was a retaliation against his prep school, Oxford and Bullingdon Club friend, Mr Osborne, whom he blamed for "dripping poison" to the newspapers about Gordon Brown, then Prime Minister.

Is there anything else I should be aware of?

Having declared at the weekend that his proposal was a shoo-in, Mr Rothschild has taken a couple of knocks this week, which leave the outcome genuinely too close to call. On Monday three investors thought to oppose his plan bought a 10 per cent stake in Bumi and yesterday Standard Life, thought to be a key ally of the scion, announced its opposition.

You mentioned Jarndyce and Jarndyce earlier. Does that have anything to teach the Bumi protagonists?

It just might. Dickens' fictional case centred on an inheritance and dragged on for so many generations that the legal costs eventually devoured the estate they were fighting over. A cautionary tale indeed.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies