How your finances will be affected by the Autumn Statement

Who fared better? The rich or the poor? The single or the married? Simon Read and Julian Knight examine the consequences across the key categories

Single male

Men on average or below-average earnings will be cheered by the substantial uprating of personal allowances from April. The Chancellor went much further than previously announced, and individuals will now be able to earn up to £9,440 from next April without paying any income tax. The threshold for the 40 per cent income tax rate, which has been frozen in recent years, will rise by 1 per cent in 2014 and again in 2015, from £41,450 to £41,865, and then to £42,285. But this is likely to be much lower than inflation or even wage increases. As a result, far more people will be sucked into the 40 per cent tax bracket, a process called "fiscal drag". This could raise an extra £1bn a year for the Treasury by 2015. But if our singleton is reliant on his car, he will benefit from the Chancellor's decision to forgo the planned 3p increase in petrol duty.

Single female

Income tax personal allowances are to rise by much more than was announced in the last Budget. From April 2013, a single female will be able to earn £9,440 before paying any income tax. This will aid women in particular, as they tend to occupy more part-time and lower-paid posts. The Chancellor said that people earning the national minimum wage will see their income tax liability halved. The much heralded 'bonfire of civil servants' is bound to hurt women as they are over-represented among the ranks of the public sector. For younger people looking to get their foot on the property ladder, there was nothing to cheer in the Autumn Statement as stamp duty was left untouched. But those looking to save for a deposit did receive a small boost with the amount that can be saved tax free in an Individual Savings Account each year rising from its current level of £11,280 to £11,520.

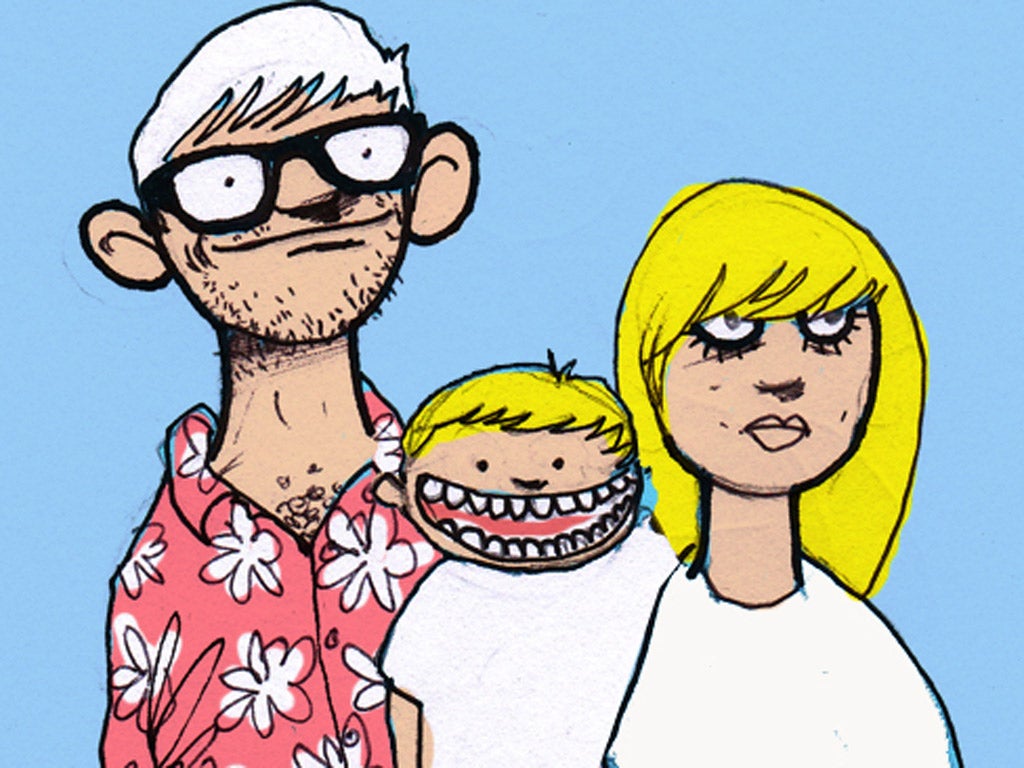

Poor nuclear family

Hard-up families that have been forced to cope with the Coalition years of austerity were told by the Chancellor yesterday that it's going to be at least another year of belt-tightening. He admitted that his target of reducing national debt by 2015-16 is going to be missed, and he said he now hopes to reduce the debt by 2016-17. With that in mind, Mr Osborne limited the rises in out-of-work welfare benefits – normally increased in line with inflation – to 1 per cent. With inflation currently at 2.7 per cent a year, the lowest-income families drawing benefits will effectively see their handouts worth 1.7 percentage points less. However, that's tempered by the rise in personal tax allowances, which go up by £1,335 in 2013-14 to £9,440, putting an extra £266 a year into workers' pockets.

Middle-income nuclear family

The rise in personal tax allowances from next April to £9,440 will help middle-income families, putting an extra £266 a year into their household fund. The average weekly household expenditure was £483.60 in 2011, so that extra cash works out at half a week's household spend. But it's not to be sniffed at, especially when the existing £8,105 tax-free allowance was only due to climb to £9,205. Of more use could be the scrapping of the planned 3p increase in fuel duty next month. Depending on how much ferrying the kids around is involved, that could end up as a tidy saving. Also useful is the increase in the amount people can put into a tax-free Individual Savings Account, to £11,520. But the bad news is that the 400,000 people being dragged into the higher-rate tax band are likely to be drawn from these families.

Married, no kids

With no expensive children to pay for, you may be free to stash more money into a tax-free individual savings account, so the Chancellor's announcement of an increase in the annual allowance to £11,520 will please. However, depending on your view of the currently fluctuating stock markets, you may be disappointed that he failed to take the opportunity to increase the amount you can put into cash savings in an ISA – it remains at half the total, £5,760. Mr Osborne's introduction of AIM shares into the ISA package shouldn't be of much interest, unless you really want to take a punt with your savings. However the reduction in pension contribution limits to £40,000 a year may be a little confusing as that could clearly be perceived as a sign that saving for retirement is frowned on, when everything else this Government has said about the issue has indicated otherwise. With no children to worry about, packing cash into a pension should have been a priority but maybe it could now make more sense to consider another property, especially with there being no mention of the dreaded Mansion Tax in yesterday's statement. Of more interest to the drivers among you will be the U-turn over the 3p increase in fuel duty. Due in January, it has been scrapped. That will make the runs down to the country all the more affordable.

Single mother

Any rise in the annual amount you can earn without having to pay tax can make a huge difference. The Chancellor's announcement that it will climb to £9,440 – inching ever closer to the coalition's stated aim of making it £10,000 – will therefore cheer. It will effectively add £266 a year to your purse. There is also good news about child benefits, if you are still able to claim them. Having been frozen by the Chancellor, they will be unfrozen from 2014 for two years, which will see them going up. However, the increase will be limited to 1 per cent a year, which is far below the current rate of inflation, at 2.7 per cent. That means, in real terms, any extra benefit will be worth less, buying you less food or clothing. If you're out of work, any benefits that you're still entitled to will also climb by 1 per cent from 2014, again much lower than the rate of inflation. So your spending power will be cut but the Treasury will save an extra £2.5bn from these benefit adjustments. In fact, research from the House of Commons Library suggests that 81 per cent of the key additional direct tax, tax credit, and benefit changes in yesterday's Autumn Statement will come from women. Never mind, eh? There's good news if you can still afford to take your car on the road. The Government has scrapped the planned 3p increase in fuel duty set to hit in January.

Rich nuclear family

The cut in tax relief on pension savings by a fifth will hit rich families the most. If you planned to stash plenty of cash away for your retirement, you may need to have a hasty rethink. The amount you can put into your pension each year will fall from its current £50,000 level to £40,000 in 2014. Not only that, the lifetime limit will be slashed from £1.5m to £1.25m. On the other hand, the starting point for higher-rate tax is to be increased by 1 per cent and personal tax allowances are to go up by £1,335 in 2013-14, which is worth an extra £266 a year. Meanwhile, the National Insurance upper earnings limit, which is equivalent to the higher-rate tax threshold, will be reduced to £797 per week from April 2013. That will be a saving of about £123 a year for those earning more than £42,500. Homeowners will also be pleased to see no 'mansion tax' introduced, despite LibDem hopes.

Pensioner couple

All pensioners will benefit from the uprating of the basic state pension in line with earnings, prices or a minimum 2.5 per cent. But the age-related personal allowances that allowed older people to retain much more of their income will still be superseded by a single personal allowance available to all regardless of age. Those retired who are in income drawdown – where they keep their pension capital invested but draw a regular income from it – will benefit from a change in the rules that means the amount of income they will be able to take each year will rise. Those with very healthy pension pots, higher than £1.25m, will be subject to tax. Previously, the lifetime limit on funds was £1.5m. Of course, £1.25m sounds like an awful lot of money but this will impact pensions of senior public-sector workers. Like single pensioners, the 1 per cent increase in inheritance tax will draw more estates into the taxman's net.

Single pensioner

The key news is that the squeeze on welfare announced for families and the unemployed won't hit pensioners. The Chancellor said that he still intends to continue with the 'triple lock', where the state pension rises in line with earnings, prices or a minimum 2.5 per cent. As a result, the basic state pension will rise 2.5 per cent next year to £110.15 a week. But for people looking to leave something behind, the news was not so good with the current £325,000 threshold on inheritance tax only set to rise 1 per cent from 2015-16. This means it is likely that by the latter half of the decade, far more estates will be subject to IHT on death than is presently the case. Meanwhile, in a bid to simplify the tax system for pensioners – and save some cash – the Chancellor had previously announced the scrapping the age-related allowances for anyone reaching the age of 65 on or after 6 April 2013. Instead, there will be a single personal allowance for all.

Unemployed

If there is one group more than any other that has lost out as a result of the Autumn Statement, it is Britain's almost three million unemployed. Unable to benefit from the dramatic uprating of income tax personal allowances, the unemployed are left with the pain of benefit increases that are likely to be well below inflation. From April, work-related benefits such as jobseekers' allowance will rise by 1 per cent. This compares with the current level of inflation as measured by the Consumer Price Index of 2.7 per cent. But the pain doesn't end there as the 1 per cent uprating of benefits such as jobseekers' allowance, employment and support allowance and income support will be 1 per cent for the next three years. This means that the £71 jobseekers' allowance is likely to rise by , next year. And for those unemployed families, the news is worse still with child-benefit rises capped at 1 per cent for two years.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks