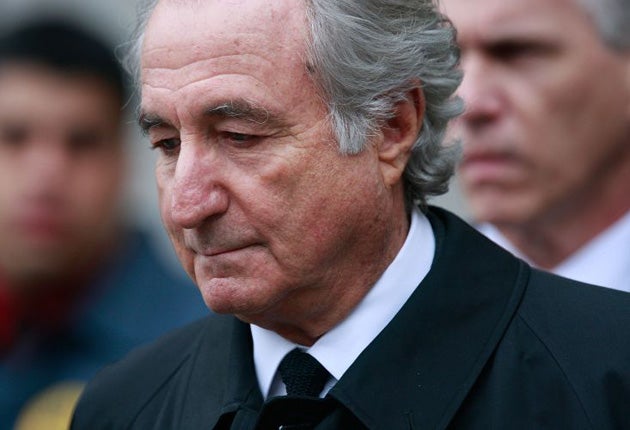

HSBC 'took kickbacks to keep Madoff in business'

Bernie Madoff was able to con thousands of extra investors by using a British bank which "looked the other way" and ignored repeated warnings that he was engaged in a sophisticated fraud, according to the man charged with recovering their losses.

HSBC and its staff were accused of receiving "kickbacks for looking the otherway while legitimising BLMIS (Bernard L Madoff Investment Securities) through their name and brand, making it attractive to investors".

The accusations were levelled in a $9bn (£6.4bn) US lawsuit filed on behalf of Madoff's victims by Irving Picard, the New York lawyer liquidating the convicted fraudster's empire. Madoff is serving 150 years for the $65bn fraud, one of the biggest in history. Madoff's pyramid investment or Ponzi scheme "could not have been accomplished or perpetuated unless the HSBC defendants agreed to look the other way and to pretend they were ensuring the existence of assets and trades when, in fact, they did no such thing", Mr Picard said in the filings.

The bank was said to have been repeatedly given evidence of "red flags" against Madoff's operations – including twice by the international accountancy firm KPMG – only to ignore them because of the lucrative fees it was making through funnelling investors towards the conman.

"Had HSBC and the defendants reacted appropriately to such warnings and other obvious badges of fraud ... the Madoff Ponzi scheme would have collapsed years, billions of dollars, and countless victims sooner," said Mr Picard. "The defendants were wilfully and deliberately blind to the fraud, even after learning about numerous red flags surrounding Madoff."

Mr Picard wants to recover the $9bn from HSBC and a network of international funds that acted as "feeders", enticing investors to place money with Madoff's investment company. It makes the bank the biggest defendant so far, eclipsing lawsuits already filed against the Swiss bank UBS and America's JP Morgan. Other defendants named in the HSBC suit include the Italian bank UniCredit and Austria's Bank Medici.

The accusations levelled against HSBC will come as a huge embarrassment to a company which has become increasingly controversial, having threatened to quit London for Hong Kong should the Government seek to impose too heavy a levy against banks or attempt to break it up after the Independent Commission on Banking, set up by the Chancellor, reports next year.

However, suits against more European banks are likely to follow. The lawsuit, filed in the US Federal Bankruptcy Court in Manhattan, is the latest move by Mr Picard who has filed more than 100 lawsuits over the last few days in a bid to recover funds from those institutions which he claims enabled the fraud or those who received "false profits" by getting their money out of the scheme before it collapsed. Mr Picard faces a deadline of Friday – the two-year anniversary of Madoff's arrest – to file everything.

The writ says that, despite KPMG's warning of "fraud risks and deficiencies" with the Madoff funds, "HSBC defendants nevertheless continued to enable Madoff's fraud for their own gain". It adds that, having found itself "no longer satisfied with being a mere marketing tool", HSBC "developed derivative structured financial products that poured even more money into BLMIS's business, providing Madoff with the substantial assistance he needed to keep the Ponzi scheme going".

Madoff's scheme required a constant supply of new investors to enable him to pay off others – often favoured clients – who wanted get their money out. The fraud, which began in the early 1990s, was only discovered after clients tried to withdraw nearly $7bn during the downturn and he was unable to pay.

The lawsuit says that, in a 2001 due diligence report, "HSBC noted that the investment community was 'baffled' by Madoff" and doubted that the "split-strike conversion strategy (SSC)" that he purported to employ could generate the returns he claimed.

It says that HSBC "suspected that Madoff might be illegally front-running the market using information he gleaned from his market-making operations". They also feared the "potentially greater risk" that Madoff "was not, in fact, implementing the SSC strategy".

But it goes on: "Driven by the steady returns BLMIS purported to produce, and the profits it generated, the HSBC defendants looked the other way. Red flags that should have alerted HSBC that something was wrong included the suspiciously high returns generated by Madoff, the secrecy with which he conducted his operations and the fact that they seemed immune to market turbulence that afflicted other investment funds.

"Instead of reacting to these red flags with any modicum of suspicion, scepticism, or candour, the defendants reacted with sarcasm," the lawsuit says. It goes on to claim that in February 2006 two HSBC staffers – whose names have been blacked out in the court filing – put the stunning performance of the funds down to "the magic of Madoff".

In a statement, HSBC said: "HSBC is defending itself vigorously against Madoff-related claims that have been brought against it in various jurisdictions around the world including in class actions in the US. HSBC believes that the US court-appointed trustee's claims of wrongdoing are unfounded and it will defend itself vigorously against these claims as well."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments