Hamish McRae: We're narrowing the gap but we still depend too much on service exports

Economic Life: Last year's surplus on finance and business services covered more than half our deficit on physical trade - and that was in a bad year for these industries

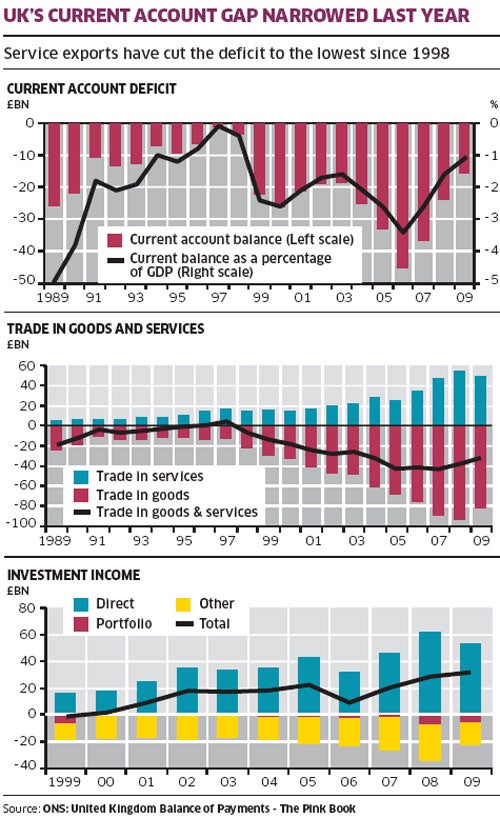

The UK balance of payments gap narrowed sharply last year, with the current account now less than 1 per cent of GDP. In normal times you might have expected this to be celebrated. It is still a gap, and so in one sense we are still living above our means. But it's one that is quite manageable in the global context. And it is a lot healthier than those of many other large, developed economies, including the US; in fact, it's the closest we have come to balance since 1998.

This information comes from the annual balance of payments "Pink Book", to give it its popular name, which contains a wealth of information about the trade and investment relations that this country has with the rest of the world. The printed version is not yet available but the online one came out last weekend, to remarkably little fanfare – I was not aware of it until it was pointed out to me. This is odd because the balance of payments does matter hugely, particularly in the context of all the debates about the need to rebalance the economy away from domestic consumption and towards exports, and away from the financial sector and towards the manufacturing one. So it deserves some comment here.

The highlights of the current account are shown in the graphs. As you can see from the first one the current account deficit has been narrowing now for three years. It is still large in absolute terms, but thanks to the growth of the economy as a whole it has come down swiftly in relative terms.

The second graph shows the familiar pattern of a large deficit in trade in goods partially offset by a surplus on trade in services. The UK remains the second largest exporter of services in the world, after the US, whereas we are only about the sixth largest exporter of goods. However, exports of services alone would not have been enough to narrow the gap to the extent that has occurred, and the country also relies on investment income from abroad, as the next graph shows. The whole of this surplus comes from direct investment, that is investment in factories, mines and so on owned by British companies in other countries. These countries also have investments in the UK, of course, but it seems we earn a much higher return on our investments overseas than they do on their investments here. On portfolio investment (in holdings of shares and bonds), we are roughly square.

Keen examiners of these graphs might note that the numbers don't quite add up. That is because we also have to finance a deficit of the Government, now running at more than £10bn a year. This is made up largely of our membership payments to the European Union, foreign aid, and the cost of keeping armed forces abroad.

Other points include, on the physical trade account, our trade in oil, where we have a small deficit since 2005; and, on the invisible trade account, our trade in shipping (big surplus) and air transport (small surplus), and our trade in travel and tourism (huge deficit but not quite as huge as in previous years – remember that 2009 was the year we stayed at home).

All this is pretty much as you might expect. We have seen in previous cycles how any fall in the value of the pound shows through most swiftly in the tourism account. We as individuals are very price sensitive when making our holiday choices, and the fall of sterling last year cut foreign holidays. Equally, people in other countries took the opportunity of relatively cheap UK prices to come here, spending more than in previous years. We still had a tourism deficit of £13bn but that was the lowest since 2001.

The surprise, at least to me, was how well our foreign earnings from financial services held up. Last year was a catastrophic year for most of the financial services industry and it is true that net exports were down on 2008. But the surplus on financial services was still £33bn, equal to 2007 and thus the second highest ever. If you add in other business services, a lot of which are associated with finance, the net exports were about £47bn. In other words, the surplus on finance and business services covered more than half our deficit on physical trade. Remarkably, that happened in a bad year for these industries.

I do find it astounding that more attention has not been paid to all of this. Here is a huge industry delivering a huge annual surplus to the balance of payments. So its health matters tremendously to all of us. Without it we would be struggling to afford all those foreign cars and all that food we import, not to mention the foreign holidays. We ought by rights to be crawling over the data, seeing what might be done to boost exports from, for example, the insurance industry. We ought to be thinking about the implications of tighter professional visa restrictions on our legal firms and tighter student ones on our universities. We ought to be selling London as a financial centre that has come through the financial catastrophe in pretty good shape – remember it was banks headquartered in Edinburgh and the north of England that needed government help, not London, for if Lloyds had not been suckered by Gordon Brown into rescuing HBOS it would have been fine.

But there is a genuine dilemma here. The right policy, as a general rule, is to support success and cut failure. You do things you are good at, not things that other people can do as well or better. According to that policy, we should be doing everything we can to attract more inward investment in financial services, whereas actually we have been doing quite the reverse. We have been trying to drive investment away. We give subsidies to foreign companies to build cars here (and we have a deficit on that) and we put an extra tax on bank earnings. I understand the political reasons for that, but rationally it is absurd.

But equally you don't want to have too many eggs in one basket. As a general principle, every economy should be as broadly based as possible. So this export performance by our service industries, in particular our financial services, however impressive it is, does suggest that it will be difficult to rebalance towards other industries. There are also regional implications. To an overwhelming extent the financial services industry is based in London and the South-east and, as noted, the offshoots in Edinburgh, Newcastle and the like have not covered themselves with glory. But it is not healthy for one part of the country to have to pull along the rest behind it. You can already see the political resentment about that.

The good news from the Pink Book is that we don't have a serious balance of payments' deficit; the bad news is that we do remain heavily dependent on service exports and in particular on finance. There is a further point: the whole debate about industrial structure assumes that it is possible for governments to have an impact on it. But looking at these statistics, I'm not sure that's true any more, except at the margins.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies