David Blanchflower: Have the policymakers at the Bank of England gone completely nuts?

Economic Outlook:

The Bank of England's Monetary Policy Committee (MPC) last week published its latest forecasts for the British economy in its May Inflation Report. This followed its meeting a week earlier when it decided, presumably much to Chancellor Osborne's chagrin, that it would make no change either to interest rates or to the scale of its asset purchase programme. One of the major lessons from the 1930s is that central bankers are not powerless to act even if they think they are, and more action is better than less. So once again, in my view, the collective sitting on hands looks a major policy error.

We will not know until later this week whether there were any dissenters. My guess is that it may well have been a split of 6-3 with Martin Weale, David Miles and Adam Posen in the minority. In an interview with Market News International Adam Posen (who we also learnt on Friday is leaving the MPC in August to become the next president of the Peterson Institute) says he became too optimistic about the UK's economic outlook in the last few months and he may have been premature to believe the MPC had done enough quantitative easing. That suggests he voted for more QE this month.

The background to this is an economy that has the slowest recovery from recession in over a century, having contracted by 0.2 per cent over the last six quarters. To put this in context, out of the 34 OECD countries, over the last six quarters GDP growth in the UK ranked 29th, ahead of only Japan, Estonia, Italy, Portugal and Greece. On the day the Inflation Report was released there was a welcome reduction in the unemployment rate, but that news was tempered by an increase in the number of long-term unemployed by 27,000. Employment also grew, but that was restricted to older workers; there was no increase in the employment of those under 25.

Of additional concern was that wage growth was reported as 0.6 per cent, driven largely by a drop in bonuses. But this continues a steady trend downwards in both nominal and real wage growth. In March, nominal wages grew by 0.6 per cent, and with a 3.5 per cent CPI that gives a real wage fall of 2.9 per cent. So real wages are falling fast, which goes a long way to explain why consumer confidence and spending are both weak.

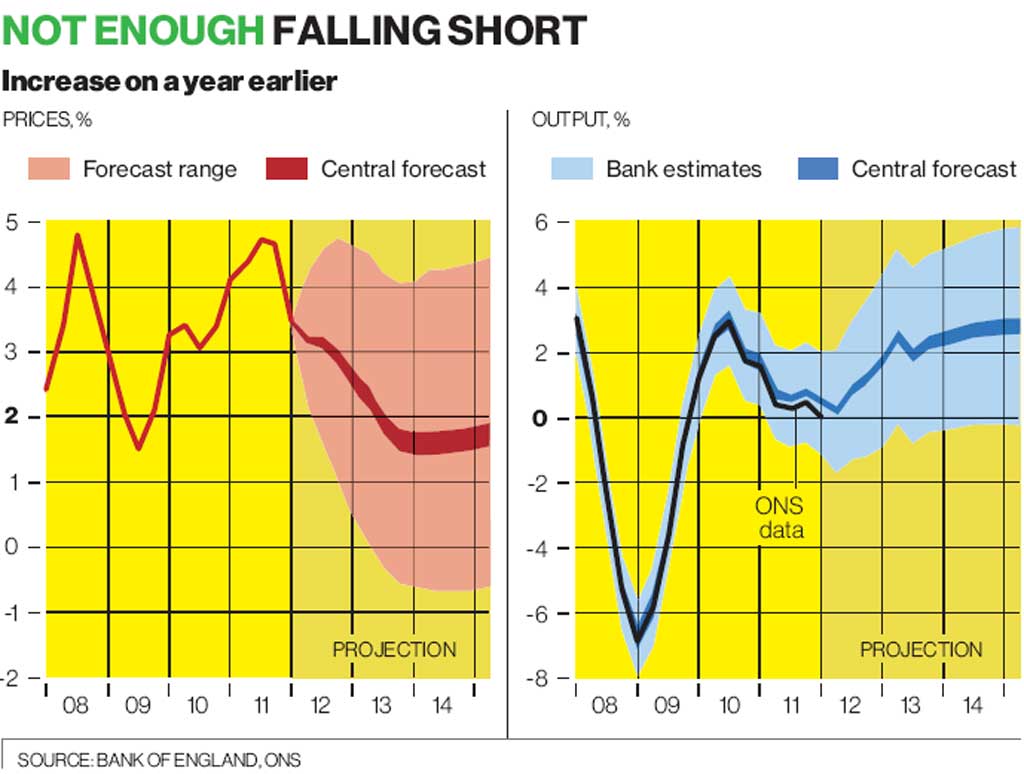

The MPC's main forecasts in the form of fan charts for growth and inflation are shown above. Let's start with the growth forecast, which the MPC, as in almost every quarter since the recession started, had to downgrade. It still assumes all is going to be back to normal soon, with growth possibly as high as 6 per cent in 2014, but no chance of zero or negative growth. When I explain this to business audiences, it always draws a big laugh. The MPC failed to incorporate any of the potential risks from the euro area to the forecast, as they said that they are hard to quantify. Of particular concern is that the MPC appears to believe that the majority of the growth they are predicting will come from consumption, as inflation falls. But falling real wage growth suggests that is unlikely.

The inflation fan chart suggests that inflation will come down and will hit the target in mid-2013 and then go below it and stay below it through 2014. The MPC's job is actually to get inflation to hit the 2 per cent target, and so it is hard to understand, on the basis of this chart, why they didn't loosen further and do additional QE. The fan chart says they should have done more and surely would have done more if inflation was above target. The falling oil price suggests that inflation may start to surprise on the downside. Brent crude oil futures are down 10 per cent since the beginning of May. The committee judged that the risks to inflation were balanced on the upside and the downside. Are they nuts? Even though they couldn't quantify the risks from Europe we clearly know the direction: they are on the downside.

Targeting inflation hasn't delivered the promised economic stability, far from it. It is now time for a change. In a new book*, Olivier Blanchard, chief economist at the IMF, puts it well: "Before the economic crisis began in 2008, policymakers had converged on a beautiful construction for monetary policy. We convinced ourselves that there was one target, inflation, and one instrument, the policy [interest] rate. And that was basically enough to get things done. One lesson to be drawn from this crisis is that this construction was not right: beauty is not always synonymous with truth. There are many targets and many instruments ... Future monetary policy is likely to be much messier".

Messy indeed. There have been calls for the MPC to target nominal demand, but I just don't think that is practical given the frequent data revisions that occur. A simple change, which amounts to much the same thing, would be to first raise the inflation target to 4 per cent. This could be done next year when the CPI changes to include house prices based on rental equivalence. Second, the mandate should be extended to become dual and explicitly include "maximum employment" as of the Fed, which is tasked with maintaining "maximum employment, stable prices, and moderate long-term interest rates".

Raising the inflation target to 4 per cent would mean that rates could remain lower for longer, which would boost growth. It also helps to deal with the problem of the zero nominal bound; rates have to rise again eventually so that when the next shock comes along they can be cut. We also have a growing body of evidence from behavioural economics that changes in unemployment have a much bigger effect on wellbeing than do changes in inflation.

In a speech this week the Prime Minister made it clear that there is to be no change fiscally. Policy errors have lowered the UK's growth prospects but have raised the likelihood that the UK will lose its AAA credit rating.

*In the wake of the crisis. Leading economists reassess Economic Policy, edited by O. Blanchard, P. Romer, M. Spence, and J. Stiglitz, MIT Press, 2012.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks