Now meat price surge raises fear of food inflation

Hike in demand from emerging nations pushes cost of lamb to 37-year high

Freakish weather conditions and soaring demand from China, Brazil and other fast-emerging economies have pushed meat prices around the world to a 20-year high.

International food prices have risen to their highest in two years, shooting up five per cent between July and August. Wheat is up by more than 50 per cent since May.

Meat prices are at their highest since 1990 on the United Nations Food and Agriculture Organisation's index, up 16 per cent on last year and almost a third higher than at the beginning of last year. Lamb is at a 37-year high, beef is the most expensive in two years and pork stands at record levels.

The immediate cause is the rapid inflation in the cost of livestock feed, caused by the spike in the cost of wheat because of the Russian drought. Fertiliser prices have also risen dramatically.

Although this will push inflation in the UK and other advanced economies a little higher next year, the most dramatic effects will be felt in poorer nations where food takes a much larger share of household budgets. In Mozambique yesterday, protesters burned tyres on the streets of the capital Maputo and there were reports of another fatality, a day after at least four people were killed in clashes between police and rioters. Mozambique produces only 30 percent of the wheat it needs and imports the rest.

Mozambique is unlikely to be the last country to see unrest because of the price of food; similarly high prices in 2008 sparked riots from Mexico to Indonesia, before the global slump pushed commodity prices back down.

In Russia, one-quarter of arable land was destroyed this summer (10 million hectares, or 25m acres) in the country's worst drought on record. An export ban has exacerbated the problem for other nations. Panic buying of virtually any foodstuffs in Russia has ensued.

On the supply side of the equation, there has also been pressure on production in major meat powers such as Argentina, the US and Australia, again due to a succession of dry seasons and generally low prices for a time that discouraged investment in new stock. In Australia, herds need to be rebuilt after breeding cattle were slaughtered for sale – which may cut beef exports by 5 per cent this year.

Other soft commodities, from coffee and tea to cotton and orange juice, have also hit new highs this year, largely because of unusual weather, though there has been some moderation in recent weeks as fears for global economic growth have faltered.

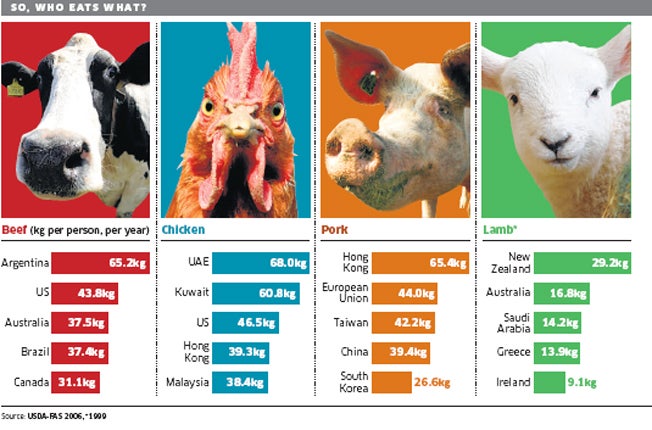

Longer term, apart from the possible effects of climate change, the principal pressure on food prices is the growth of more prosperous middle-classes in nations such as China, Brazil, Indonesia and India, who typically choose a diet richer in protein as their incomes rise, with a taste for pork and poultry.

Pork consumption is rising most in Russia, Brazil, Vietnam and Mexico, and record demand for beef in the world's second largest beef producer, Brazil, will limit its exports.

A combination of growing populations with changing dietary habits will underpin meat and other food prices until agricultural productivity catches up, experts say, although resistance to such innovations as genetically modified food may hold back advances. The trend towards biofuels as oil has become more expensive has also pushed grain prices higher. Speculation has sometimes amplified trends up and down.

A major commodities price explosion is the last thing a fragile world recovery needs. More poignantly, it threatens the very survival of the one billion of the world's poorest who live on less than $2 a day.

The rise of mince

Sales of mince have overtaken those of steak and of roasting joints for the first time. The move towards the relatively cheap option is a warning that the beef industry is in peril, farmers and butchers claim.

Supermarkets are devoting more and more shelf-space to mince in a bid to "lure" customers in, Oisin Murnion, chairman of the National Beef Association (NBA) said. He added: "If more mince goes on the shelves then more beef cattle will be massively devalued and more farmers will give up producing it."

NBA figures show that supermarkets sell mince at an average of £3.70 per kilo, compared to more profitable cuts that sell for up to £19 a kilo.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments