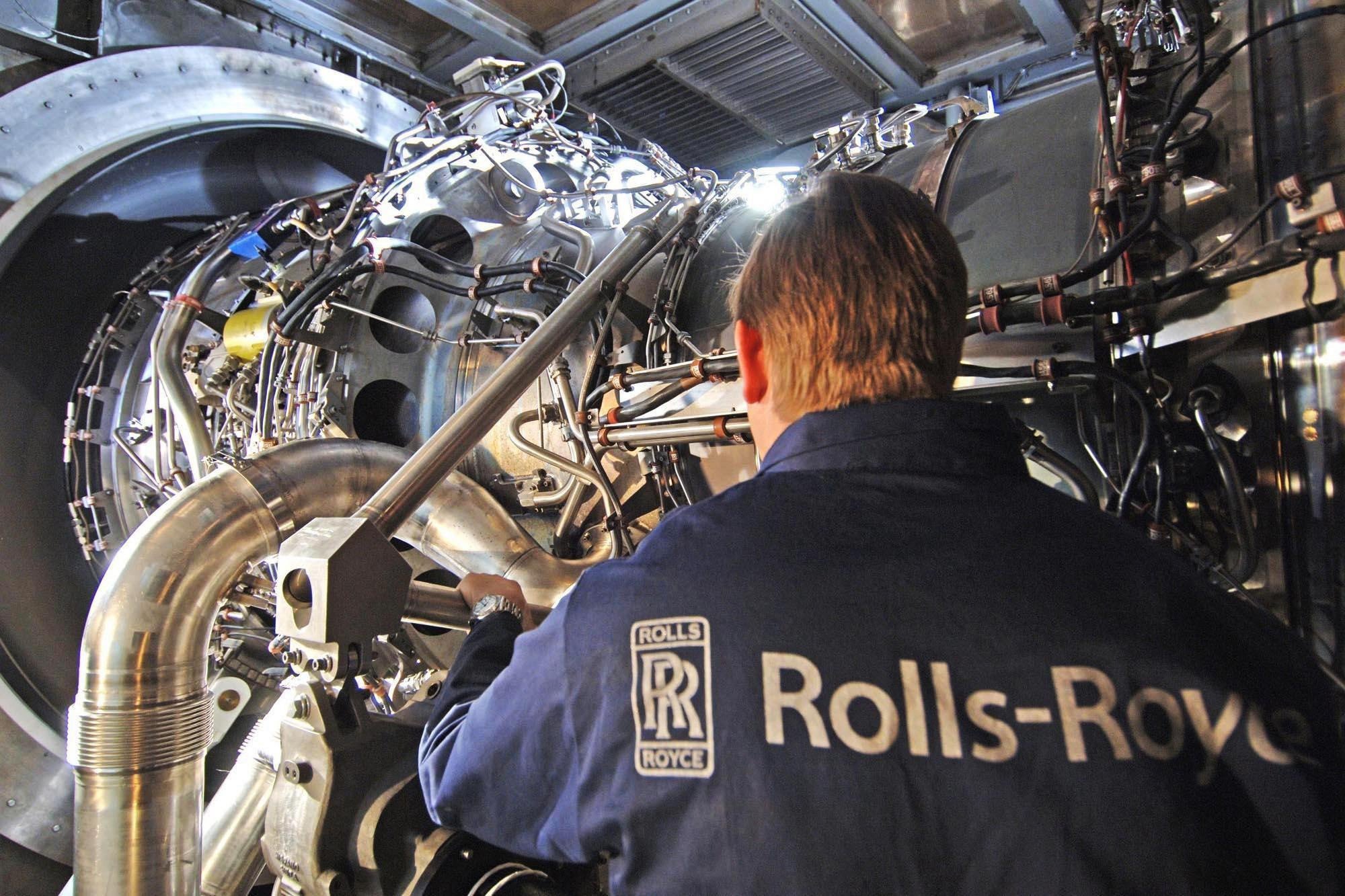

FTSE 100 latest: Rolls-Royce share price rises despite mammoth £4bn loss due to pandemic

Engine-maker says Covid-19 has had ‘severe impact’ on performance as flights have been cancelled around the world

Rolls-Royce posted a mammoth £4bn loss for 2020 as the pandemic caused planes to be grounded, decimating demand for engines and the service contracts that go with them.

The group blamed a “severe impact of Covid-19 pandemic on group performance and near-term outlook” and warned this year remained uncertain for the aviation industry.

In 2019, Rolls-Royce had reported underlying pretax profits of £583m.

Warren East, chief executive of Rolls-Royce, said: “We have taken decisive actions to enhance our financial resilience and permanently improve our operational efficiency, resulting in a regrettable, but unfortunately very necessary, reduction in the size of our workforce.”

Rolls cut 7,000 jobs last year as part of a cost-saving programme that is expected to see a total of 9,000 redundancies by 2022. Around two-thirds of the cuts will fall in the UK, Rolls has said.

The company has also tapped some £7.3bn of funding from shareholders and emergency lending from the Bank of England.

Mr East added: “With the support of our stakeholders we successfully secured additional liquidity with a rights issue, bond issuance and further credit facilities put in place during the year.

“We have made a good start on our programme of disposals and will continue with this in 2021.”

On a statutory basis, Rolls reported pretax losses of £2.9bn against losses of £891m in 2019.

The FTSE 100-listed firm saw its share price rise 2.6 per cent despite the results.

Laura Hoy, equity analyst at Hargreaves Lansdown, said: “No amount of cost saving and restructuring was enough to offset massive declines in civil aerospace, the group’s largest division.

“Defence was the only bright light but it makes up less than 30 per cent of overall revenue so it’s 8 per cent uptick in profits was buried under heavy losses in all of the group’s other segments.”

The FTSE 100 barely moved in Thursday morning trading, edging down 0.2 per cent while European markets approached their pre-pandemic highs.

The pan-European Stoxx 600 index approached its pre-pandemic peak after a rally in technology company shares lifted the benchmark 0.4 per cent.

Lucy Powell MP, Labour’s shadow business minister, said: “The UK’s aerospace industry is operating on a wing and a prayer as a result of the government’s failure to back British businesses with the targeted support they need.

“With aviation levels not expected to reach their 2019 peak for years, and the French and German governments pumping billions into their aerospace industries, it is vital that ministers take action to avert the tailspin the industry is in.”

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies