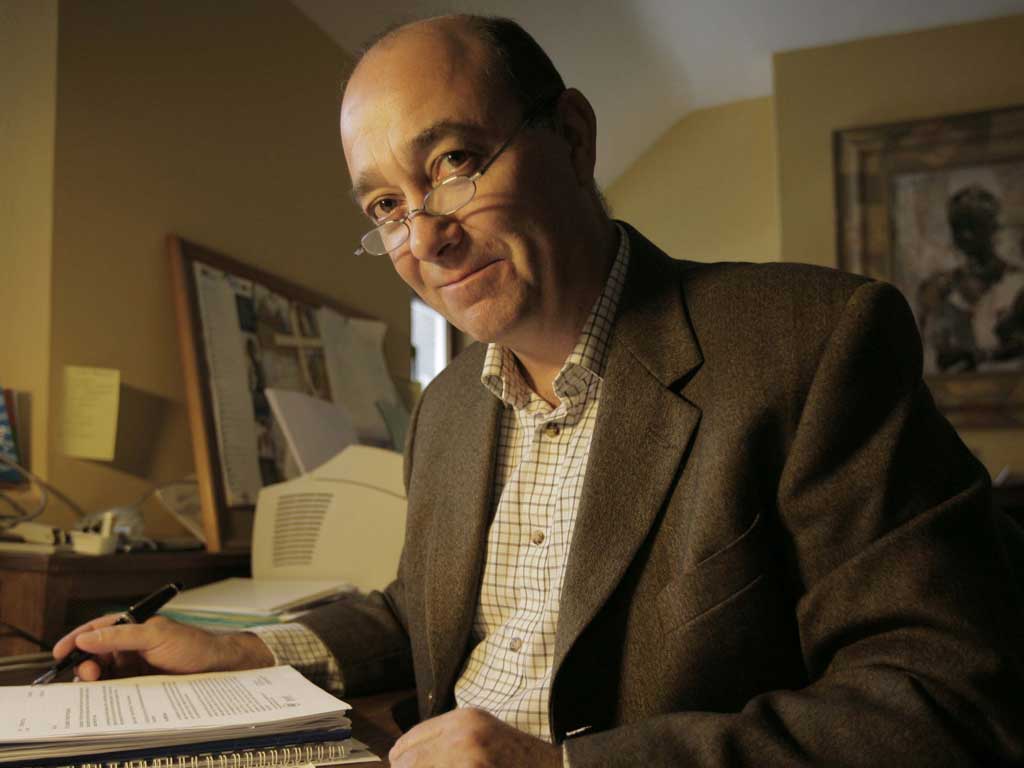

On the warpath: Whistleblower Paul Moore on Lloyds Banking Group’s 'pathetic' £28m fine

As Lloyds is hit with a fine for mis-selling, whistleblower Paul Moore speaks out

Paul Moore, the celebrity whistleblower whose explosive evidence over HBOS led to the resignation of one of the City’s top bankers, is appalled.

Indeed, even Mr Moore, whose opinion of bankers is about as low as you can get, can’t believe the latest revelations that Lloyds Banking Group had devised another incentive scheme which led to the mis-selling of yet more dud products to customers.

“There’s no other word for it –I am appalled and Lloyds customers should be outraged. After everything that happened during the banking crisis, and all the talk about improving regulation by the regulators, it’s beyond belief that the Lloyds board allowed such a scandal to happen again,” he says.

“And the regulators? Well, they were asleep at the wheel – again. They should have checked out the Lloyds incentive scheme too.”

Mr Moore also described the decision by the Financial Conduct Authority (FCA) to fine Lloyds £28m as “measly” and unlikely to act as a deterrent to future bankers.

In a devastating report published earlier this week, the FCA found Lloyds salesmen guilty of selling £2bn worth of products such as stocks and shares Isas and illness or income insurance cover to 700,000 or so customers of Lloyds, Halifax and Bank of Scotland.

“This fine is pathetic and will not act as a deterrent for any bankers who have shown, time and time again, that they ignore such penalties because they don’t hurt. The fine should have been at least a quarter of the £212m revenue made from the mis-selling. That, together with the £28m, might make them think more seriously.

“Lloyds now faces a bill of at least £100m to compensate its customers who were mis-sold products between January 2010 and March 2012 in what has been described as a bonus-induced ‘grand in your hand’ selling frenzy by staff, with one salesman so frightened of losing his job that he sold himself a product to make up the numbers. What’s so astonishing is how Lloyds could have created such an incentive-scheme when what happened at banks like HBOS should have taught them how dangerous they are.”

The dangers inherent in bonus-based selling became obvious to Mr Moore while he was head of risk at HBOS from 2002 to 2005.

He was so worried by the sales culture that Mr Moore warned the board but was ignored and left with a non-disclosure agreement.

However, he was so incensed when HBOS collapsed and was rescued by Lloyds, he appeared before the Treasury Select Committee in 2009 with his bombshell of claims that he had warned the then Halifax chief executive, James Crosby, about the dangers of the bank’s rotten sales culture. His evidence forced Mr Crosby to resign as deputy chairman of the Financial Services Authority – now the FCA – and he lost his knighthood.

Yet what angers Mr Moore even more today is that still no one has been punished or charged for their actions.

“Why isn’t action being taken against the Lloyds risk or compliance officers involved. Why isn’t the regulator taking action against the board directors or the non-executives? And, why didn’t the regulator demand to look at any of the new incentives schemes being designed? There has been a total lack of oversight at every level.”

So far Lloyds has hinted the only redress will be to claw-back bonuses from past and current directors such as ex-boss Eric Daniels, former head of retail Helen Weir and possibly the current chief executive Antonio Horta-Osorio, who was running the bank for 12 months before the bonus schemes were stopped in March 2012.

“I find it difficult to see how Mr Horta-Osorio can wriggle out of this. He was in charge,” Mr Moore adds.

“Why does no one take any accountability? I’ve realised that it’s impossible to change the banking culture so the only way to change things is to compete with them.”

And that’s what the whistleblower has done. He’s set up a new, peer-to-peer lender, Assetz Capital, which has already lent about £10m to around 30 small businesses.

“We say we are replacing positively disgusting finance with positively disruptive finance. And it’s doing good – lending to companies for jobs and growth. And its simple and safe – I would even let my 87-year-old mother take out a loan or lend.”

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies