Hamish McRae: Renminbi on the way to being the world's most important currency

Economic Life: The road to a world of multiple reserve currencies will be a bumpy one, and people will get hurt

Are the dollar's days as the prime world reserve currency numbered? Yes, but dethroning it will take a long time, and the road to a world of multiple reserve currencies will be a bumpy one. Along the way people will get hurt.

Several things have come together in the past few days which highlight the inherent fragility of the dollar's position. In the spring, during that period of blue funk, US Treasury assets were regarded as the prime global investment. As confidence has returned, two things have happened. One is that the focus has shifted to other currencies, notably sterling. Yesterday the pound was trading at just under $1.65, about halfway back from its bottom of below $1.38 earlier this year and the $2 level it was at in July last year. (Against the euro the pound was above €1.17, the highest it has been this year.) That is partly a change in perception about sterling: the growing evidence that though the UK economy may not come up much this year, it may have stopped going down. But it also reflects a return to normality: people appreciate that while holding non-dollar currencies carries risks, holding the dollar carries risks too.

The other thing that has changed is long-term US interest rates. In the spring the yield on 10-year US Treasury securities was under 3 per cent; now it is 4 per cent. There are two practical consequences of that. Investors that bought bonds earlier this year have lost money, with foreign investors hit by the double blow of a fall in the dollar and the fall in the price of the bonds. And US home-buyers have been hit by a rise in mortgage rates. In the past month the 30-year mortgage rate was well below 4 per cent. Now it is over 5 per cent, and this in a market where the Federal Reserve is supporting it by acting as a buyer of mortgage notes.

All this is important because it says two things. One is that investors worldwide now are worrying rather more about the ability of the US government to keep funding itself – yes, it can always borrow the money, but it will have to pay more for it. The other is Fed policy can drive down short-term rates, but long-term rates are set by the market.

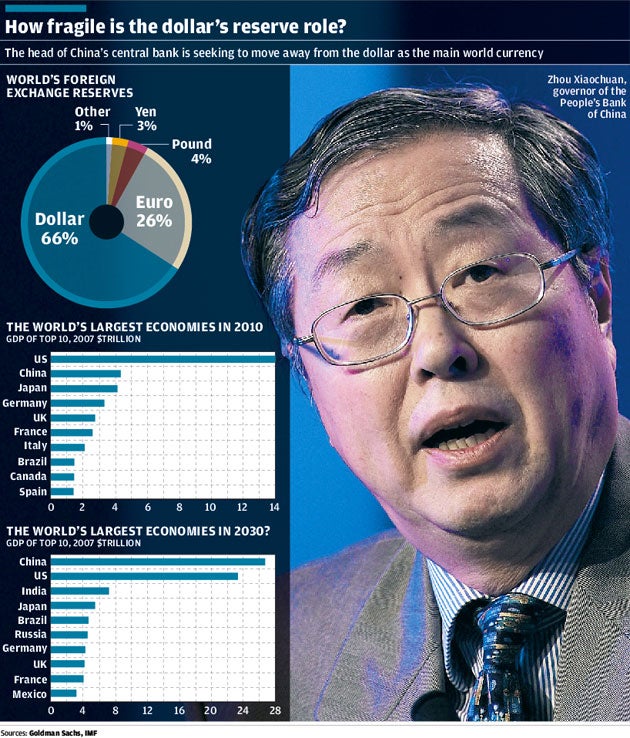

This leads to a further and even bigger issue: the position of the dollar as the world's premier reserve currency. As you can see from the pie chart, more than half the world's official currency reserves are denominated in dollars, with the euro in second place. The vast majority of these dollar holdings are in short-term Treasury bills, with the result that the US government can in part finance itself in this way. That depends, however, on the dollar remaining the principal reserve currency.

Step back a moment. A century ago, sterling was de facto the world reserve currency, though central banks held most of their reserves in gold. That was rational because though the UK was not the world's largest economy – it was number three, behind the US and Germany – it was the largest trading nation. After the Second World War, the pound and the dollar were the two designated reserve currencies under the Bretton Woods fixed exchange rate system, and that just about made sense because most of the Commonwealth was in the sterling area. But successive devaluations of the pound reduced its role, and when the effective devaluation of the dollar in 1972 ended the fixed exchange rate system, reserves came to be held in a mix of currencies, with dollar primus inter pares. Central banks held dollars because of its acceptability, the breadth of US markets and the general underpinning of its position as indubitably the world's largest economy.

More recently the dollar's role has been supported by China's willingness to hold dollar assets. It has pumped money into dollars to hold down its own currency and offset the massive trade surpluses it has accumulated over the past five years – rather as Japan did in the 1980s and 1990s.

But now two things are happening. China is becoming the world's second largest economy. It may have already passed Japan, but it surely will next year, as the top bar chart suggests. And within a generation it is on track to become the world's largest economy, with the Goldman Sachs Brics' model suggesting that it will pass the US in about 20 years' time. The league table of the world's top 10 economies in 2030, as projected by that model, is shown in the final graph. Note that India is expected to become the number three economy, and both Brazil and Russia will be ahead of Germany.

When we reach that stage it would be irrational to expect the dollar to remain the principal reserve currency, or indeed the main denominator for most commodities. Actually the transition will start much earlier, if that is what the principal holders of reserves and other assets really want. So the next question is: what does China want?

As a general principle it is worth under such circumstances to listen to what its leaders say. Back at the end of March, an article by Zhou Xiaochuan, governor of the People's Bank of China, the central bank, was posted on its website. He suggested replacing the dollar with a new reserve currency controlled by the International Monetary Fund. The aim would be to create a currency "that is disconnected from individual nations and is able to remain stable in the long run, thus removing the inherent deficiencies caused by using credit-based national currencies".

"The outbreak of the crisis," he continued, "and its spillover to the entire world reflected the inherent vulnerability and systemic risks in the existing international monetary system."

As it happens, the IMF does have a quasi-currency, Special Drawing Rights, but these were invented for a completely different purpose: to provide additional liquidity for world finance under the fixed exchange rate system and allay fears that the limited stock of gold in central bank reserves would stifle the growth of world trade. So the invention was rendered redundant by the move to a floating rate system. I suppose you could in theory cobble together a system where SDRs replaced the dollar, but in practice it is not going to happen. It was hard enough getting agreement on SDR allocations in the first place, and I cannot see international agreement on that now. In any case, all monetary history shows that currencies have to have international confidence behind them for people to be prepared to hold them, and it is not at all clear who would be the ultimate backer for SDRs.

What I think will happen is different. I think we will move gradually towards a multicurrency reserve system, with central banks holding a variety of foreign currencies, including the Chinese renminbi and the Indian rupee alongside the dollar, euro and so on. And they will hold them not because of any formal agreement but because it makes commercial sense to hold in reserves the currencies of your principal trading partners.

As for the currencies in which the main commodities will be denominated, that will be a toss-up between a single currency, the dollar or the renminbi, and a basket of currencies. But that will be a matter of convenience. At the moment the dollar is used for oil because the US is the world's biggest oil user. But many international steel contracts are in euros, reflecting the importance of Europe as a steel user. Both may change. Once China is the world's largest economy the renminbi will become the world's most important currency.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments