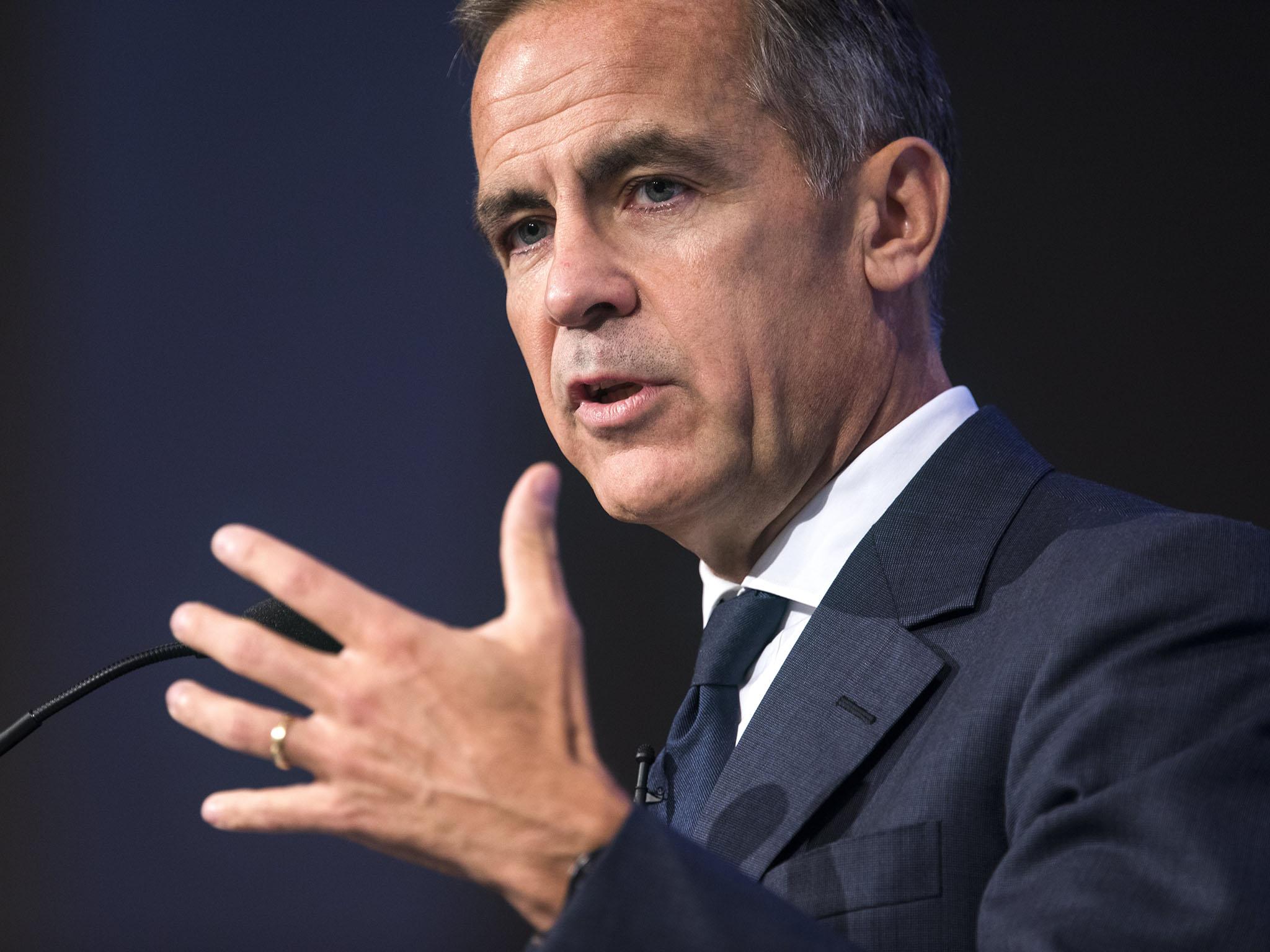

UK interest rates likely to rise from historic lows 'over coming months', says Mark Carney

The Governor says some withdrawal of monetary stimulus is likely to be appropriate in order to return inflation to its 2 per cent target

The Bank of England Governor, Mark Carney, has reiterated that UK interest rates are likely to rise from their historic lows “over the coming months”, setting the scene for the first rate hike from the central bank in 10 years.

He also warned that Brexit will – in the near term – reduce Britain’s openness to overseas trade and that leaving the EU was already reducing the potential size of the British economy.

Speaking at the International Monetary Fund in Washington, Mr Carney, repeated the view from the minutes of the most recent Monetary Policy Committee (MPC) meeting last week that the cost of borrowing is likely to rise later this year absent a sudden deterioration.

“If the economy continues to follow a path consistent with the prospect of a continued erosion of slack and a gradual rise in underlying inflationary pressure then, with the further lessening in the trade-off that would imply, some withdrawal of monetary stimulus is likely to be appropriate over the coming months in order to return inflation sustainably to target,” he said.

The Bank’s nine person MPC voted by 7-2 to keep rates on hold at 0.25 per cent last week.

But it warned that inflationary pressures would probably force a change from members relatively soon. This hawkish message was greatly enhanced when Gertjan Vlieghe, formerly the most dovish member of the MPC, signalled that he was now personally prepared to increase rates.

The financial markets scrambled to reprice sterling and sterling assets last week, sending up the pound to its highest level against the dollar since last year’s Brexit vote.

In the wake of the release of Mr Carney’s speech text the currency was trading at $1.3524, around 0.5 per cent down on the day.

Ten-year gilt yields were at 1.295 per cent, up from just 0.975 as recently as 7 September.

Mr Carney stated that while the goal of many Brexiteers was to make the UK more open to international trade and to sign new free trade deals with the likes of the EU and China the initial impact would be the opposite.

“Any reduction in openness with the EU is unlikely to be immediately compensated by new ties of a similar magnitude with other trade partners. And even if new agreements with other partners could be struck instantaneously, the reorientation of business relationships will take some time.”

“This makes Brexit, relative to the experience of the past half century, unique. It will be, at least for a period of time, an example of de-globalisation not globalisation. It will proceed rapidly not slowly.”

Inflation currently stands at 2.9 per cent, and is expected to shortly breach 3 per cent.

The official target is 2 per cent.

Mr Carney said in his Michael Camdessus Central Banking Lecture on Monday that the Bank was more pessimistic about the potential growth rate of the UK economy due to Brexit.

“On the supply side, the process of leaving the EU is beginning to be felt,” he said, pointing out that the Bank thinks investment levels by 2020 are likely to be a fifth lower than expected before the Brexit vote.

“The latest indicators are consistent with UK demand growing a little in excess of the diminished rate of potential supply growth, and the continued erosion of what is now a fairly limited degree of spare capacity. If anything, recent developments suggest that the remaining spare capacity in the economy is being absorbed a little more rapidly than had been expected, and that inflation remains likely to overshoot the 2 per cent target over the next three years,” he said.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies