Mark Carney seeks to downplay impression of rift with Theresa May on Bank of England money printing

The Bank of England Governor suggested he was not alarmed by the Prime Minister’s words to the Tory Party conference and said he ‘absolutely [did] not’ see them as an attack on the Bank’s independence.

The Bank of England’s Governor Mark Carney has said he “entirely agrees” with the spirit of Theresa May’s views on monetary policy, trying to play down any sense that the Prime Minister intends to undermine the independence of the central bank.

In her speech at the Conservative Party conference on Wednesday, Ms May criticised the fact that the Bank of England’s money printing and low interest rates have made the wealthy richer and promised that “a change has got to come”.

The unusually critical words prompted some to question whether the Government was preparing to shut down the Bank’s quantitative easing programme, which was extended by £70bn in August by the Monetary Policy Committee to help the UK economy in the wake of the Brexit vote.

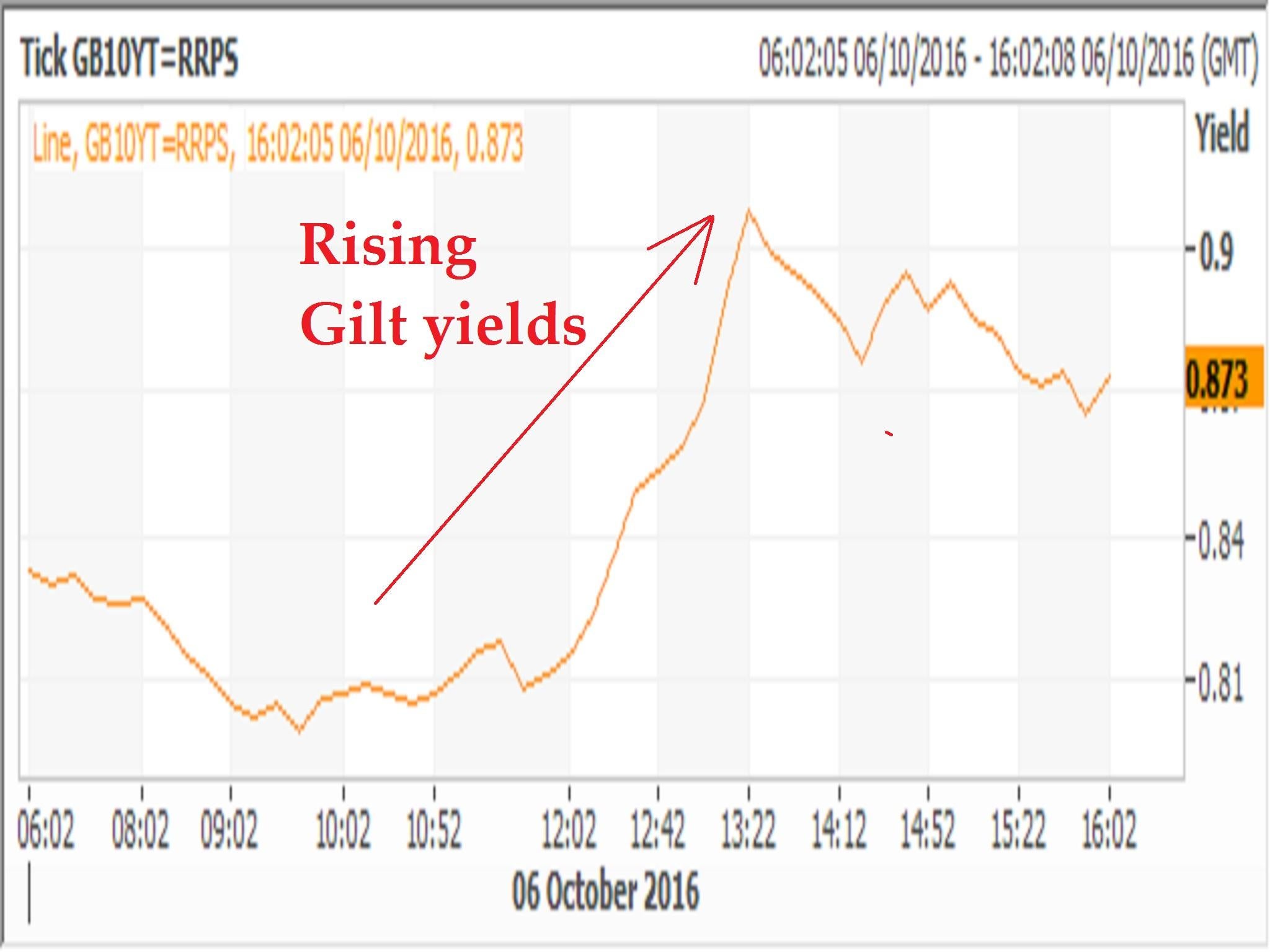

There was something of a market sell off of UK 10-year government bonds (known as Gilts) on Thursday with yields, which move in the opposite direction to prices, rising by as much as 10 basis points to 0.9 per cent, seen by some as a market reaction to Ms May’s comments.

Gilt sell off

But speaking at the International Monetary Fund’s meeting in Washington on Thursday afternoon, Mr Carney suggested he was not alarmed by the Prime Minister’s words and said he “absolutely [did] not” see them as an attack on the Bank’s independence.

He agreed that it was true QE has distributional wealth consequences by boosting all asset prices, but added it was not the job of the central bank to "offset" these.

The Prime Minister’s aides sought to quash the idea of an encroachment on the Bank’s operational independence immediately after her speech on Wednesday.

And George Freeman, the Conservative MP who chairs the No 10 policy board, suggested to BBC Newsnight that the Government would use fiscal policy, rather than rely on monetary policy from the Bank of England, to support GDP growth and that moves along these lines would be unveiled in Chancellor Philip Hammond’s Autumn Statement on 23 November.

Sam Hill of RBC Capital Markets said the Government might seek to offset the inegalitarian wealth impact of QE through other fiscal measures such as special pensioner bonds, which give older savers a higher income on cash balances than the market rate.

“We don’t necessarily think the only response is to ask the existential question about QE – to QE or not to QE? That is probably not the question,” he said.

“Rather, we think it is more likely to remain a policy tool available to the Bank of England, but that there will be additional complementary government action to tackle the side effects.”

Mr Carney must decide in the coming months whether he wishes to extend his tenure as Governor to 2021, or leave in 2018 as he originally planned when he took the job in 2013.

In an interview with Bloomberg Television on Thursday, Mr Hammond said he would “welcome his [Mr Carney’s] decision to stay if that is the decision he makes”.

The Bank has taken interest rates down to an all-time low of 0.25 per cent and acquired £375bn of UK government bonds to stimulate the economy.

In August it announced another £70bn of asset purchases, including £10bn of corporate bonds, and indicated it might cut rates still further later this year to help the economy weather the shock of the Brexit vote.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments