Barclays hit by new storm as chiefs probed over £7bn Arab bailout

Four key figures investigated over commissions in vast Middle East deal to save bank in 2008

Barclays was engulfed in a new scandal last night after it emerged that finance director Chris Lucas is among four "current and former employees" under investigation by the Financial Services Authority over the multi-billion pound bailouts that the bank received from the Middle East in 2008.

The probe focuses on millions of pounds in commissions the bank paid to help secure the £7.1bn raised from Qatar, Abu Dhabi and its own shareholders in November 2008, and the £4.5bn from investors including Qatar and Sumitomo Mitsui Banking Corporation in June 2008.

The FSA is looking at the extent to which the payments were properly disclosed by the bank.

News of the investigation was revealed for the first time on page 87 of the bank's interim results statement yesterday. The identities of the three other executives have not been disclosed, but The Independent understands that Bob Diamond, the former chief executive who paid a key role in raising the Middle Eastern cash, is not among them.

The Independent approached the Financial Services Authority last week with questions about the Middle Eastern deal, but sources at the regulator denied knowledge of an investigation.

However the FSA's hand was forced this week by Barclays, which sources close to the bank said "wanted to make sure everything was on the table given the current climate".

Last month Mr Diamond resigned after the bank was agreed to pay £290m in fines over attempts to fix Libor interest rates.

The cash injections from Arab investors in 2008 meant Barclays was able to avoid taking funds from the British taxpayer during the financial crisis by contrast to Lloyds and Royal Bank of Scotland. But the nature of fund raisings proved hugely controversial with UK investors.

They argued that the terms offered to secure the funds from the Gulf states were overly generous and unfair because they were not made available to Barclays' existing shareholders. There was also unhappiness about the commissions now under investigation.

The issues being probed by the FSA relate to documents from the June 2008 fundraising citing "an agreement for provision of advisory services" by Qatar Investment Authority to Barclays in the Middle East and "to have agreed to explore opportunities for a co-operative business relationship" with Sumitomo Mitsui Banking Corporation. A further statement at the time said: "Barclays and Qatar Holding have entered into an agreement for the provision of advisory services by Qatar Holding to Barclays in the Middle East".

The second cash call, in November 2008, included commissions of 4.2 per cent of the total amount raised, significantly above the 3 per cent that is more customarily found in fund raisings. These commissions are usually paid to investment banks who advise on and underwrite share issues, but in Barclays' case the money was paid direct to the investors themselves and related parties. The cash was made up of £3bn of so-called "Reserve Capital Instruments" which were issued to Qatar Holding LLC, a subsidiary of country's sovereign wealth fund, and entities representing Sheikh Mansour Bin Zayed Al Nahyan, a member of the Royal Family of Abu Dhabi best known for his ownership of Manchester City.

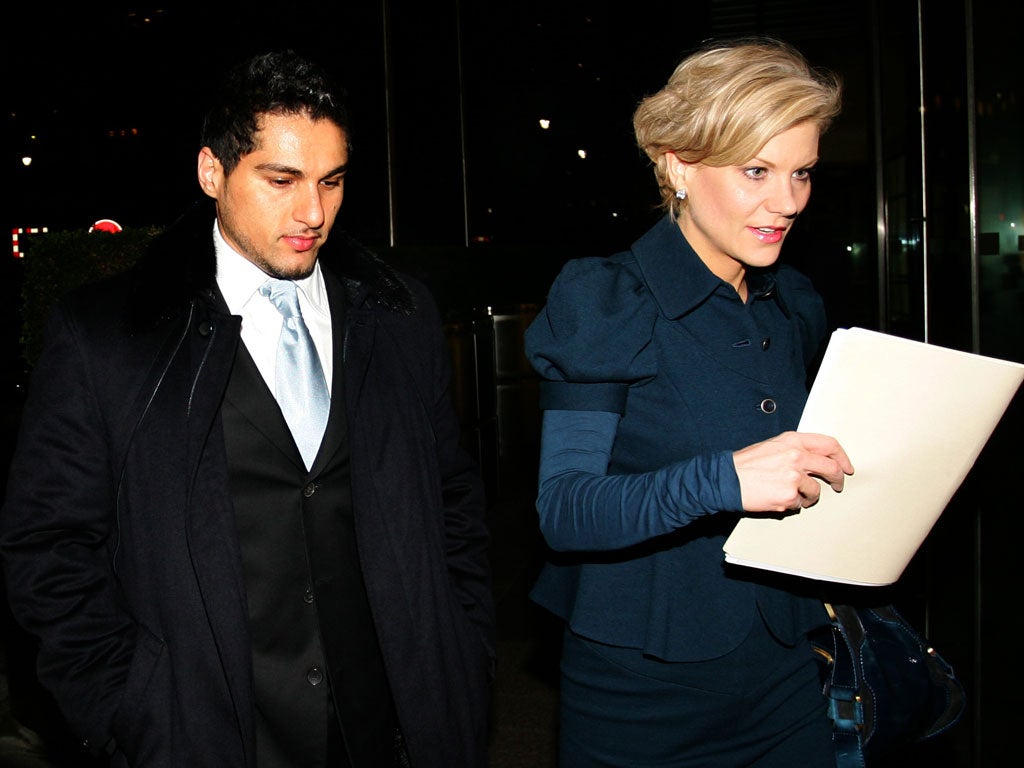

He was represented by Amanda Staveley, the financier and former model who was once closely linked to Prince Andrew and reportedly made £40m from the deal. Sources close to her said yesterday that she believed everything that should have been disclosed from the Abu Dhabi end of the deal was made public.

Barclays said that it "considers that it satisfied its disclosure obligations and confirms that it will cooperate fully with the FSA's investigation"

The RCIs paid an annual coupon – or interest rate – of an astonishing 14 per cent until June 2019 at a time when base rates were virtually zero.

The company issued a further £2.8bn in so called "Mandatory Convertible Notes" (MCNs) – paying 9.75 per cent – to Qatar Holding, Sheikh Mansour Bin Zayed Al Nahyan, and Challenger Universal. The latter was incorporated in the British Virgin Islands in June to hold shares in Barclays and owned by the chairman of Qatar Holding, Hamad Bin Jassim Bin Jabr Al Thani, and his family.

Investors in the RCIs were paid a commission of 2 per cent on top of their value, amounting to £60m. There was a further commission of 4 per cent of the principal amount on the MCNs, or an additional £112 million.

In addition, Qatar Holding received a fee of £66m for having arranged certain of the subscriptions in the capital raising. Barclays estimated the total fees and expenses relating to the transaction amounted to £300m.

One governance expert told The Independent: "They were basically getting an incredibly good deal. And getting paid for it to boot."

The investigation does not involve anyone other than Barclays and its employees. There is no suggestion of any impropriety of any other party.

John Mann, a member of the Treasury Select Committee who has threatened to hold his own banking inquiry after being left out of the Parliamentary Inquiry into banking standards, said any commissions had to be taken on by any inquiry into Barclays. "It must be part of the investigation. Any real inquiry has to look directly into these issues and not just Libor," he said.

Barclays' continuing difficulties with regulators took some of the shine of results that beat City forecasts. Underlying pre-tax profits, before one off charges, rose by 13 per cent to £4.2bn in the six months to 30 June.

The dealmakers

Chris Lucas

Few could have imagined that the affable numbers man would be involved in anything that could attract the attention of regulators. He is about as different as one could get from the aggressive American investment bankers who have come to dominate the bank in recent years. Mr Lucas is a career accountant who joined Barclays in 1999 after a lengthy career with PricewaterhouseCoopers. Mr Lucas has become infamous for his monotone delivery at Barclays results press conferences.

Amanda Staveley

The part-time former model, one time girlfriend of Prince Andrew, workaholic and dealmaker extraordinaire, played a key role in Barclays' Middle Eastern rescue. Ms Staveley, the daughter of Yorkshire landowners, has a formidable network of contacts in the Middle East. Her "in" was the opening a restaurant in Newmarket, the headquarters of British horseracing, in her early 20s. British flat racing is dominated by wealthy owners from the Persian gulf, and her restaurant was popular with members of Maktoum family that own the Godolphin syndicate.

Sheikh Mansour

Football has become to the Abu Dhabi politician Sheikh Mansour what horseracing is to the rulers of the next door emirate of Dubai. While the Maktoum family's jockeys wear royal blue, Sheikh Mansour is most closely associated with the sky blue of Manchester City. The Sheikh, who is an accomplished horseman himself, has pumped millions into the club, wresting the Premiership title away from Manchester United in the process. A minister and a banker in the emirate, his personal fortune has been estimated at £20bn.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.