Charities call for ‘help to repay’ scheme for household energy debt

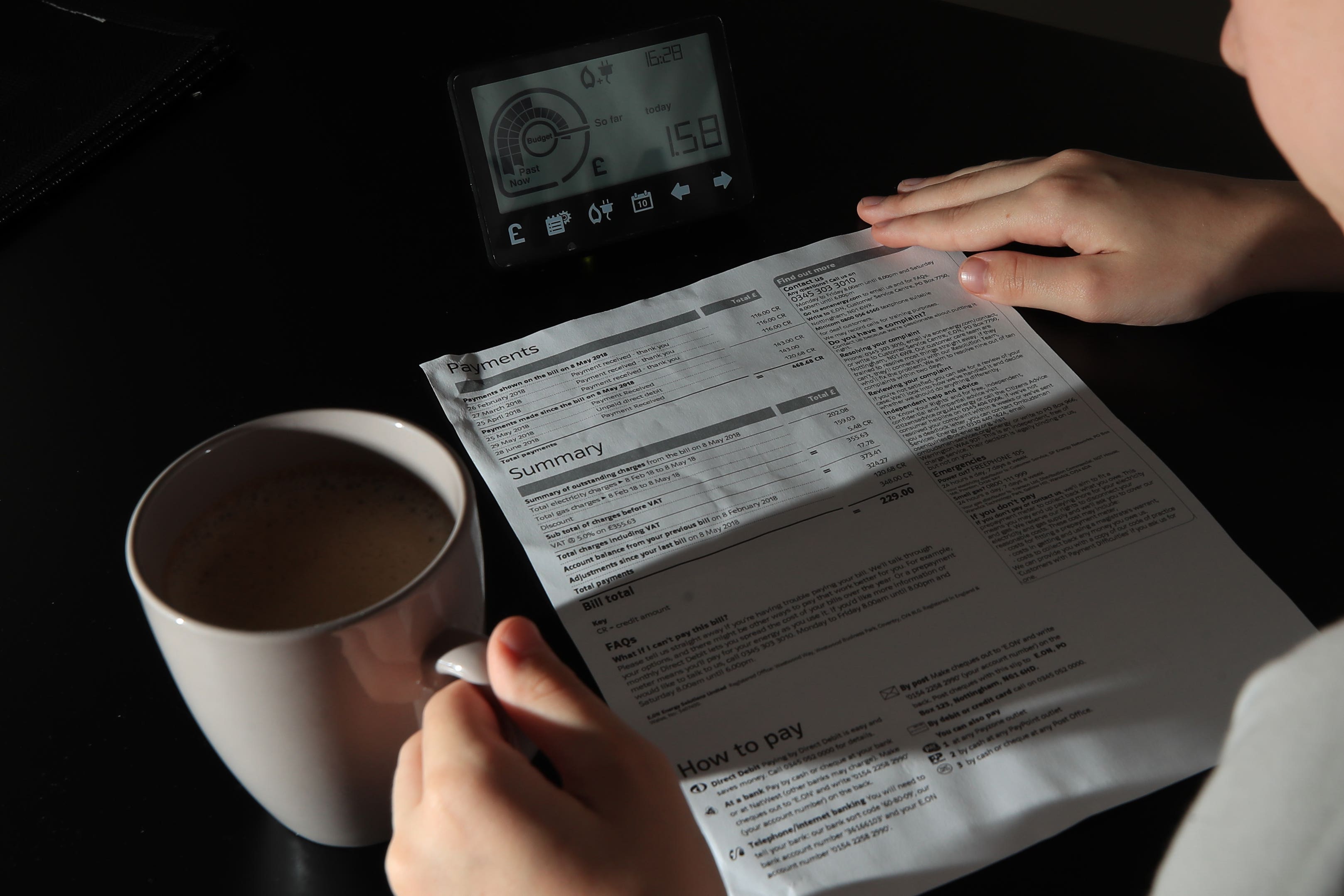

An estimated 5.5 million UK adults are behind on their energy bills, according to a survey for the Money Advice Trust.

Charities have called for a “help to repay” scheme for energy bills as millions of households struggle to repay arrears.

An estimated 5.5 million UK adults are behind on their energy bills, according to a survey for the Money Advice Trust, the charity that runs National Debtline and Business Debtline.

The service said the findings confirm the “heavy toll” soaring energy bills have taken on household finances, with 2.1 million more people in energy arrears in April than a year ago and millions struggling to get help from their suppliers.

Some 7% of those polled said they were unable to access help with their bills after contacting their suppliers for support, while 6% reported being unable to get through to their firm.

An estimated 3.2 million people have received demands from their energy supplier for repayments of arrears they cannot afford, the Money Advice Trust said.

As a result of the research, the Money Advice Trust, StepChange Debt Charity, National Energy Action, Scope and 10 other organisations have written to Energy Secretary Grant Shapps to call for a dedicated Government “help to repay” scheme for energy arrears, to provide repayment matching and the option to write off debts for people dealing with unaffordable arrears.

The letter also calls for urgent reform of debt collection practices for energy arrears.

Joanna Elson, chief executive of the Money Advice Trust, said: “Energy bills might finally be falling but for millions of households the effects of this cost-of-living crisis are already baked in.

“With more people falling behind on energy and other essential bills and millions facing unaffordable demands for repayment, we need urgent action to make sure everyone has access to a safe route out of debt.

“The Government has already provided substantial support to help with the cost of living but no-one should underestimate the scale of this continued crisis.

“The help to repay payment-matching scheme we are proposing will help those who otherwise will simply not be able to dig themselves out of the energy arrears that this crisis has created. And for those most in need, the Government should introduce an essentials guarantee to link the rate of universal credit to cover the cost of essential goods like food and energy.”

Energy debt is surging to unprecedented levels and it's clear that households are just unable to cope

Simon Francis, co-ordinator of the End Fuel Poverty Coalition, said: “Energy debt is surging to unprecedented levels and it’s clear that households are just unable to cope.

“The majority of this new debt is caused by the record high energy prices which have caused misery for millions but generated excess profits for the firms involved in Britain’s broken energy system.

“Rather than end the windfall tax early, as the Government plans to do, it should instead look at how this could be used to help get those people suffering back on an even keel.

“Not only would this help reduce levels of fuel poverty now and into next winter but it will also help wider household finances, ensuring people no longer have to cut back on essentials.”

A Government spokesperson said: “We know this has been a difficult time for families, which is why the Government has covered around half of the typical household’s energy bill over winter.

“We are providing additional support to the most vulnerable, with an extra £150 for disabled people and £900 for those on means-tested benefits.

“We welcome the recent reduction in the price cap and will continue to monitor energy prices and keep support schemes under review.”

Opinium surveyed 2,000 UK adults between April 25-28.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.