Stephen King: Who needs who? America and China must avoid making past mistakes again

Western nations look at the recent success of the emerging world with a mixture of admiration, envy and anger

In some areas of our lives, globalisation is more or less complete. On Friday, for example, I discovered that my birthday had become a major global event. I received unsolicited e-birthday cards from hotels in Qatar and Singapore, and from the Virgin Flying Club. It was all rather anonymous and depressing. In other areas, however, globalisation is in danger of crumbling.

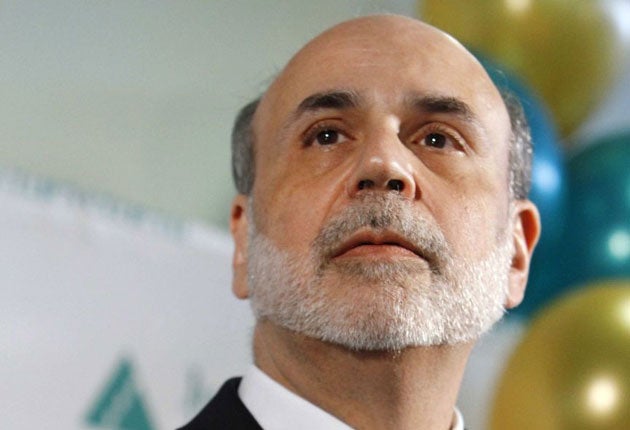

As Ben Bernanke, the chairman of the US Federal Reserve, noted on Friday, "international policy coordination is especially difficult now because of the two-speed nature of the global recovery".

Mr Bernanke is absolutely right. Western nations look at the recent success of the emerging world with a mixture of admiration, envy and anger: admiration, because China, India and other nations have pulled millions out of poverty; envy, because while the global policy stimulus has been very effective in the emerging world, high levels of debt have made it a lot less effective in the developed world; and anger because, for many Western policymakers, Mr Bernanke included, the policies pursued by emerging nations – notably the deliberate undervaluation of exchange rates – are a major threat to sustainable global economic recovery.

To emphasise the point, Mr Bernanke invoked the spectre of the 1930s. "In the period prior to the Great Depression, the United States and France ran large current account surpluses, accompanied by large inflows of gold... Neither country allowed the higher gold reserves to feed through to their domestic money supplies and price levels, with the result that the real exchange rate in each country remained persistently undervalued... These policies created deflationary pressures in deficit countries...which helped bring on the Great Depression".

Today, the equivalents of the US and France are China, Russia and Saudi Arabia – all of which run large current account surpluses, providing the global offset to America's current account deficit.

Like the US and France in the 1920s and early-1930s, they're not terribly keen on either a rise in their exchange rates or, instead, a pick-up in domestic money-supply growth and inflation. And, as with the 1930s, the world's deficit nations are struggling with deflation. Last week, the US published its lowest core inflation rate in over 50 years.

To be fair, Mr Bernanke emphasised that he had no intention of forecasting a return to the conditions last seen in the 1930s. Instead, he wanted to argue that, until and unless the world's surplus nations allowed their currencies to rise, the global economic recovery would remain lopsided, unbalanced and very vulnerable. Eventually, he argued, the two-speed world would become a one-speed world. And he clearly believed that a one-speed world would be stuck in first gear.

It's at this point that I begin to have my doubts. For all the warnings about the inability to sustain "two-speed" growth, a "two-speed" global economy has been the reality for decades.

Since the 1950s, East Asia has sustained a per capita economic expansion faster than on any other occasion in human history. Throughout the last decade, the emerging world as a whole has grown at least three times faster than the developed world. And it is this strong, persistent and seemingly resilient expansion that makes me wonder about one of Mr Bernanke's key conclusions.

In his words, "...a strong expansion in the emerging market economies will ultimately depend on a recovery in the more advanced economies..." Does this still hold true? Not obviously. Two important themes have begun to emerge in recent years. First, strong emerging-market growth is beginning to undermine growth in the developed world. China's hunger for raw materials – now increasingly being mimicked in other parts of the emerging world – has left commodity prices high despite the depths of the recession in the West. In the "bad" old days, this would have left the West facing significantly higher inflation but, today, the risk lies more with lower output. Even in the UK, where inflation is too high relative to target, there has been no wage response. Adjusted for inflation, wage growth has been pitifully weak, hindering the pace of both debt repayment and the economic recovery. The level of economic activity remains depressed by past standards.

Second, the underlying drivers of global economic growth are increasingly coming from the emerging world. It's easy enough to caricature China and other nations as being entirely dependent on exports – a view that Mr Bernanke is happy enough to support. Yet the data reveal a very different picture. Of the 3.2 per cent increase in world consumer spending recorded in 1998, all but 0.3 percentage points came from the developed world.

This year, a very different story emerges. Of the 2.4 per cent overall increase in global consumer spending, more than half comes from the emerging world.

The picture on investment is even starker. Global growth in capital spending has more than doubled since the late 1990s. At the height of the technology boom, capital spending rose at a 6 per cent annual rate, two-thirds of which came from the developed world. This year, capital spending will deliver a 10 per cent gain. Four-fifths of this rise will come from the emerging world.

We are witnessing a true revolution in global economic affairs. The engine of economic expansion is no longer to be found in the debt-ridden West. Instead, the emerging nations find themselves in the driving seat of global growth. And as their economies increase in size, so they will increasingly trade with each other. Why, for example, would a Brazilian company set its sights on selling to US consumers when Asian domestic demand is expanding so incredibly quickly?

If, though, demand in the emerging world is growing so quickly, why do these countries run current account surpluses? Why do they appear to be saving rather than spending?

The answer relates to supply and demand. Although consumption and capital spending are both rising very quickly, they are not rising quite as quickly as output.

China and other emerging nations are producing more than they are consuming and, hence, running current account surpluses. But does that mean they are dependent on US and other Western consumers?

Not necessarily. It's easier, in fact, to turn the argument on its head. Whether they like it or not, Western consumers are increasingly dependent on the low-cost production and ample credit provided by the emerging nations.

But this sense of dependency doesn't play well in the West. Whether it's Nobel peace prizes, exchange-rate policies or broader economic rebalancing, the West's voice is falling on deaf ears, partly because the leaders in the emerging world are particularly attuned to the stench of hypocrisy.

In the late-1990s, following the Thai baht crisis, the West lectured Asian and other emerging economies over their profligate ways and demanded a period of hair-shirt austerity. With the roles now reversed, the West seemsnot to have the stomach for the medicine that it once prescribed for everybody else.

Stephen King is managing director of economics at HSBC

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks