City puzzled by £1bn valuation as AO.com unveils listing plans

The AO.com valuation is at odds with initial estimates of £300m made in September

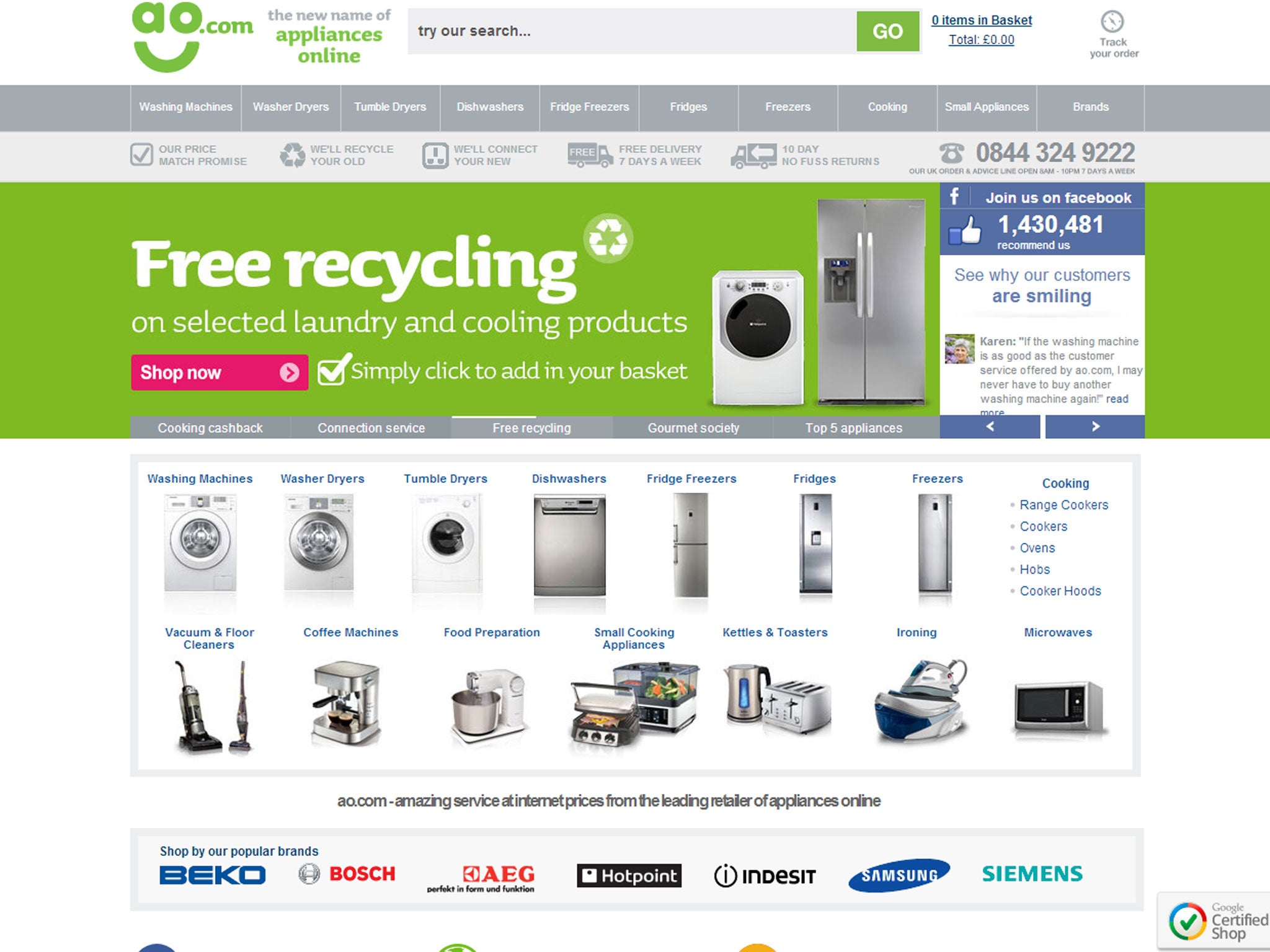

The starting gun was fired on the first of a whole host of major retail listings on the London Stock Exchange yesterday when online white goods firm AO.com revealed its eagerly anticipated plans for a £1bn float.

However, the announcement has left analysts and commentators puzzled by such a high valuation for a business with sales of just £275.5m and £10.7m underlying profits.

They point out that by comparison, larger rival Dixons, the owner of Currys PC World, had sales of £8.4bn last year and is on course to pre-tax profits of around £150m this year. Its market cap is £1.6bn.

The AO.com valuation is also at odds with initial estimates of £300m made in September when management approached banks to start the IPO process.

Undeterred, the founder and chief executive John Roberts has pushed forward with a flotation, which could leave him with a £400m fortune if successful.

The company wants to cash in on the City’s current insatiable appetite for IPOs, especially in the retail sector, where many see the opportunity for high returns particularly in online businesses.

Other high-profile floats also expected to be announced in the coming months include Poundland, Pets at Home, DFS, House of Fraser and Sir Terry Leahy’s B&M Bargains.

The festive period was defined by internet sales, which were up 19 per cent, according to the British Retail Consortium, compared with last year, while the high street struggled. The big winners, such as Next, performed particularly strongly online.

The retail analyst Nick Bubb said: “It remains to be seen what investors will ultimately decide AO.com is worth, but its mooted valuation certainly makes Dixons look cheap.

“White goods are obviously low-margin products, compared to fashion, and it’s hard to see that the business can ever make that much money, despite its excellent customer service reputation.

“It still has to compete in the UK with mighty Amazon, as well as the “multi-channel” presence of Dixons, and it has yet to move into Europe.”

He added that internet-only businesses are not always attractive propositions, considering Dixons’ own foray with pure play company Pixmania, which led to years of losses.

A note by Barclays added: “Dixons’ [share price] is 15 per cent off its recent highs, mainly on speculation that AO.com will be disruptive to Dixons’ trading. We believe that there has been an exaggeration in this argument since AO sales are less than 10 per cent of Currys’ sales while prices are similar.”

AO.com was launched 14 years ago by Mr Roberts. It is the UK’s largest online domestic appliances business.

Management has announced a series of high profile non-executives, including the current chairman of online fashion retailer Asos and the former Amazon UK boss Brian McBride, along with the former finance director of John Lewis, Marisa Cassoni.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies