Hamish McRae: It is no good squealing about dodgy borrowers who cannot get bank credit

Economic Life: Banks as a whole will not be able to help much in financing the recovery. Some will, many won't, and for some banks the game is simply survival

Today is stress-test day for European banks. The idea is to assure everyone that most of them are sound, even in the event of another bout of financial stress, and that those which are not will in some way be supported, perhaps by having new capital pumped into them, perhaps by being taken over. A similar exercise worked in the US, where banks are now convalescing, and there are hopes it will work in Europe too.

Let's hope that is right. The authorities are seeking to avoid the mistake made by Japan, where duff loans were concealed and the banks staggered on, unable to lend much to new, sound companies because they were carrying so many bad debts from companies that would have otherwise gone under completely. The particular difficultly now, though, is that a lot of the European bank loans are in the form of sovereign lending to weak eurozone countries. Just as the Japanese authorities pretended some companies were solvent when they were really bust, there is a danger that European authorities will pretend that some countries will be able to repay their debts when really they cannot hope to do so. We will see.

But the exercise is worthwhile because it asks the right sort of question, the "what if?" one. It is the question the monetary authorities and the banks should have been asking themselves during the boom. Had they done so, both monetary policy and the banks' response to that would have been very different.

It is worth looking at what happened to bank lending through the boom because it gives a feeling as to what might happen during the recovery. The danger is that banks will make the opposite mistakes, swinging from being overly optimistic to being overly pessimistic, and the monetary authorities will compound this error.

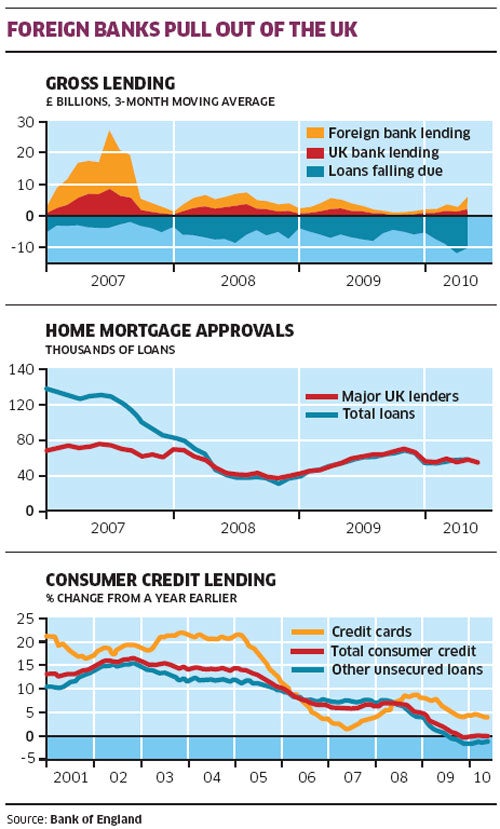

The easiest way to see this is to look at the UK, rather than Europe as a whole. The Bank of England issued its latest Trends In Lending report earlier this week, and the graphs here come from that. The top line shows total syndicated loans to British businesses – those are the large loans split between a group of banks, with each one chipping in a bit to make up the total. As you can see, through 2007, the final year of the boom, it was foreign banks that plunged into this market, overshadowing British banks. And because loan repayments (earlier syndicated loans falling due) were low, there was a large flow of funds into British business. Now both foreign and British banks have pulled back from this market, but foreign ones have cut back harder. Since the value of loans maturing has risen, there is now a net outflow to the banks from the companies. In other words, companies are not fully rolling over loans as they fall due, either from choice or because they cannot get the money.

Now look at the next graph. This shows what has been happening to Britain's mortgage market. Note the similarity. In 2007 loan approvals were running at more than double the present level, but more than half of those were from foreign lenders or fringe UK ones. The big UK lenders have plugged on at pretty much the level they were at during the boom, but the disappearance of the rest means there is something of a famine in mortgages.

The third graph shows consumer lending over a longer period. Right through the first seven years of the decade, credit card debt soared, rising by 20 per cent a year. Then lenders started to cut back and it is now growing by about 4 per cent year. Other forms of consumer lending have actually gone negative, with the result that total consumer lending is flat.

So what lessons should we draw from this? Politicians focus on the lack of lending now, both to companies and on mortgages, and make vague, threatening noises about making banks lend more. But that is plain silly. The problem of lack of lending is not really anything to do with British banks; it is the withdrawal of foreign banks.

So how to you get foreign banks to increase their loans in Britain? Hectoring will hardly help. Do you think a Spanish bank, clobbered by the collapse of property prices and construction business back home, will listen to some British minister? The main thing on its mind will be how to scramble through the stress test, and adding more British mortgage business would probably have the reverse effect.

Or maybe there should be tax incentives for foreign banks to lend in Britain? Er, wait a minute, aren't we actually increasing taxation on banks that do business here? Is it not just possible that this might encourage them to lend to some other country instead?

In any case, where were the policymakers in 2007? I understand why many people feel that since taxpayers have had to rescue some of the banks (not all, of course), the banking sector needs closer regulation. But if you are trying to apportion blame it must surely be divided between the monetary authorities, who permitted credit to surge in that way, and the banks that did the actual lending.

Look again at those graphs and ask yourself, was there not a huge error in policy? I suggest that when the history of all this is written the majority of economic historians will conclude that the authorities should shoulder much more of the blame. That was the time when they, and the banking regulators, should have been doing the stress tests.

Now look again at what is likely to happen in the coming months. It is worth doing these tests, largely because it will make explicit what we already know in outline – that some European banks are carrying a bundle of very doubtful debt and should make provision for that. But the result will be that European banks as a whole will be not be able to help much in financing the recovery. Some will, many won't, and for some banks the game is simply survival.

I think we have to be adult about this and accept that banks will not play as big a role in finance in future as they have in the past. Actually, I personally welcome this for two reasons. First and most obviously, it seems to me that the world has suffered massively from the waste of that last boom and that a more constrained financial climate will lead to a more sustainable economic recovery.

Second, less obviously, I suggest that a financial system that relies more on securities markets and less on banks is inherently more secure than one that relies too heavily on bank finance. There are more decision points – a mass of investors rather than a few banks. Leverage, while necessary and inevitable, is inherently risky. Investors are prepared to take risk provided they are rewarded for it; banks are not, or should not be. So see this stress test as part of a much wider task. This is to nudge the world's financial system towards a place where risk is carried by people who want to take it, not by the bank round the corner, and still less by the taxpayer.

But in saying all this, we should be honest with ourselves. This will be a world where dodgy borrowers won't be able to get bank credit, and there is no good squealing about that.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments