David Blanchflower: How bad must it get before Slasher Osborne is sacked?

I question whether these new self-employed jobs, especially part-time ones, are good jobs

On 22 June 2010 the new Chancellor of the Exchequer, George Osborne, presented his emergency Budget. In the House of Commons he argued: "This Budget is needed to give confidence to our economy …Our policy is to raise from the ruins of an economy built on debt a new, balanced economy where we save, invest and export. An economy where the state does not take almost half of all our national income, crowding out private endeavour. An economy not overly reliant on the success of one industry, financial services – important as they are – but where all industries grow. An economy where prosperity is shared among all sections of society and all parts of the country."

As everyone must know by now, the economy hasn't grown; the people haven't prospered; there has been no fundamental rebalancing, the country remains over-reliant on financial services; investment and exports have not taken off; declines in the public sector have crowded out the private sector; and we aren't all in it together.

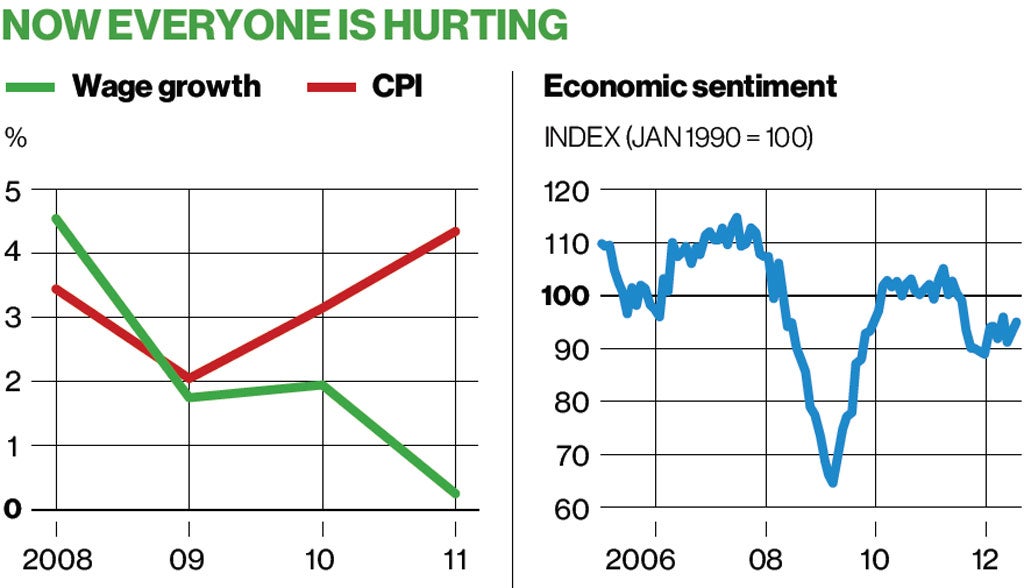

Far from boosting confidence, exactly the opposite occurred. Business and consumer confidence both collapsed from May 2010. The graph provides the evidence and shows that the spring of 2010 was almost exactly the pinnacle for confidence in the UK economy. The Coalition looks to have killed off animal spirits, not least by talking the economy down. Slasher achieved exactly the opposite to what he hoped. As he went on to say, "unless we now deliver on that promise of action with concrete measures, that credibility … will be lost." That credibility has already been flushed away.

Plotted is the European Commission's monthly Economic Sentiment Index for the UK, which is a weighted average of four business surveys, covering production, services, construction and retail and a consumer confidence index, which itself is a weighted average of four consumer surveys covering individual reports on an individual's financial situation; their views on the general economic situation in the country, what they expect to happen to unemployment, and their plan for savings over the following year. Confidence in the UK economy has been in recession territory for about the last year.

During the last week there was more incontrovertible evidence, over and above the confidence data, that the economy remains in double-dip recession:lending numbers were poor; house prices started falling again; and the latest Purchasing Manager's Index (PMI) for manufacturing plunged again, falling from 48.4 to 45.5, to its lowest level since May 2009. Output, inventories and new orders all contracted sharply; the construction and services PMIs were also weak.

Some commentators have argued that things are much better in the UK in this recession than in previous ones, when unemployment reached much higher levels. For example, in January 1993 unemployment hit 10.7 per cent, compared with 8.1 per cent today. But that ignores the fact that unemployment spells then were long, which meant that approximately 10 per cent of the workforce was unemployed all the time and 90 per cent of the workforce was never unemployed; now everyone is hurting. Moreover, most workers were able to obtain real wage increases throughout most of the post-war period right up until 2007. Since then real wage declines occurred across most of the wage distribution except at the very top end. That can be seen from a comparison of average weekly earnings with the Consumer Prices Index inflation data. If the CPI growth is higher than wage growth then real earnings are falling, and vice versa. So from 2011 on, not only are the unemployed hurting, so are the employed, who are now seeing negative real wage growth, even though the CPI is declining.

There is also the issue of what has happened to the earnings of the 4.2 million self-employed. Their earnings are not included in the AWE, and we know from earlier research that the typical self-employed person halfway up the earnings distribution earns less that the equivalent employee halfway up the wage distribution. Note that some self-employed workers even make negative earnings or losses. There has been an increase of 200,000 in the number of self-employed workers since this government took office, while the number of employees is approximately unchanged, so the self-employment rate (the percentage of workers who are self-employed) has risen from 13.6 per cent to 14.2 per cent. One third of this increase is in part-time self-employment; my examination of the latest data for Q12012 suggests, as one might expect, these are primarily women, and principally in childcare, cleaning and hairdressing. It seems unlikely, then, that these are budding entrepreneurs; there is a possibility that they have failed at both self-employment and wage employment and are pursuing low-level menial work on very low piece rates. Limited demand for their services may well be keeping both their hours and their earnings down. The danger here is that the Government has pushed people out of poverty out of work into poverty in work. I question whether these new self-employed jobs, especially the part-time jobs, are good jobs. In any case, there is no evidence that a higher proportion of workers that are self-employed is associated with any positive macroeconomic outcome.*

A YouGov poll for The Sunday Times showed that just 15 per cent of voters thought Osborne was doing a good job. Despite that, David Cameron has confirmed in an interview that Slasher will be staying on as Chancellor, because apparently he is "is doing an excellent job". Nothing could be further from the truth; he isn't. How bad does it have to get? We shall see.

* David G Blanchflower, "Self-employment: more may not be better," Swedish Economic Policy Review, vol 11(2), Fall 2004, pp 15-74.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies