UK consumer borrowing is still holding up, according to the latest data from the Bank of England.

Total unsecured household lending was up £1.4 billion in February, leaving the annual growth rate at 10.5 per cent.

City analysts polled by Reuters had pencilled in a slightly lower figure of £1.3bn.

Consumer spending, supported by borrowing, has been the central reason why GDP growth has held up strongly since last year's Brexit vote.

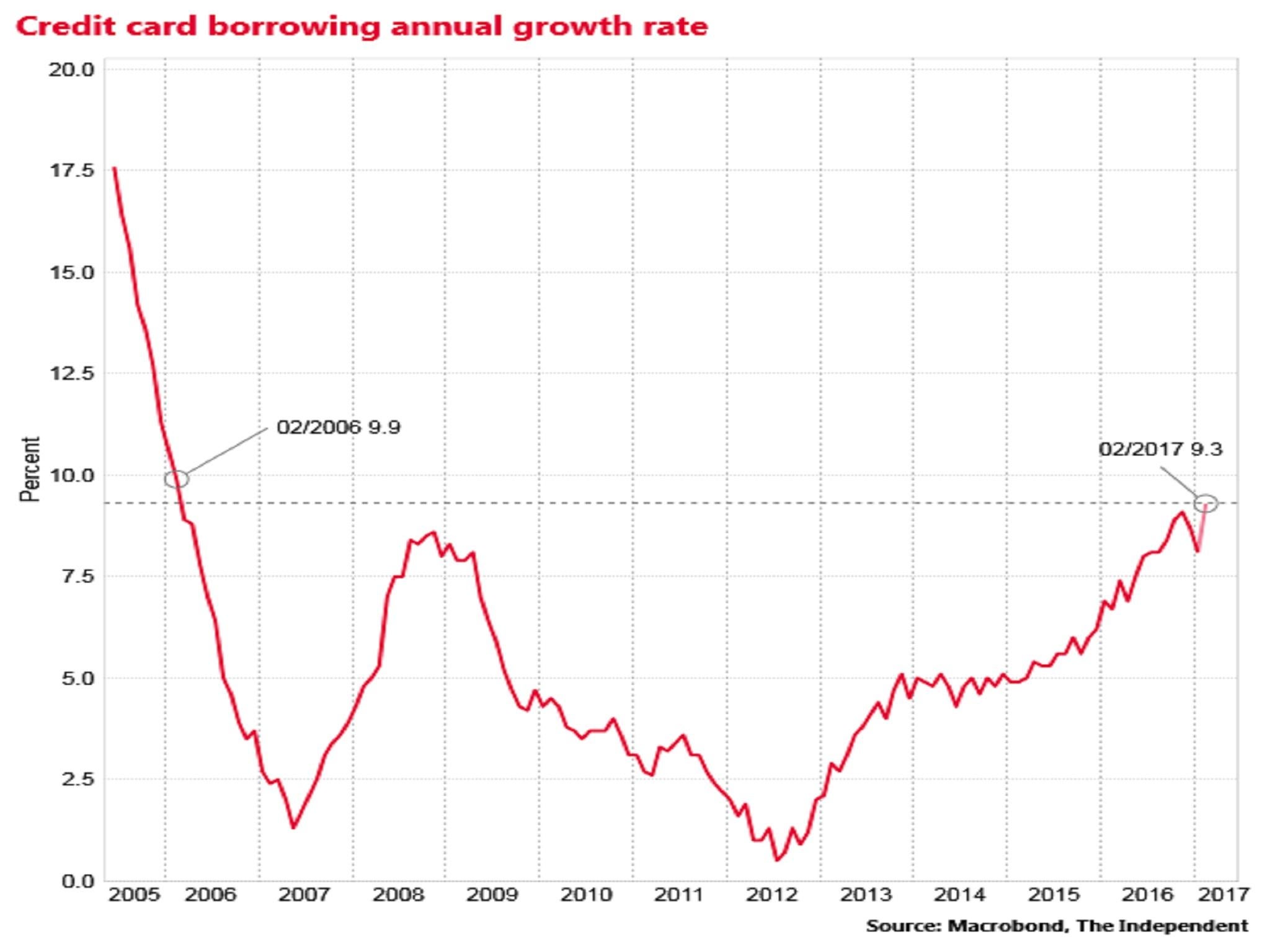

Credit card borrowing in February rose by £600m, taking the annual growth rate back to 9.3 per cent, the fastest in 11 years.

Plastic flexing at 11 year high

The category of “other loans and advances” increased by £900m, an annual growth rate of 11.1 per cent.

However, the overall annual consumer credit growth rate was down from a peak of 10.9 per cent hit last November and February's growth figure was below the £1.6bn average of the past six months and some economists expect the slowdown to continue.

“The signs of a modest underlying slowdown in unsecured consumer borrowing from the peak levels seen around last November broadly links in with the impression that consumers are becoming more cautious as their purchasing power is increasingly diluted by rising inflation along with muted earnings growth,” said Howard Archer of IHS Global Insight.

Separately, the Bank data shows the number of new loans for house purchase was 68,315, down from 69,114 in January and less than the 69,900 City analysts had expected.

“Intensifying pressure on households’ incomes from rising inflation will continue to dull home buyer demand and house price growth,” said Samuel Tombs, economist at Pantheon.

The UK economy grew by 0.6 per cent in the third quarter of 2016 and 0.7 per cent in the third quarter.

The minutes from the Bank of England's Monetary Policy Committee's latest meeting show a forecast of 0.6 per cent GDP growth for the first quarter of 2017.

The initial estimate from the ONS will be released on 28 April.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments