David Blanchflower: Unravelling puzzle of jobless 'fall' that isn't

Economic Outlook: What is good for the American people appears not to be good for Romney

To give my readers a clue what life is like in my neck of the New England woods, our local paper shared the front page between the following two headlines: 'US Sends Elite Forces to Libya' and 'Fire in Hanover, Destroys Sheds, 12 Chickens Perish'. The next day news of the Fed's announcement of QE3 was relegated to a single paragraph on the second page, bottom left.

It really was a very big deal for the world though that the Fed announced the start of QE3, and made clear in the statement it released after its two-day meeting that it was doing so because "the committee is concerned that, without further policy accommodation, economic growth might not be strong enough to generate sustained improvement in labor market conditions. Furthermore, strains in global financial markets continue to pose significant downside risks to the economic outlook".

The statement made clear it would add $23bn of mortgage bonds to its portfolio by the end of September, a pace of $40bn in purchases a month. It will then announce a new target at the end of this month, and every subsequent month, until the labour market outlook improves "substantially", as long as inflation remains in check.

It also intends to continue with Operation Twist through the end of the year via its programme to extend the average maturity of its holdings of securities and reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities.

The central bank will buy mortgage-backed securities at a rate of $85bn per month through the rest of the year, and then $40bn per month until the labour market "improves substantially," while explicitly extending super-low interest rates through mid-2015.

The Fed has a dual mandate to focus on both inflation and unemployment, and this announcement makes it clear, for now anyway, that it is targeting unemployment rather than inflation. Good.

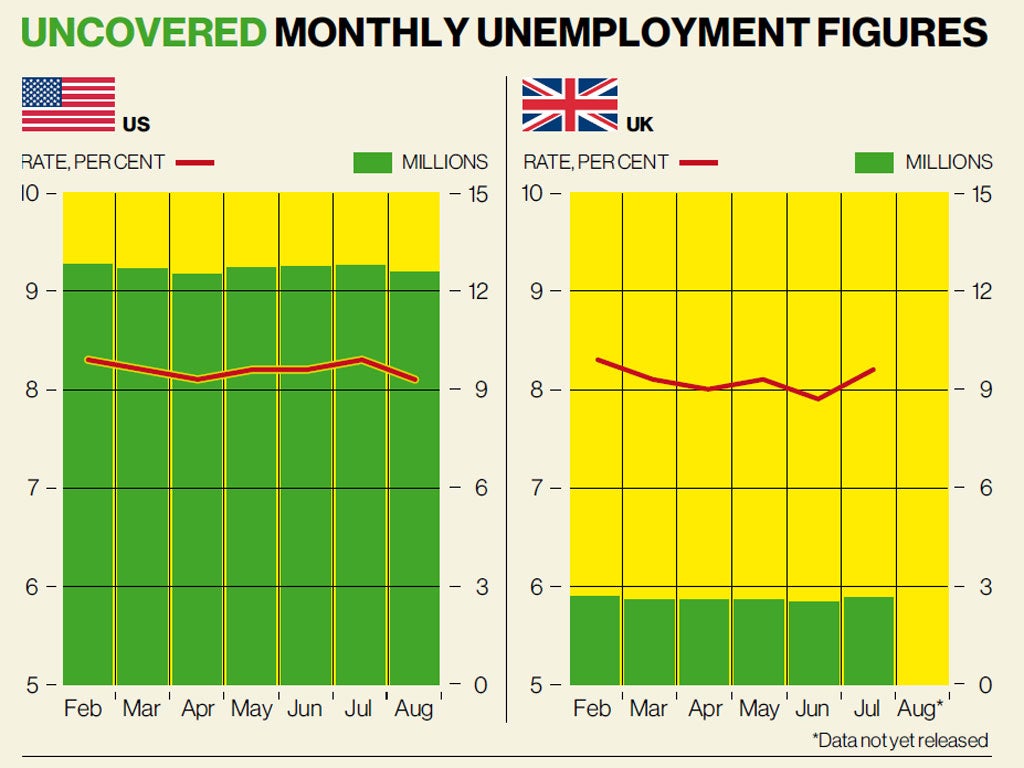

As can be seen from the graph, unemployment in the US fell by 250,000 in the most recent data release, but is still unacceptably high with around 12.5 million unemployed with a jobless rate of 8.1 per cent, about the same as in the UK.

Members of the FOMC also produced forecasts of inflation, growth and unemployment. Of particular note were committee members' predictions for inflation, whose central tendency for every year from 2012-15 is everywhere below 2 per cent. Interestingly, the next day the Bureau of Labor Statistics released details of the all-items Consumer Price Index, which increased 1.7 per cent before seasonal adjustment.

Real average hourly earnings for all employees fell 0.7 per cent from July to August, seasonally adjusted. Despite protestations of some on the right about fears of inflation, there isn't any.

Presidential hopeful Mitt Romney, who had earlier in the week received a good deal of adverse publicity across the political spectrum in relation to his ill-considered comments about the Middle East, issued a statement describing the Fed's announcement as "further confirmation that President Obama's policies have not worked".

He added that "printing more money, at this point, comes at a higher cost than the benefit it is going to create". It is actually rather unclear what that means, but presumably he thinks it is a bad idea for the Fed to pursue its mandate. What is good for the American people appears not to be good for Romney, who apparently knows less about macroeconomics than I know about ballroom dancing, which is zero.

That leads me to the jobs data in the UK, which was published by the Office for National Statistics this week and showed a decline in unemployment of 7,000 and an increase in employment of 236,000 on the quarter. Well actually it didn't. These estimates arise from the bizarre way the ONS reports the jobs data – which compares a three-month average with the next three-month average.

No other country in the world does it this way, as it covers up the true underlying picture of what is going on. It turns out that figures by single month are available, and I report them in the graph in a comparable way to the US. So according to the ONS, unemployment fell from 2,599,000 to 2,592,000. But quite to the contrary it rose between June and July by 113,000.

Similarly in the US despite the fact we know that unemployment fell by 250,000 according to the daft way the ONS reports the data, unemployment went up by 96,000. In terms of jobs, the single month estimates make it clear that employment actually fell by 19,000 between June and July – from 29,618,000 to 29,599,000 – although it did rise between April and June. Part of the explanation for giving three-month averages is apparently due to sample sizes being too small, but there is a simple fix to that: make them bigger. Unemployment was up by 113,000, not down as the coalition claimed.

Part of the explanation for the so-called 'productivity puzzle' is the under-recording of employment in the years 2004-08. More than a million workers from Eastern Europe, mostly from Poland, came to work in the UK. They were not migrants; indeed when asked how long they intended to stay, about 80 per cent said less than three months. Given that they were not migrants and did not intend to reside permanently in the UK, they were not picked up in the employment counts.

When the crisis hit, the amount of work they did fell – perhaps by reducing the number of times they came to the UK or the length of their spells as it became hard to find jobs. Say in 2007 on average a million worked 10 spells of three weeks but by 2011, even if the same million worked on average two spells of two weeks, then employment falls by half a million. Of course, in these circumstances even though measured employment doesn't fall, output, housing and retail spending would drop, as the accession workers aren't spending as they spend more time at home.

Sad about the chickens though.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments