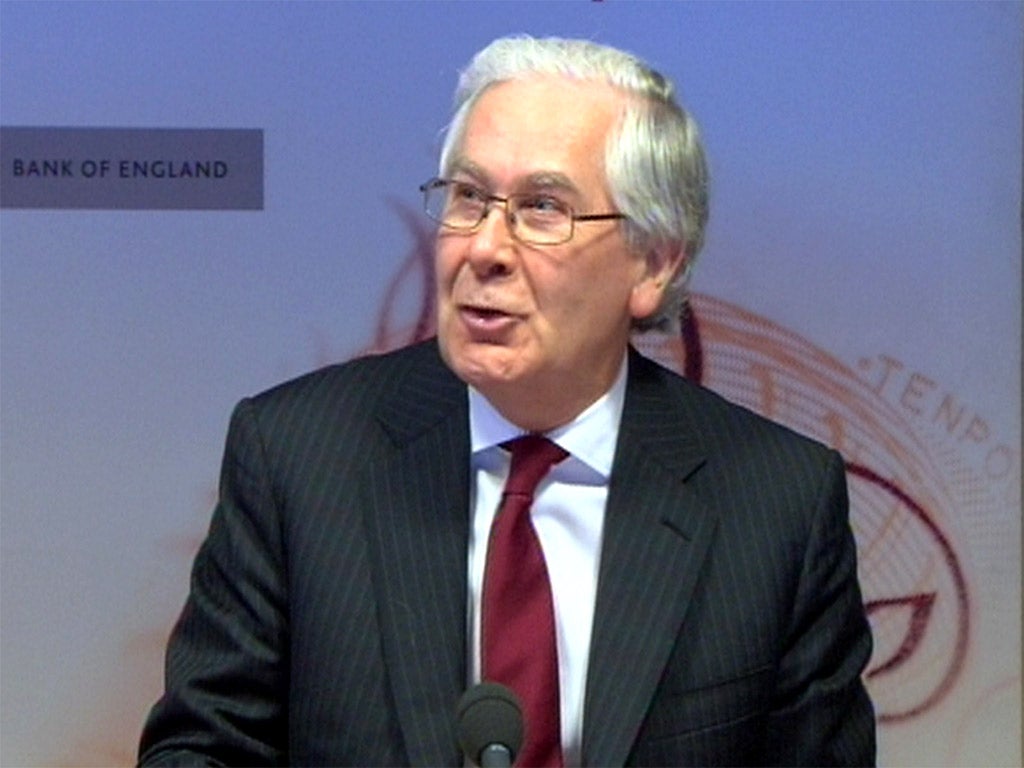

Outgoing governor of the Bank of England Sir Mervyn King issues warning over 'Help to Buy' scheme

The outgoing governor of the Bank of England has warned that George Osborne's plan to boost the housing market is "too close for comfort" to a general state guarantee for mortgages.

Sir Mervyn King said there was "no place in the long run" for the Chancellor's Help to Buy scheme, which will see the Government will guarantee up to 15% of a mortgage on properties worth up to £600,000.

The scheme, which starts in January 2014, is due to run for three years and Sir Mervyn warned it must not be allowed to become permanent.

In an interview which will be broadcast on Sky News' Murnaghan programme today, Sir Mervyn said: "I'm sure that there is no place in the long run for a scheme of this kind.

"This scheme is a little too close for comfort to a general scheme to guarantee mortgages. We had a very healthy mortgage market with competing lenders attracting borrowers before the crisis, and we need to get back to that healthy mortgage market.

"We do not want what the United States have, which is a government-guaranteed mortgage market, and they are desperately trying to find a way out of that position.

"So, we mustn't let this scheme turn into a permanent scheme. Now when is the right time to terminate it will depend on economic conditions at the time."

Sir Mervyn said the economy was in a "modest recovery" but "we certainly can't be satisfied with it".

He said: "We will need to do more to use up the spare capacity, and to get back to a healthy, growing economy. But we are in a recovery period now, I think, yes."

Sir Mervyn's concerns about Help to Buy echo those of the Treasury Select Committee, which reported on the Budget last month.

The committee warned the Government will come under "immense" pressure to extend Help to Buy in three years time.

It said: "The unintended and unwelcome outcome could well be that a scheme designed to deal with a supposedly temporary problem in the UK housing market becomes a permanent feature of the UK housing market."

Help to Buy consists of two elements, an "equity loan" scheme and the mortgage guarantee.

Under the equity loan new or existing homeowners will need to raise a deposit of 5% of the value of the property they want to buy, but can borrow up to a further 20% from the Government on an interest-free basis. The biggest loan available will be £120,000.

PA

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments