Brexit latest: City of London economists scrap recession forecasts

Positive data in recent weeks has prompted several economics teams at Square Mile institutions to upgrade their forecasts

City of London economists have been revising away their expectations of a new UK recession on the back of surprisingly solid economic data and industrial surveys since the Brexit vote as well as anticipated stimulus from the Bank of England and the Government.

In the wake of the 23 June referendum result most City forecasters slashed their growth forecasts for the UK dramatically, with many pencilling in an outright contraction in GDP for two quarters, a technical recession.

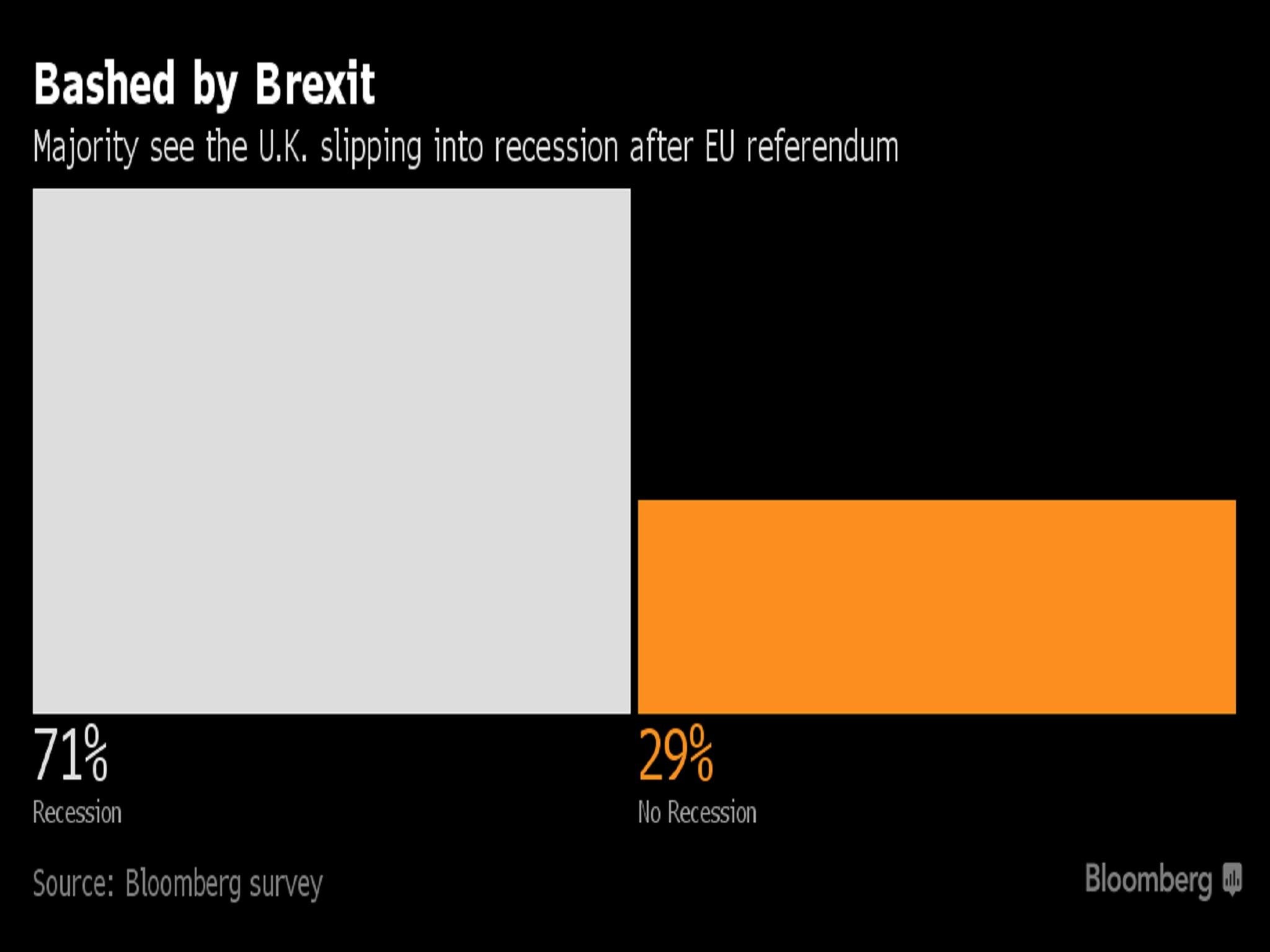

A survey of 35 economists by Bloomberg on 29 June found that 71 per cent of those questioned expected a recession either this year or next.

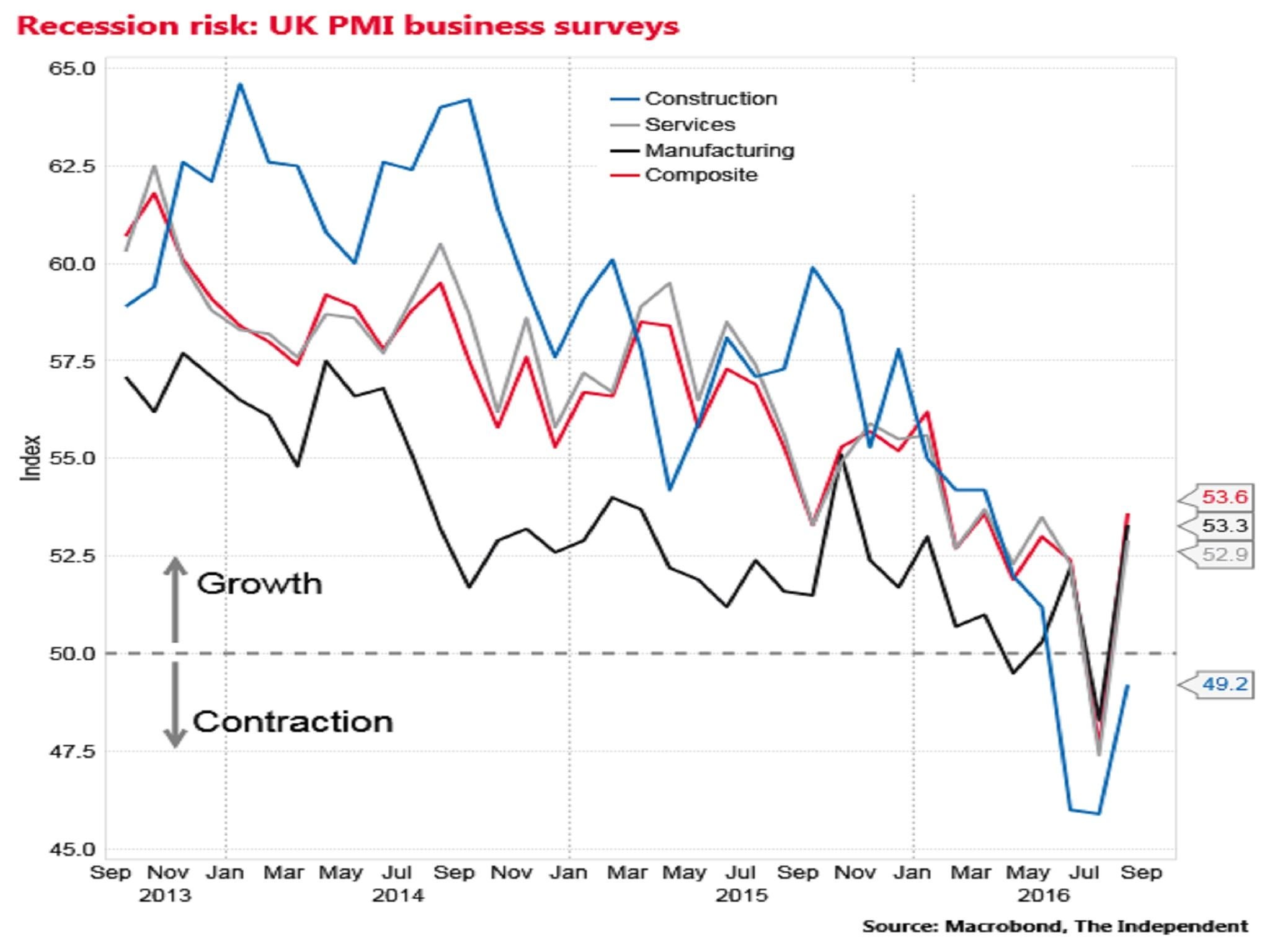

But the positive data on retail sales in July from the Office for National Statistics and a bounceback in the closely-watched Purchasing Managers’ Indexes in August have prompted several economics teams at Square Mile institutions to revise their forecasts.

“We’ve ‘marked-to-market’ our growth forecast from a sharp slowdown and Brecession, to a lesser slowdown, which narrowly avoids a technical recession,” said Morgan Stanley’s team.

They had previously forecast a 0.4 per cent contraction in the third quarter of the year, but now they expect growth of 0.4 per cent.

Initial gloom

Credit Suisse economists said the Brexit shock had been “materially less than we expected in late June” and added “we now expect subdued growth, but not a recession”.

Goldman Sachs cited the Bank of England’s monetary easing in August and its expectation of further cut in interest rates to just 0.1 per cent in November as well as an anticipated “substantial” fiscal easing from the Government in the Autumn Statement as the reason for its own upgrade.

“Incorporating these new monetary and fiscal stimuli into our forecasts, we now expect the UK economy to avoid even the ‘technical recession’ that we had foreseen immediately after the referendum” London-based analysts at the Wall Street institution said.

Goldman also said that the cumulative reduction in the level of UK GDP by 2019 to be 2 per cent, an improvement on the 3 per cent hit the bank had previously envisioned.

Bouncing back

JP Morgan, which had previously expected a GDP contraction in the third quarter, now expects growth.

“Recession risk in [the second half of 2016] has vanished for now” said the economists of Citi, and added that this may interfere with its forecast that the Bank will cut interest rates again in November.

Other economists, who previously thought growth would fall to zero, have also upgraded their forecasts.

IHS Global Insight said: “Having initially feared that the economy could stagnate in the third quarter due to heightened uncertainty following June’s Brexit vote, we now believe the economy could grow by around 0.3 per cent with consumers leading the way… Furthermore, we are starting to wonder if [that] may be on the cautious side.”

However, no City economists have revised their forecasts to the extent that they now expect the Brexit vote to have zero negative impact on the UK economy.

And some are sticking to their bearish judgements.

Pantheon Macroeconomics said it would be “unsurprising” if the Purchasing Managers’ Indexes tanked again in the coming months.

“It is far too soon to breathe even a tentative sigh of relief just yet; recession risk is still very real,” it said.

The ONS’s first estimate of GDP growth for the third quarter will not be released until 27 October. Growth came in at 0.6 per cent in the second quarter (mostly prior to the referendum), higher than expected by City economists.

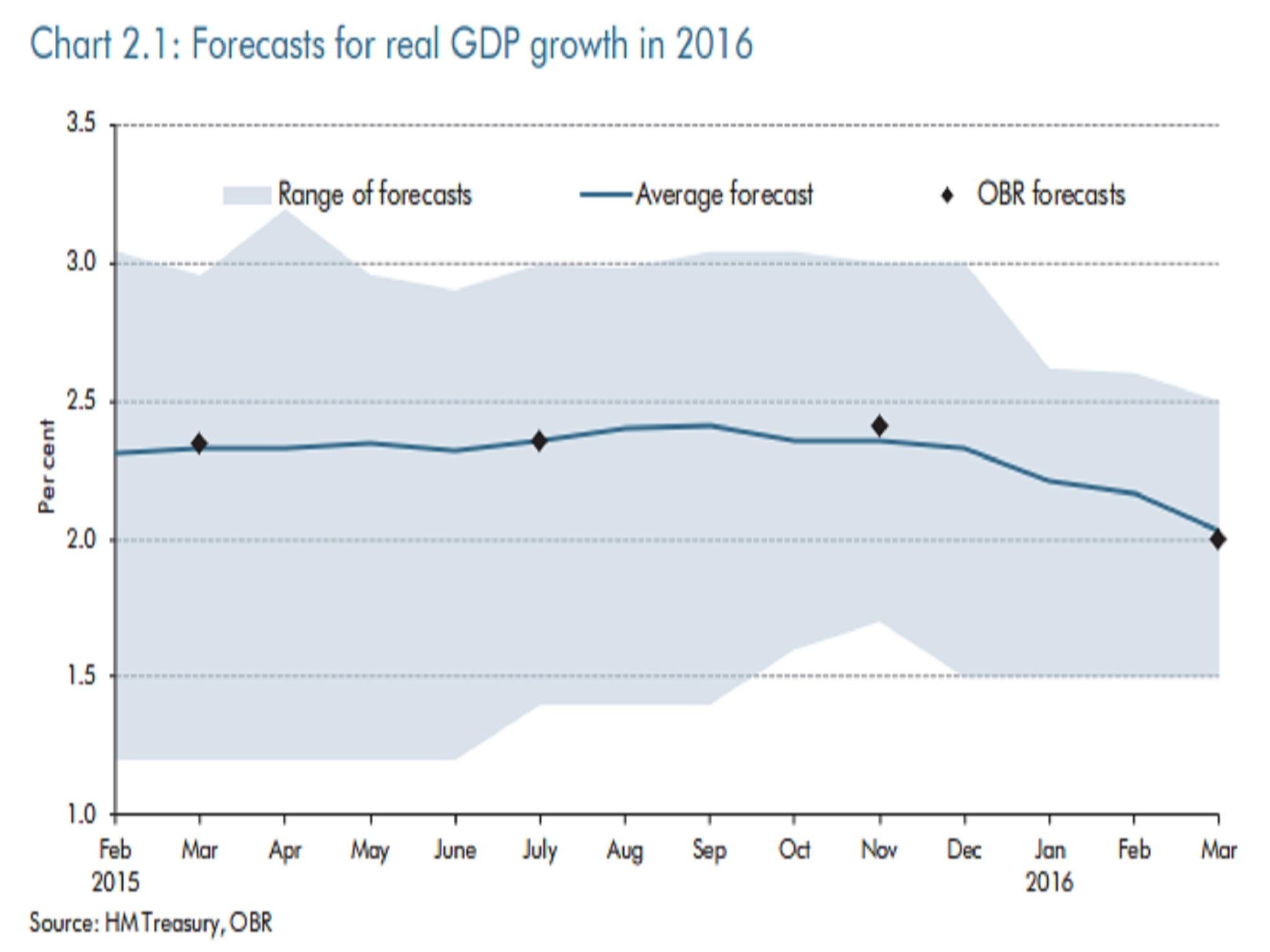

The new GDP forecasts from the Office for Budget Responsibility – the Treasury's own forecaster – are likely to be crucial in influencing the Chancellor’s fiscal decisions in the Autumn Statement.

In the past OBR forecasts have been close to the average of the range of views of City and independent economists.

Middle of the pack

.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments