Hamish McRae: China's slowdown is a blip and could actually help us

Economic View: A cargo of liquefied natural gas not being imported by China is a cargo available to be imported by us

It looks very much as though the slowdown in China is real. So what does that mean for the rest of us? There have, for the past 20 years, been two stories about the Chinese economy. One is that the racing growth will continue for the foreseeable future. The other is that the boom cannot continue and the strains will bring it to an end. Until now the first story has been right and the second one wrong.

Perhaps the most extraordinary feature of the past decade has been the way growth continued despite the catastrophic recession in the developed world. There was no recession in China, or indeed India. In both countries domestic demand expanded enough to offset the decline in exports, and in the case of China, the main expansion came from a surge in investment.

Not all that investment was wise. The general reason why China has managed to press onwards has been that if you grow at 10 per cent a year you can grow through your mistakes. Build too many homes? Wait a couple of years and demand will have filled them. Build yet another huge airport? Again, wait a bit and the traffic will come. Build too many roads? Well, given the increases in the car fleet, you cannot build too many roads.

But now there are signs that the investment has indeed run ahead of demand. That is obvious in areas where there is excess global demand, such as steel production. It is less obvious unless you travel around the country outside the major conurbations and see the endless blocks of empty flats.

So is this slowdown really serious in the sense that it will have serious knock-on consequences for the entire Chinese economy, or will it be a blip through which the country can go on growing?

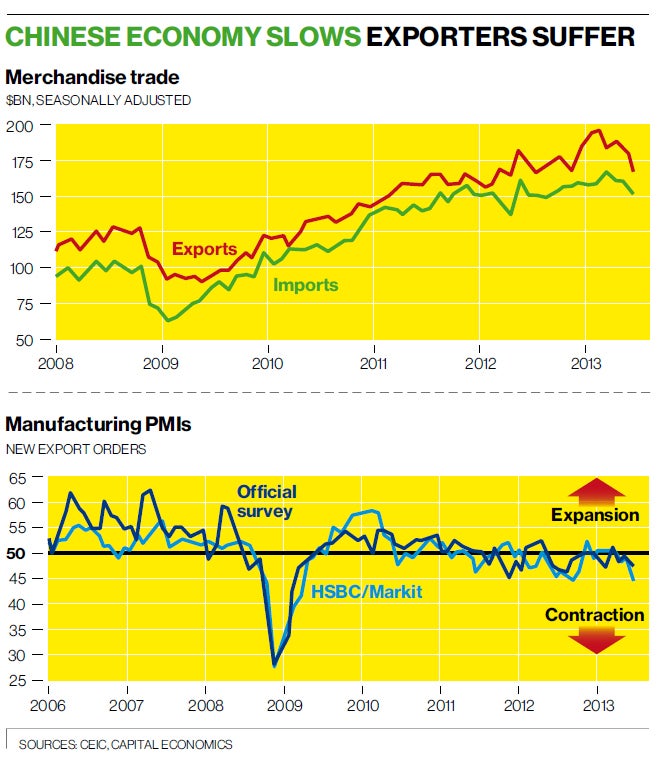

Both the evidence and the past experience points towards the blip outcome, but it may be rather a big blip. The two graphs give some feel for what is happening. As you can see merchandise exports recovered swiftly after 2008 and the country remains in huge trading surplus. But the dip this year is the most serious since 2008 and exports have barely risen over the past year. There is, as a number of commentators including Barclays and Capital Economics have pointed out, a special reason that partly explains the recent fall. It seems that Chinese companies over-invoice exports to Taiwan and Hong Kong as a way of getting money round capital controls. The authorities have cracked down on this, with the result that exports to those two destinations have slumped. But exports to Europe have naturally been weak – they are lower now than in 2011 – and exports to the US have been stagnant. The only significant export growth is coming from the emerging world. The figures just out yesterday came as something of a shock as exports overall were down 3.1 per cent on the year, with imports down 0.7 per cent.

The other graph shows what manufacturers expect for export orders, both as officially measured and as charted by HSBC/Markit. These are the familiar purchasing managers' indices, where anything above 50 signals expansion and anything below contraction. As you can see both are in negative territory, the unofficial index more so than the official one. That suggests a further decline in exports in the months ahead.

The question then becomes whether domestic demand can again be pumped up to fill the gap. It is very hard from a distance and with such a huge country to form much of a judgement. You hear, for example, tales of unsold cars piling up in the dealerships, but you also hear of a drive to redevelop slum neighbourhoods on the edge of large cities, starting in the next few months. The common sense view is that the authorities can always loosen credit controls and pump up demand that way, rather as we in Britain used to in the 1950s with changes in hire purchase controls. That supports the "blip" outcome theory.

If that is right, what does it mean for the rest of us? The most immediate impact of the slowdown has been on the rest of Asia, for a fall in demand for imports hits China's neighbours first. Emerging markets have been pretty weak in the face of this.

Primary producers will also suffer and it is intriguing now to see the debate in Australia about the need to rebalance the economy away from over-reliance on raw materials exports. For European countries with large exports to China, notably Germany, a fall in demand would be negative too. But from our own point of view in the UK, I think slower growth in China may turn out to be a net positive.

That argument goes like this. We don't export a huge amount of physical stuff to China. Yes, it is a fast-growing market and yes, it is important at the top end. That top end is less likely to be affected than the middle market. In addition a lot of our exports come in the form of invisible exports, services of all kinds, including for example Chinese students coming to the UK. That too seems unlikely to be hard hit – the biggest wounds to that business are the self-inflicted ones over visa access.

So a slowdown would not greatly damage export earnings. It would, however, take pressure off import prices. A cargo of liquefied natural gas not imported by China is a cargo available to be imported by us. One of the reasons, albeit not the major one, why the West has had to struggle so hard to escape recession is that this time it has not benefited from the usual fall in energy and raw materials prices that has been associated with previous recessions. Even a modest shading off of the oil price would directly feed through to family budgets, for a couple of pounds less to fill the tank is a couple of pounds to be spent in the supermarket.

Conclusion? Yes, there is a slowdown in China. No, it will not be a serious one. And maybe, on balance it will help the struggling West.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks