Hamish McRae: Things are at a crucial stage for Europe but what if China turns off the tap to the US?

Economic Life: Austerity moves may persuade the markets most weaker eurozone countries are good for their money. Equally, they might decide the US is not a safe haven

The story is moving to Toronto. This weekend the G20 economic summit takes place there against growing concerns about a double-dip to the recession in the developed world, the threat to European banks from a "Club Med" sovereign default, and – by contrast – the self-confidence of the emerging nations.

There is one obvious division within the G7 members of the summit: how quickly the fiscal deficits should be scaled back. The US position remains that its huge deficit supports economic growth, criticising Germany's recent budgetary cutbacks. Germany for its part believes that fiscal irresponsibility would undermine recovery, a view that I suppose is now implicitly supported by the UK. It is the view of our own Government, and that of the Office for Budgetary Responsibility, that had we tried to cut the deficit more slowly any fiscal boost would have been offset by higher borrowing costs.

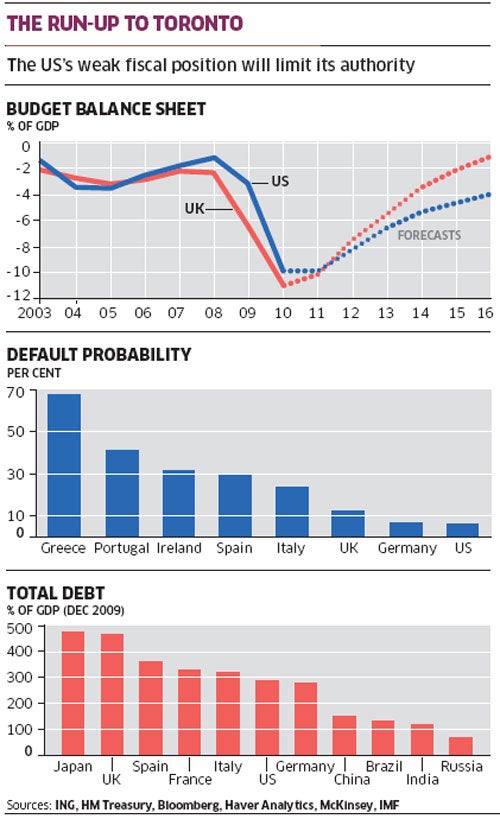

The US and UK have the highest budget deficits, relative to GDP, of the large developed nations and you can see in the first graph the somewhat different profiles the two countries are taking to get back towards balance. The UK projection is the central one published this week by our OBR, while the US projection comes from the economics team at ING Bank. We face a similar scale of problem but we are planning to correct it more swiftly.

Why the difference between the US and Europe? You could say that there is an intellectual schism, with the US more inclined to listen to some of its Keynsian-minded economists, but actually I think the real reason is the practical one. The US can, at the moment, borrow the money. By contrast all Europe has been spooked by the prospect of a Greek default and the knock-on effect that has had on the creditworthiness of other European nations. The second graph shows some calculations by ING Bank of the market's assessment of the likelihood of a sovereign default, derived from the rate on credit default swaps – the cost a buyer of debt has in effect to pay for insuring that the lender won't default.

This is just a snapshot of the market view now but as you can see the markets are saying that there is a significant risk for Spain and Italy and some risk for the UK. Germany and the US, by contrast, remain safe havens for the scared investor. ING comments that these calculations probably overstate the risk for the US. At any rate you can see why the country is relatively relaxed about its debts.

The problem for Europe is not just that countries are finding it hard to fund themselves. One effect of these fears of default has been that many of the weaker European banks, which hold large chunks of sovereign debt, cannot fund themselves. They won't lend to each other, they cannot raise funds from outside investors, and their governments cannot afford to bail them out. Instead they are relying on the European Central Bank to keep them afloat. The Bank of England acknowledged the weakness of the European banking system in its new Stability Report yesterday, noting that despite the support, market pressures had not abated.

Markets are fickle and it is plausible that the austerity moves by the weaker eurozone countries will eventually persuade the markets that most of them (Greece being the exception) are good for their money. Equally, it is plausible that they might conclude that the US is not a safe haven after all.

We are not there yet, not at all. Whether the US can continue to fund its deficit turns on the attitude of global savers and in particular China. We are in a two-tier world. All the established developed nations carry a huge burden of debt. None of the large emerging economies has significant debts. You can see this distinction in the bottom graph, which shows total debt levels of selected mature economies vis-à-vis those of the Brics. Note, these are total debt levels, that is to say government debt, corporate debt and individual debt. The balance varies from country to country. Japan carries huge government debt, approaching 200 per cent of GDP. The UK has lower public debt, even now, but has much higher personal debt and higher corporate debt, particularly of financial institutions. Within the Brics, too, the composition of the debt varies.

But the really dramatic distinction is not so much within these mature economies, or indeed within the Brics, but between these mature economies and the Brics. The least indebted of these developed economies, Germany, has debt levels nearly double that of the most indebted of the Brics, China.

I have been puzzling about this. Does it really matter? What are the consequences? Is debt going to hold back the entire developed world through this growth phase, just as it seems to have held back Japan for past two decades?

You can explain some of the debt by saying that advanced economies have assets against these debts. We have mortgages to be sure but we have homes. Governments have debts but there are also the embedded assets of a country – the physical infrastructure to be sure, but more importantly the educational and social assets. We have our costly social security systems but eventually the Brics will need to invest in their social security systems too. Looked at from the other direction, China, which has spent a huge amount on building infrastructure, has higher debt levels than India or Russia, both of which have more to do now.

That provides only modest comfort, through. These debt levels shown in the graph do not include off-balance sheet liabilities, including for example public pension costs. Add those in and the developed nations appear even more indebted. You really do have to ask whether there will be the political will to service the debts that are still continuing to be built up.

The G20 summit will focus on the recovery but since it is a G20, not a G7, the perceptions of that recovery will be different from different parts of the world. This year is something of a tipping point, for not only has China passed Japan to become the world's second largest economy; it looks as though it will become a bigger manufacturer than the US.

With economic power comes political clout. China has averted a row with the US by allowing its currency to creep upwards against the dollar, an act that mathematically reduces the value of the country's dollar holdings. The rise of the yuan will continue, albeit slowly. The crucial question is to what extent will China switch the deployment of its financial surplus from US Treasury bills to financial assets in other currencies and to physical assets outside of the US, including commodities and land. If some European banks are on life support from the ECB, the US government is on life support from global investors, notably China.

I have little feeling in advance of Toronto to know how this tension between China and the US will play out. But it is ultimately much more important than the tension between the US and Germany over fiscal consolidation. The Germans are not going to do what the Americans tell them to do and that is that. But the row goes no further. The China/US relationship will get tenser and tenser as the Chinese economy approaches that of the US in size. We are not there yet and won't be for a decade or more. But I have a feeling that China will not continue to finance the US for that much longer and when it cuts back, the US will not be pleased.

Our experts tackle the questions that are perplexing readers

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments