Hamish McRae: Why are we considered a safe haven, while Germany isn't?

Economic Life: I expect the Chancellor will take comfort from this seal of approval from the markets when he makes his Autumn Statement

It is good to be proved wrong from time to time because it makes you recalibrate your ideas. The flip this week in bond yields, with Britain now able to borrow more cheaply than Germany, is something I had not expected to happen. Rationally Germany should be more creditworthy than us. The sovereign debt levels are broadly similar, for while Germany has a slightly higher overall level of national debt relative to GDP, it has a much smaller running deficit. Indeed, we are still adding so fast to our debt that we will probably top out at much the same level as Germany in three or four years' time. We also have much higher levels of personal debt and our banking system carries proportionately larger debts too. It is true that the UK will not technically default because we can monetise our debt – the Bank of England can print the stuff – but we can and have depreciated our currency and thus reduced the real value of our debt. There is of course the doubt about the future of the euro, but that should carry a potential benefit for holders of German Bunds. Were the eurozone to break up they would benefit either from a stronger euro, as the weaker countries would be shed, or from a return to the German mark. It should be win, win.

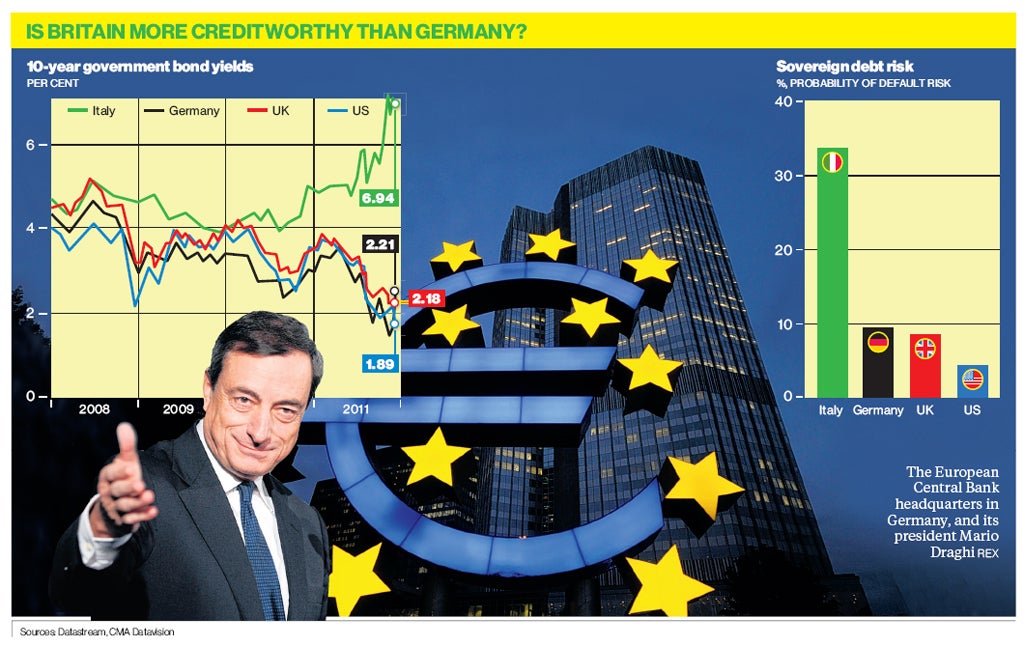

But it isn't, or at least in the fickle mood of the markets, it does not look like that. This week, the interest rate on German 10-year debt rose about the rate on the equivalent gilts. The gap is tiny: yesterday the rates were 2.21 per cent for German debt and 2.18 per cent for gilts. But it is symbolic: go back a couple of years and there was a significant gap, as you can see from the first graph. Indeed we were ranked the same as Italian debt, whereas now Italian debt is trading at 6.94 per cent, a whisker under what is perceived as the point-of-no-return level of 7 per cent. Go above that and you need a bailout.

You can see a market response to this in the other graph. This shows some calculations on the cumulative probability of default made by CMA Datavision. It calculates these probabilities from the credit default swap prices; these were done based on last month's numbers, so they show what the market was thinking ahead of this most recent fright. Italy was given a one-third possibility of defaulting, with Germany and the UK below 10 per cent and the US below 5 per cent. These numbers sort of reflect what subsequently happened to rates, for even then Germany was ranked as slightly riskier than the UK.

I expect that our Chancellor will take comfort from this hard-won seal of approval from the markets when he makes his Autumn Statement on the nation's finances next week. I do think the Coalition as a whole deserves true credit for playing the weak hands of cards it was dealt with measured skill. But are we really in that good a place? And what about the US?

If the UK rates look anomalous, given our slow pull out of recession and given the mountain of debt that still hangs over us, so surely does the situation of the US. You may have read the reports this week of the evident breakdown of its efforts to get an agreed deficit-reduction programme in place. Why are we both "safe havens", whereas the eurozone – even the German chunk of it – is not?

There are three broad explanations, with the truth probably being some mix of all of them.

One is that there is a wave of risk-aversion sweeping across the world and anything associated with the eurozone carries a taint. There are stories of Japanese fund manages shifting money out of Bunds and into gilts. There may be a feeling that gilts are a good place to park funds because there are other opportunities in the UK, so the currency risk can be offset. There may be fears that were the eurozone to break up, it would happen in an uncontrolled way and that anything denominated in euros would, for a period, be frozen. There may even be fears of currency controls in Europe. Even if the possibility of having your funds frozen is tiny, it is not a risk you want to take.

The second explanation is that Germany's creditworthiness will be undermined by it being forced to guarantee other countries' debts. Were the EU to issue "Eurobonds" or "Stability Bonds" as we are supposed to call them, the ultimate back-stop could only be Germany. Buyers would want to know what sort of guarantee they had were the eurozone to break up. France has retained its AAA rate for the time being but its bonds are not behaving like AAA debt: the yield yesterday on 10-year French bonds was 3.66 per cent, ie nearly 1.5 per cent more than German or British debt.

So any move towards jointly backed eurozone debt undermines Germany. It is mathematics. If these new bonds enable countries such as Italy or Spain to borrow more cheaply than they otherwise would (and there is no point in the whole idea if they can't) thenthat is because they are using part of Germany's creditworthinessas a backstop. It follows that if they pay less, Germany will have to pay more. You can see why Angela Merkel is less than thrilled by the idea.

And the third explanation? It is that the European Central Bank will have to save the eurozone by flooding Europe with euros. It is already printing money to keep the banks of peripheral countries alive; it is intervening in the bond markets to hold down the price of Italian and Spanish debt so it is in effect financing those governments too. But while you can defend such action in an emergency – ensuring stability in the markets is a classic textbook function of central banks – this cannot be a long-term solution. You can defend central banks creating money to offset a liquidity crisis but not a solvency crisis. The plight of Spain and Italy is a mixture of the two but whereas six months ago the problem seemed more one of liquidity, it may be sliding towards one of solvency now.

Mario Draghi, the new president of the ECB, is likely to be as firm on this point as his predecessor Jean-Claude Trichet. It can supply liquidity but it cannot bail our governments. But – and this may account in part for the new ugly mood of the markets – there is a nagging doubt that it might have no option but to bail out governments because there is no one else with the firepower to do it.

So what will happen? It is easier to see what will happen in 10 years' time than what will happen next month. Andrew Smithers of Smithers & Co (who has, incidentally, been very right about the banking crisis) has just put out a paper suggesting that the eventual outcome will either be a smaller eurozone built around a German-led fiscal union or a move back to national currencies. But that will need a whole new raft of European politicians to carry either through, because the present generation are too tainted by the experience of the euro.

All this, of course, is far off – and quite how we get there utterly uncertain.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks