Hamish McRae: The dance this winter will probably be two steps forward and one step back

Economic Life: Consumer demand can be inflated for a while by policies such as cash rebates on cars or tax breaks on home sales. But when these run out demand flops back

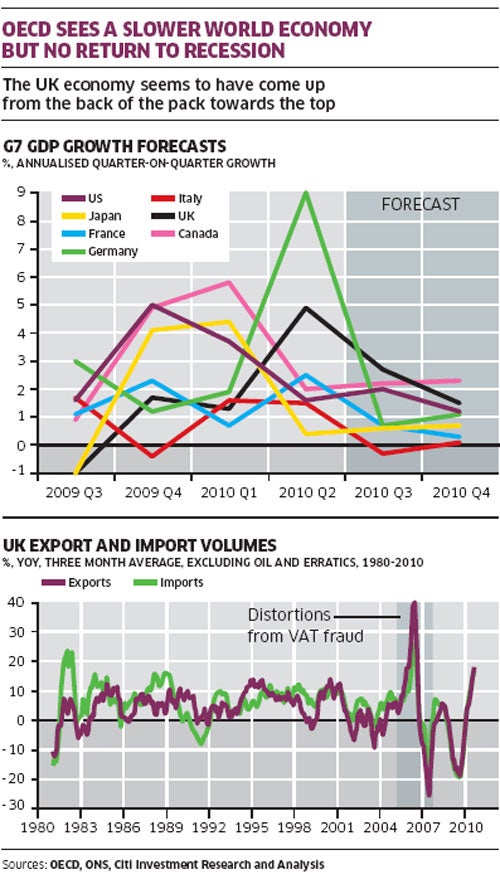

We may just scramble through. The latest forecasts from the Organisation for Economic Co-operation and Development (OECD) give us a good reason to pause and reflect on what will undoubtedly be a difficult few months ahead. It has been evident for some time that there would be some sort of pause in the recovery and you can see mounting evidence for that in recent data. So it is no surprise that the OECD forecast should downgrade the outlook for the world as a whole.

But it now seems Britain may have become the second-fastest-growing economy of the G7 after resources-rich Canada and that is, to say the least, very helpful given the rumpus ahead. It is a view that squares with the latest growth estimates from the National Institute of Economic and Social Research, which confirm that the UK economy is now almost exactly on the track of the recession in the early 1980s, and is heading solidly upwards (the OECD forecasts for the second half of the year for the major economies are shown in the main graph). For the UK, this has policy implications. Those with long memories will recall that the 1981 Budget of the then chancellor, Sir Geoffrey Howe, tightened policy before the recovery was fully evident and was famously criticised by 365 economists. As it turned out, that Budget is now reckoned to have laid the basis for the long boom that followed or, at the very least, not to have damaged it to any material extent. I expect that the dire warnings of some economists now that spending cuts will derail the economy will be seen to be similarly off-beam. To be clear, I do still expect some sort of pause in growth, perhaps in the first part of next year, and that could develop into a dip for two or three months. But a move back into full-blown recession does look unlikely for the UK.

For the world as a whole, though, there is no doubt that there is already a slowdown. Several forces are contributing to this. Let's focus on three. First, there has been a sharp fall in confidence in the US, something for which President Barack Obama is paying a political price. I happen to think that this is monstrously unfair, given that he inherited an economy pumped up by the greatest housing bubble for at least 130 years, maybe ever in the history of the country. Until US house prices have stabilised, which they only sort-of have, there cannot be a secure recovery. Consumer demand can be inflated for a while by specific policies, such as the cash rebates on cars or the tax break on home sales. But when these run out, as they inevitably must, demand flops back. The blame, of course, should lie with the previous administration and the previous head of the US Federal Reserve, and it is unfortunate that Mr Obama has been unable to get this across.

So how far is the US housing market from turning? It is difficult, because it is so vast and so segmented. I have been looking at data from across the land and there are huge contrasts. In some regions, such as Washington DC and Manhattan, the market is slow but moving. There is certainly demand for rental property because a lot of people are waiting to see if there will be better deals in a few months' time, and prime homes are always in demand.

At the other end of the market – new housing estates in Florida, for example – things are really pretty dire and there will be some areas where half-built estates will never be completed. In Detroit, a city still bravely tacking long-term secular decline in its population, some inner-city areas will revert back to parkland.

But seen as a whole, I think the American housing market is likely to have bottomed-out within 18 months and, at a worst case, within 10 per cent of its present level. That would be consistent with at least another year of slow growth, with maybe a quarter of contraction. Of course, there are other forces affecting the US economy but consumption is such a large portion of it and consumption is so determined by the housing market that I cannot see a secure recovery until the housing market turns.

US consumer remains hugely important to global demand, so a grotty 18 months for America will mean a worrying 18 months for the rest of us. But if this is right – and this is the good news – by the end of next year the forthcoming growth phase of the world economy should be secure.

The second worry is China, and this is not covered by this particular set of OECD figures. The report simply notes that the major emerging economies have been growing strongly. We will get more information, and forecasts, in the next Economic Outlook, due in November. From a global perspective, the plain fact is that over the past two years the majority of the additional demand has been coming from the emerging world rather than from the developed one. So what happens to the recovery depends critically on what happens there.

And what is happening? It is very difficult to catch an accurate feeling. My impression is that so far the authorities have managed to engineer some slowing down in growth (which they had to do) without tipping the economy into a serious slide. Back in April, policy was tightened and this has had a clear impact. Now there are signs of a pick-up in sales of cars and homes, and it may be that policy will be eased in the months ahead. On a two-year view, I don't think there should be serious concern, except insofar as Chinese growth puts pressure on global resources, but that is a separate issue. But on a six-month perspective a pause is still quite possible.

And a third issue? That is the already evident pause in the recovery of world trade. Have a look at the lower graph, which looks at changes to the volume of UK trade over the past 30 years. Did you know that Britain's exports have been growing more strongly than at any time since 1980 (ignoring the VAT-related distortions)? No, nor did I until I saw a note by Michael Saunders, an economist at Citigroup. He makes the point that a rise in imports may have widened the trade gap, but that shows that domestic demand has recovered. Further, exports have been doing very well, reflecting global demand. That surge in German growth shown in the top graph is the result of very strong exports.

But there is now no question that there is a pause in world trade. I am not sure whether this is simply reflecting issues one and two above, or whether there is something else happening. My instinct is that you would expect things to slacken after the bounce off the bottom, so we should not be too concerned. But that bounce followed a collapse and demand is too weak to get all those idle container ships back to work just yet.

My conclusion? It is that the trudge through the winter will be a difficult one, but for the world it will be two steps forward and one back, which is a sight better than the other way round.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies