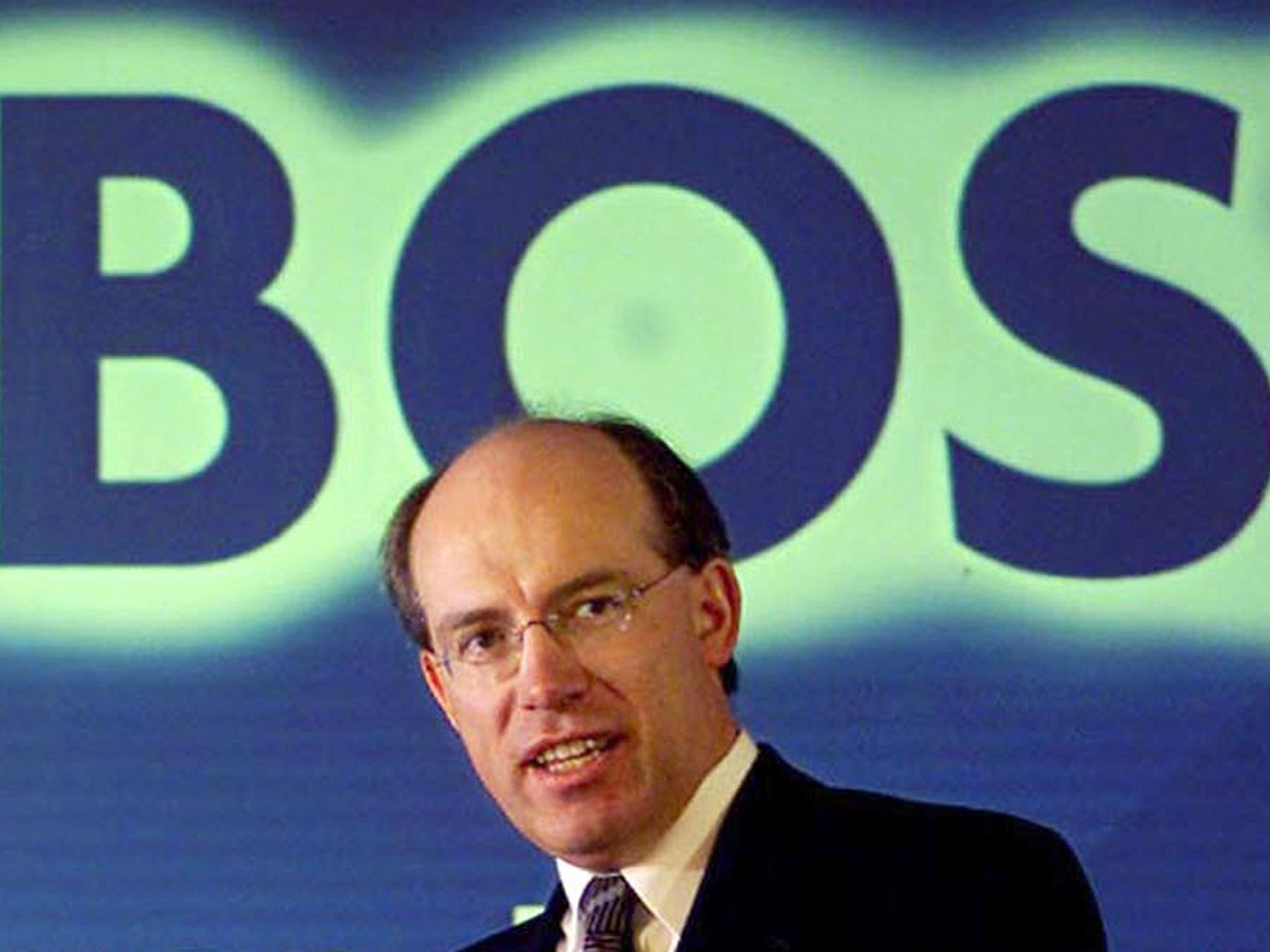

HBOS: 10 bankers 'could be banned' for 2008 mortgage-lender collapse

Two delayed reports into the collapse of HBOS have been published

Regulators will consider barring 10 executives involved in the collapse of the mortgage lender HBOS, it has emerged, after two reports were published on Thursday.

The Bank of England and the Financial Conduct Authority are considering whether to open an investigation into whether former senior managers of HBOS should be banned.

The review published on Thursday concluded that ultimate responsibility for the failure of HBOS rested with the board and senior management. They failed to set an appropriate strategy for the business and failed to challenge a flawed business model that placed too much importance on growth "without due regard to the risks", the Bank of England said.

The report also found that the regulator at the time, the Financial Services Authority, did not pick up on the extent of the risks HBOS was running because of flaws in its approach.

HBOS, which traded under the brands Halifax and Bank of Scotland, had to be rescued in late 2008 via a government-engineered takeover by rival Lloyds. Lloyds later needed a to be bailed out by the taxpayer for £20 billion.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments