David Blanchflower: We should fear deflation – not welcome it

If very low inflation is such a good thing, why does the Bank of England have a 2 per cent target?

The UK isn’t in deflation yet. While central bankers know what to do about stopping inflation, they don’t know what to do about halting deflation. The Swiss National Bank last week abandoned its attempt to defend a currency floor, which caused a sharp appreciation in its currency, which will exacerbate the deflationary forces it has already been hit by. This was largely a response to the prospect of the European Central Bank doing large-scale quantitative easing after a positive ruling on its legality from the European Court of Justice. This caused funds to rush into Switzerland from the eurozone, which has also fallen into deflation, with the latest estimate showing prices falling at 0.2 per cent a year. There is deflationary contagion in the air.

According to OECD data, inflation in Japan averaged minus 0.23 per cent between 1999 and 2013, compared with plus 2.2 per cent in the UK and plus 2.4 per cent in the US. Over that 15-year period Japan had eight years where there was deflation and two when price rises averaged zero. The UK had none where price rises were negative, while the US had one (2009). Once you have deflation it is extremely hard to get rid of it. Policymakers have no idea how to create any inflation.

In a famous speech* entitled “Deflation: making sure ‘it’ doesn’t happen here”, given in 2002, the former Fed chairman Ben Bernanke warned about the destructive nature of sustained deflation, which he argued should be strongly resisted. Prevention of deflation is preferable to a cure. America’s worst encounter with deflation was in the 1930s, when the price level fell about 10 per cent per year, which Mr Bernanke notes caused massive financial problems, including defaults, bankruptcies, and bank failures.

But he noted that a little bit of deflation is also bad. Speaking about Japan, he said: “Where what seems to be a relatively moderate deflation – a decline in consumer prices of about 1 per cent per year – has been associated with years of painfully slow growth, rising joblessness, and apparently intractable financial problems in the banking and corporate sectors.”

He argues that deflation is in almost all cases a side-effect of a collapse of aggregate demand. The economic effects of a deflationary episode, he argues, for the most part, “are similar to those of any other sharp decline in aggregate spending, namely, recession, rising unemployment, and financial stress”. Do not enter here!

The latest Office for National Statistics release showed that the UK CPI had fallen from 1.0 per cent to 0.5 per cent, largely driven by the fall in the oil price, which has more than halved since the summer, but there is a broader story. The Bloomberg Commodity Index, which tracks exchange-traded commodity futures contracts on 20 commodities, including oil, but also food, metals and gold, is down by a quarter since the summer.

The Prime Minister in a tweet, though, celebrated the fall in inflation, which he said was “good news for families. Our long-term economic plan is on track and helping hardworking taxpayers”. It remains unclear how the Coalition’s long-term economic plan, which produced the worst recession in 300 years, and lowered real wages by around 10 per cent, was able to lower world oil and commodity prices.

In its latest report on global prospects, the World Bank has argued that “the global economy is still struggling to gain momentum as many high-income countries continue to grapple with legacies of the global financial crisis and emerging economies are less dynamic than in the past”. China, they argued, is “undergoing a carefully managed slowdown”. As a consequence, they lowered their forecast of world growth in 2015 to 3 per cent, down 0.2 per cent since June 2014. Of particular note is the lowering of their forecast for China, down from 7.7 per cent in 2013 to 7.4 per cent for 2014; 7.1 per cent in 2015; 7.0 per cent in 2016; and 6.9 per cent in 2017. China continues to export deflation, with factory prices falling at over 3 per cent per annum.

Mark Carney for some time has insisted that the UK isn’t heading to deflation, but this week in a BBC interview he conceded that it is a possibility. He apparently wants to draw a distinction between what he says is “the persistently low inflationary pressures” faced in the eurozone and the situation in the UK, where tumbling oil prices have pushed the inflation rate to its lowest level since 2000.

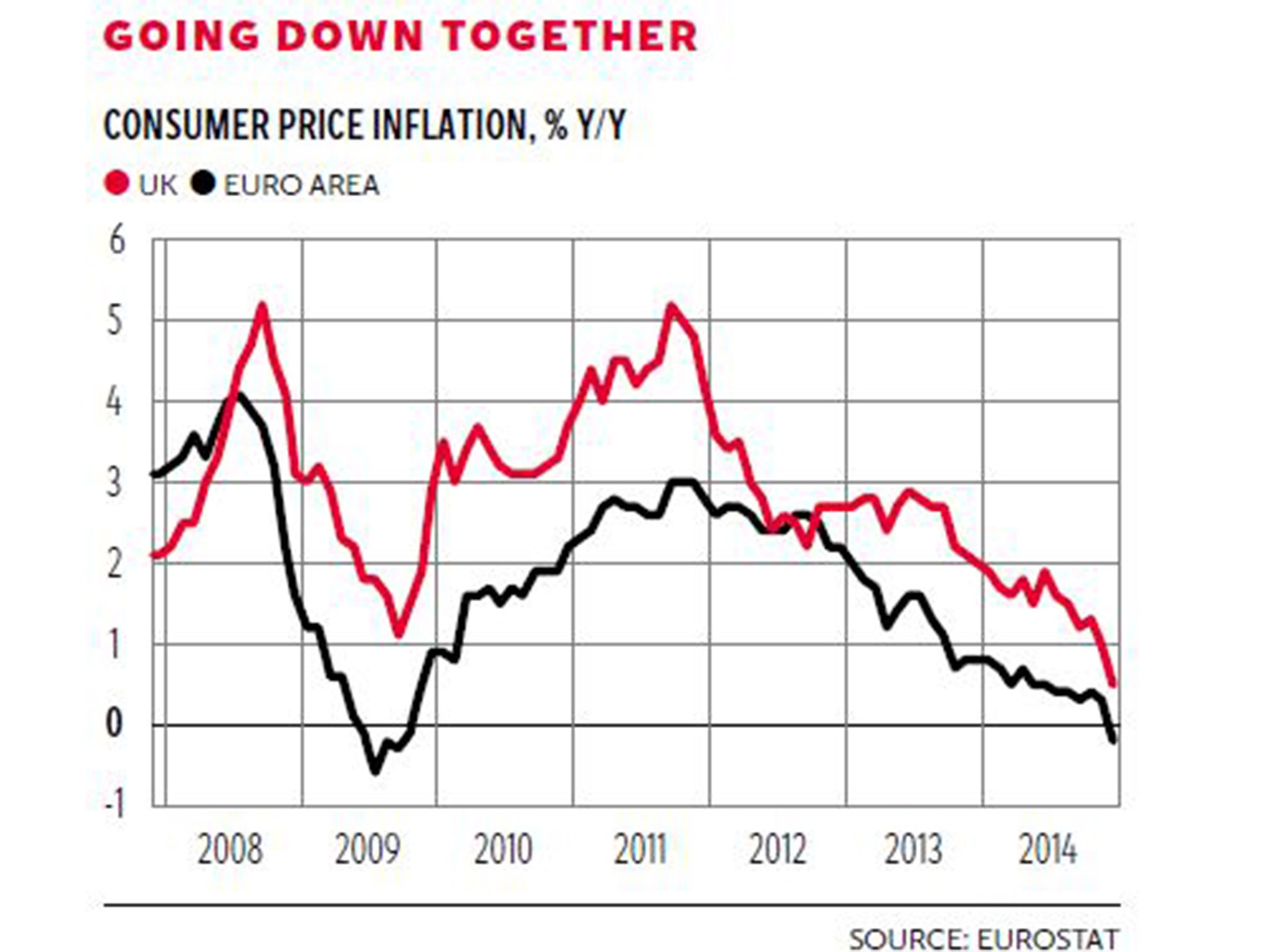

The chart, which plots comparable consumer price inflation rates in the eurozone and the UK since the start of the recession, suggests that is a highly complacent view. The two series move very closely together; for the technically minded, the correlation is 0.74. The UK series is approximately a percentage point above that in the eurozone, and both series have moved steadily downwards together since September 2011, although with a broad flattening in the UK between around June 2012 to September 2013.

Both have fallen in tandem since June 2013, well before the collapse in the oil price. The UK looks to be about 6 months behind the eurozone. Currently inflation is 0.5 per cent in the UK, and it was 0.5 per cent in the eurozone in June 2014. Deflation is coming. It may well be here just in time for the election in May.

The Chancellor will presumably insist that very low inflation is good for the economy and all part of his “long-term economic plan”. But if very low inflation was such a good thing, then it doesn’t make much sense for the Government to give the MPC a 2 per cent symmetric target. It would be better for it to have a 0.5 per cent target or even zero.

In its Review of the Monetary Policy Framework published in May 2013, the Treasury argued “the main reason why zero inflation is not pursued as a policy goal is because, in the event of shocks, it can result in deflation, or negative inflation, which is highly undesirable. For example, deflation can impose large economic costs, in the form of low growth and high unemployment, as experienced during the Great Depression of the 1930s. In addition, deflationary expectations can limit how effective monetary policy is in accommodating large negative shocks”.

Mr Carney insisted that the MPC has tools to deal with the problem of deflation. The main one he has is more quantitative easing. The prospects of a rate rise in the UK before 2020 look remote. The UK isn’t in deflation … yet.

*“Deflation: Making Sure ‘It’ Doesn’t Happen Here” speech to the National Economists Club, Washington, 21 November 2002

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments