Hamish McRae: The focus switches to the next Chancellor – and the one after that

Economic Life

Brown resigns; pound plunges. Eh? That isn't quite what the political scriptwriters have been drafting. He is supposed to be a disaster, but when rumours of his resignation swept the foreign exchanges yesterday, the pound fell by nearly four cents against the dollar. The rumour, of course, turned out to be false, but the reaction does serve as a warning against most people's assumption that our Prime Minister's departure would be met with a wave of relief. It might actually focus people's attention on the dire state of public finances and therefore be met with concern.

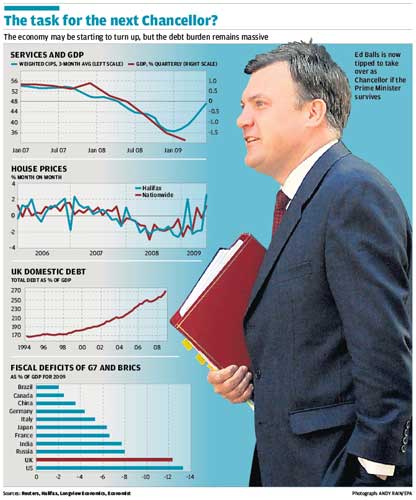

Politics are moving so fast that there probably isn't anything sensible that can be said about the future of our Prime Minister right now. But we do have to contemplate the prospect of a new Chancellor next week, presumably Ed Balls, and then another new Chancellor, presumably George Osborne, in a few months' time. That should make us focus on the long haul ahead.

So where are we now? Things have moved on the past couple of days, with two indicators of a nascent upturn. One was the suggestion that the service side of the economy is now starting to see some growth; the other that the Halifax has joined the Nationwide in signalling an upturn in prices. Neither are conclusive signs of an economic recovery, and it would be wrong to think we are through this one yet. But, equally, they do suggest that the awful downward plunge of the economy is past and the questions now will be about the timing, shape and sustainability of the recovery.

The services index is important because private-sector services make up more than two-thirds of the economy. So if they are growing, and the other sectors were not absolutely awful, then they could pretty much pull along the rest. Right now the other sectors are still awful – new car registrations in May were 25 per cent down year-on-year – but turning points in the service sector should signal a turning point in the economy as a whole.

You can see the relationship in the first graph, which shows a consolidated version of the services index, taking in such things as expectations for employment (still bad) and prices charged (still weak) as well as actual activity and new business (both positive). Capital Economics plots these against growth in the economy as a whole. As you can see, if the trend is continued this month and next and the usual relationship holds we should be back to overall growth at some stage during the autumn.

And house prices? You have to be careful about any monthly series, but with both Halifax and Nationwide going positive (see next graph) I think it is fair to say that the worst of the falls are now probably over. If the pattern of the early 1990s were to be repeated we would still have three or four years of stagnation before there were any significant rise in prices. On the other hand, finding some sort of floor would go hand-in-hand with housing activity rising, and that does seem to be happening too.

So I think we can start to say with reasonable confidence that the growth number for 2010 will be positive. Those of us who have been reasonably optimistic about next year can feel a little more comfortable with our judgement than we did even a week ago.

That will be the good news facing the next Chancellor. Now for the bad. The bad is the legacy of debt. There has been a determined effort by this Government, and by the Prime Minister in particular, to paint the surge in public indebtedness on the global situation. Of course it is partly that, but only partly, as the other two graphs make clear. Debt in the UK – adding together personal debt, corporate debt and public debt – started to rise steadily long before this downturn. In fact it set off in its upward climb about the time Labour came to power in 1997. It would not be fair to blame that entirely on government policies, but from about 2003 onwards the combination of low interest rates and wide fiscal deficits undoubtedly pushed the process along. We all borrowed too much. As a result of our personal borrowings, the net financial wealth of UK households in now lower, relative to GDP, than it was when Labour took over in 1997.

As the final graph shows, however, the UK's present fiscal plight is matched only by the US. The graph, showing the projections of The Economist for public-sector deficits this year, suggests that our position will not only be worse than that of any other G7 country bar the States, but also worse than any of the Brics. We have, ah, a worse fiscal position even than Russia. Oh dear. How on earth can we get ourselves out of this mess?

Well, that will be the task for the next Chancellor, and the one after that, and in all probability the one after that, too. As Alistair Darling, who I think deserves considerable sympathy for having been dealt a dreadful hand of cards to play, and then not being given the freedom to play it, will freely acknowledge, the fiscal position cannot be fixed in the life of the next parliament.

So what will the next Chancellor do? It is not realistic to expect much to happen until there is a change of government, which incidentally, is the most coherent argument for a change in government. It is not a criticism of the competence of Ed Balls, who I know and hold in high regard, to say that he is the wrong person to try to tackle the deficit. When a company gets into financial trouble there is always a tendency by the existing management to claim that since it knows the business it is best placed to correct the mistakes. That is always wrong. The new management may or may not be more competent than the current one but it does have fresh eyes, and you need that to change the way the business is managed.

But we will have to wait a little for the next management to be put in place, so the burden for starting on the path back to fiscal stability falls on what one might call the interim management. So whoever is Chancellor next week, the present incumbent, Mr Balls or AN Other, will have to start on the road. The markets know this: they are starting to look beyond this government to next year. That may be one of the reasons why sterling has strengthened in recent weeks. But the return of confidence has been fragile and could evaporate during the summer. Remember that currency crises usually occur when markets are otherwise quiet.

So we really do need some sort of credible plan to bring the deficit back towards balance. The fact that the economy should be close to growth by the autumn increases the need for that, for it makes clear that the prime problem has not been the recession but the borrowing binge that preceded it. Individuals are now saving again. The next two Chancellors will have to set out a similar path.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies