Gifts, perks and Moroccan luxury: How Goldman Sachs 'won over Libyans'

Establishing a relationship of “trust” with the LIA allowed the bank to make $350m from a series of trades worth $1bn that ultimately proved worthless

Goldman Sachs offered gifts, luxury trips to Morocco and an internship at its Fleet Street offices to win business from the Gaddafi placemen running the $60bn Libyan Investment Authority, papers filed at the High Court allege.

The legal claim, lodged by Libya’s new regime, claims that poorly qualified and naive staff were courted with chocolate and aftershave and were lavishly entertained on a corporate credit card issued to Youssef Kabbaj, the bank’s former head of North Africa.

The coveted internship, in London and Dubai, was allegedly handed to Haitem Zarti, brother of the fund’s deputy director, Mustafa Zarti, who owed his position to his friendship with Saif al-Islam, Colonel Gaddafi’s son whom he had met while studying in Vienna.

Such placements are more usually fought over by top-performing graduates from the world’s leading universities.

Mr Kabbaj also brought gifts of chocolates and after shave to the LIA team in Tripoli when he came to visit, calling the men his “friends”. He took six of them on trips to his native Morocco and “paid for extensive expenses for them on his corporate credit card provided by Goldman,” the claim alleges.

All this, the claim says, led to Goldman establishing a relationship of “trust” with the LIA – set up to invest parts of the country’s vast oil wealth – which allowed the bank to make $350m (£210m) from a series of trades worth $1bn that ultimately proved worthless.

The LIA claims that the bank took advantage of an unsophisticated and poorly trained body of staff at a time when Libya was being brought back into the international fold and sanctions had been eased.

Encouraged by national governments, banks had poured into Libya, keen to secure business from the oil-rich state and its $60bn sovereign wealth fund. Mr Kabbaj and the bank’s head of trading for emerging markets, Driss Ben-Brahim, became active in the country, aggressively courting and dazzling the allegedly financially unsophisticated staff.

They included the fund’s ultimate boss, Mohamed Husain Layas, described as a “commercial banker” who was hired at the suggestion of the late Colonel Gaddafi, Mr Zarti, and a corps of people aged in their 20s and 30s.

The legal papers claim they ran a ramshackle operation and had only “extremely limited financial and legal expertise”. They didn’t even have computers installed at the time the organisations were first making contact. Goldman enjoyed free access to the offices, which had little or no security.

It is claimed that the bank’s employees had offered to train these staff members in Tripoli and at its “Goldman Sachs University” in London, but that these sessions often focused on products and investments the bank wanted to sell.

Goldman, it is alleged, provided staff appraisals to the fund, which believed it had secured a “partnership” with the bank.

As such, it put $550m on deposit and then entered a series of trades in complex derivatives linked to the shares of companies including Citigroup, Banco Santander and EDF Energy. The total investment amounted to just over $1bn but the fund performed little or no due diligence and did not have the trades reviewed by expert counsel,

it is alleged. The trades soon went wrong and they were in essence worthless by the middle of 2008. The lawsuit also claims that Goldman had to be chased for paper work and confirmations and that agreements standard in such relationships had not been signed.

It alleges that the true nature of the trades was only discovered by an Australian lawyer, Catherine McDougall, who was sent to the fund from the City law firm Allen & Overy (A&O), which had taken a member of the fund’s legal team on a placement as part of a reciprocal arrangement.

She, it alleges, was “struck by how complex and one-sided the trade confirmations were” and called in A&O’s derivatives team for help.

“She explained that, rather than being cautious investments in shares or ‘quasi shares’ (as the LIA had previously thought), the disputed trades were actually complex derivatives and synthetic instruments which represented highly speculative gambles,” the claim states. “She also explained that the interests of Goldman and the LIA were not aligned, and cautioned that the LIA had put too much trust and confidence in Goldman”.

These revelations led to a furious row, as the fund protested about the trades. The dispute was still ongoing when the revolution erupted in 2011.

The claim alleges that Goldman entered into an “unconscionable bargain” with the LIA as a result of its “undue influence”. It is seeking a refund of its premiums, Goldman’s profits and interest.

But Goldman said last night: “We think the claims are without merit and will defend them vigorously.” It is expected to argue that it was not acting in a fiduciary capacity with respect to the LIA and that the authority approached it with trades, not the other way round.

But the lawsuit nonetheless throws the spotlight back on a bank memorably dubbed a “great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money”in a now famous Rolling Stone magazine article after the financial crisis.

The allegation that it exploited a client’s naivety chimes with lawsuits brought against Goldman by other clients and by regulators.

These prompted a period of introspection that led the bank to set up a “business standards” committee and to argue last year that it had become a “fundamentally different” company.

Flight to Tripoli: Legacy of 2008

Youssef Kabbaj must have been dreading his fate as he headed to Libya in early 2008 to explain how his investment back had lost 98 per cent of the $1.3bn handed to it by the Libyan Investment Authority.

Wonderfully vivid stories later emerged about how the Goldman rainmaker was torn to shreds in Tripoli.

One person who attended the meeting reported how then-LIA chairman, Mustafa Zarti was "like a raging bull," cursing and threatening Mr Kabbaj and another Goldman employee. So scared was Mr Kabbaj after being reprimanded that he reportedly hired bodyguards for the rest of his stay.

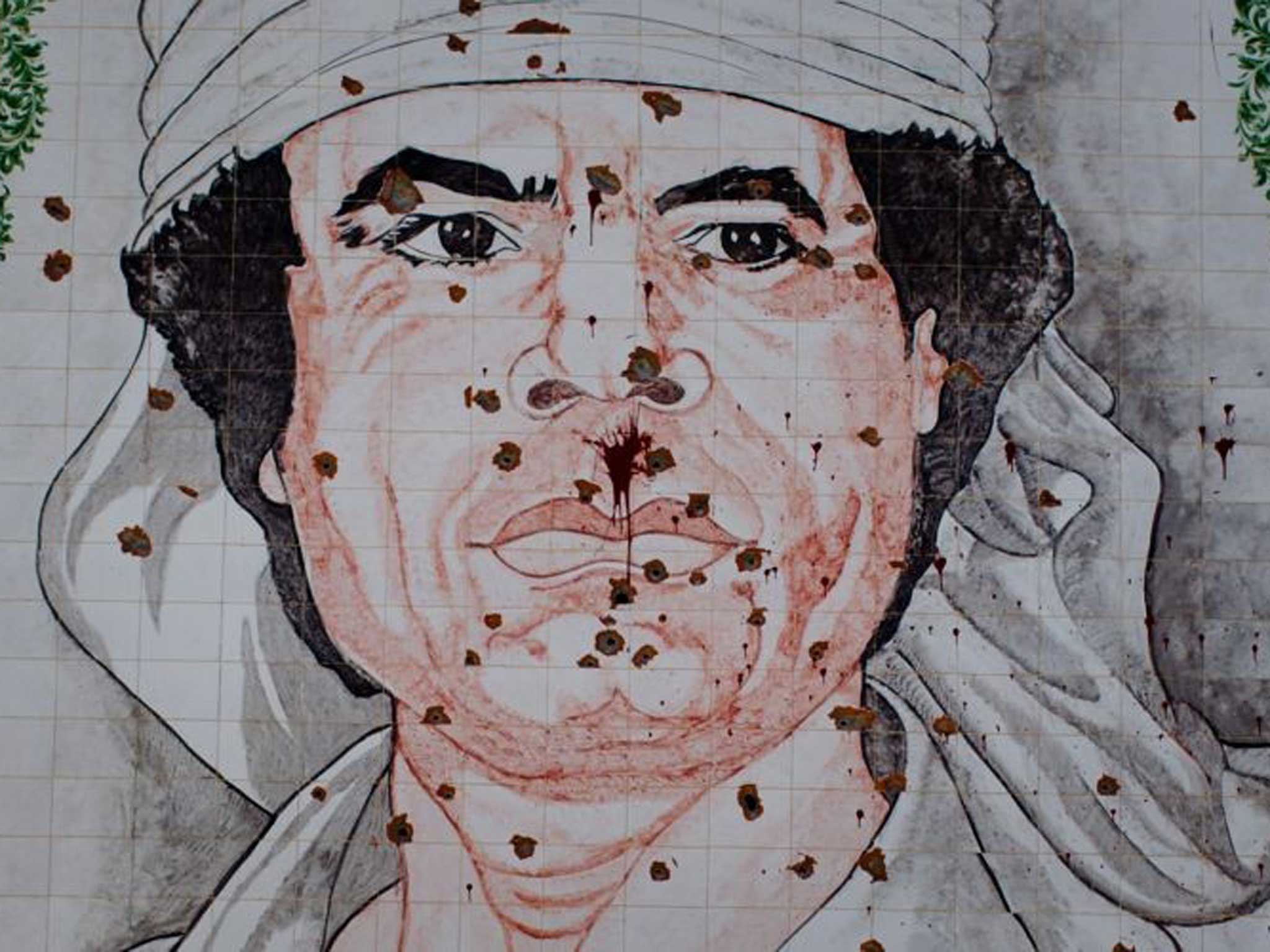

This came as no surpise, given that Mr Zarti was a close friend of both Muammar and Saif Gaddafi. To atone for the losses, Goldman reportedly offered Libya the chance to become one of its biggest shareholders.

The discussions within the investment banking giant about how to salavage the losses are believed to have included Lloyd Blankfein, the company's chairman, its chief executive, David A. Viniar, the finance chief, and Michael Sherwood, Goldman's leading executive in Europe.

Mr Kabbaj later left Goldman to join hedge fund GLG Partners.

Jamie Dunkley

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies