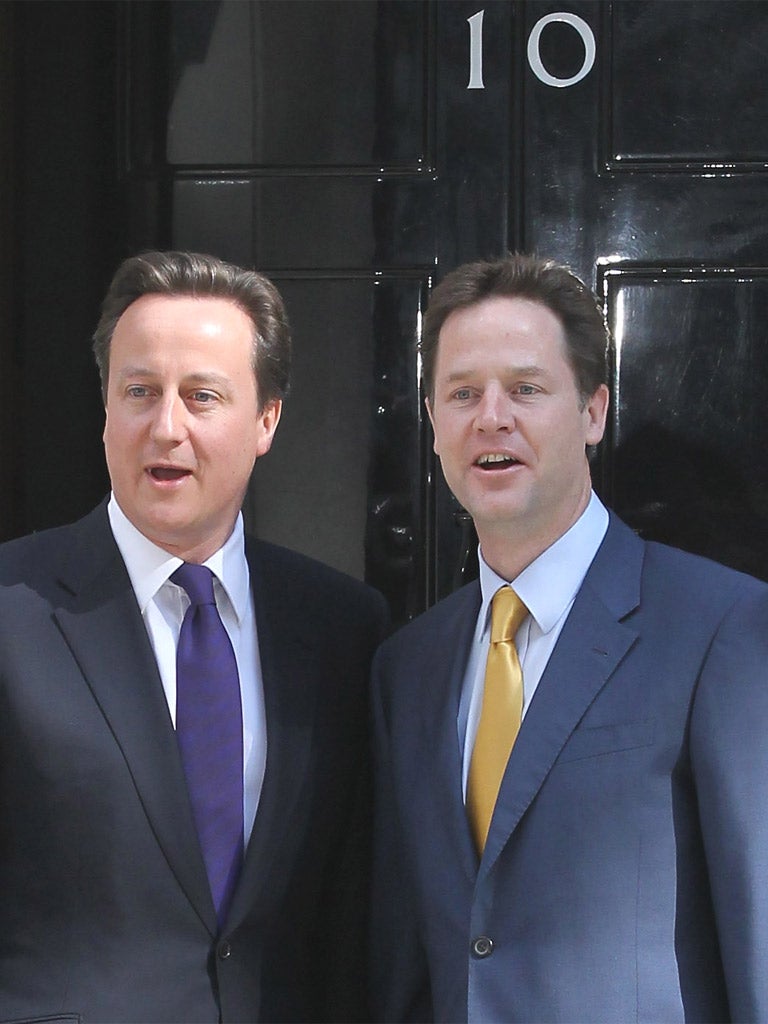

Coalition row breaks out over sale of RBS shares to the public

Although both parties want to see many of the shares go to ordinary people, Lib Dems are worried that George Osborne may adopt a scheme that would see a rise in the share price benefit the Treasury

A Coalition row has broken out over the proposed sale to the public of shares in the state-owned Royal Bank of Scotland as Liberal Democrats warned that they will not allow ordinary people to be “conned.”

Although both parties want to see many of the shares go to ordinary people, Lib Dems are worried that George Osborne may adopt a scheme that would see a rise in the share price benefit the Treasury or City institutions rather than the public. “We are not going to let him do a con job,” said one Lib Dem source. “We will looking at the small print very closely.”

The Treasury insists the Chancellor has no fixed timetable, share price or favoured method in mind for RBS. But Lib Dem ministers are convinced he plans a populist sell-off or giveaway before the 2015 general election and are concerned that people could find themselves left with shares of little value afterwards.

Stephen Williams, a Lib Dem party spokesman on Treasury matters and the first MP to campaign for shares to be handed to all 45m British adults, said yesterday: “I would like every citizen to get some of those shares so that when they increase in value they get to keep the profit, because we all suffered in different ways from the £66bn cost of the [taxpayers’] bailout. That would be a fairer way to repay the British public rather than a conventional privatisation where only the well-off would buy the shares.” He argued that a quick sell-off before the election would be “odd”.

There is tension between the Coalition partners because the Treasury was sceptical when the Lib Dems floated a 1980s-style privatisation in 2010 but changed its tune about six months ago. “It is now claiming ownership of our big idea,” said one Lib Dem.

The prospect of an early sell-off will be dealt a blow early next week, when the cross-party Parliamentary Commission on Banking Standards is expected to come out against a quickfire sale. Pat McFadden, a Labour MP on the commission, warned Treasury minister Sajid Javid in the Commons: “If you were looking for a permission slip for a quick sale at a knockdown price, you will be disappointed.”

Labour MPs claimed Mr Osborne had sacked Stephen Hester, who announced his departure as the RBS chief executive on Wednesday. But Mr Javid insisted the Chancellor was not directly involved in the discussions and that the move was a matter for the RBS board.

The Government was met with a furious reaction in the City after £1.2bn was wiped off the value of RBS after Mr Hester’s announcement. It left taxpayers, who hold 80 per cent of the bank’s shares, £950m worse off as a result of the fall in the shares – which finished down 10.6p at 315p, in contrast to both Barclays and Lloyds which finished up on the day.

Ian Gordon from Investec described the move as “deeply unsatisfactory” and accused ministers of repeatedly “making a bad situation worse”. Nic Clarke, at Charles Stanley, said the announcement “smashes any lingering pretence that RBS is being run on an arms length basis” from the Government and described it as “deeply damaging” for RBS.

Privately the responses of business leaders were considerably more critical of the Government’s role, which threatens to strain its relations with business.

City grandees praised Mr Hester’s performance in turning around a bank that was on its knees when he took over, with many feeling that he had been hard done by. Sir Roger Carr, who is preparing to take on the role of chairman of defence giant BAE Systems and is a member of David Cameron’s Business Advisory Group, said: “Stephen Hester took on a very difficult job that few had the appetite for, even fewer the competence to do.

“He has executed with skill and commitment he has taken a business that was in severe difficulty and brought it to the point of recovery and almost re-entry into the public market and he has done all of that with integrity, authority and dignity.”

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies