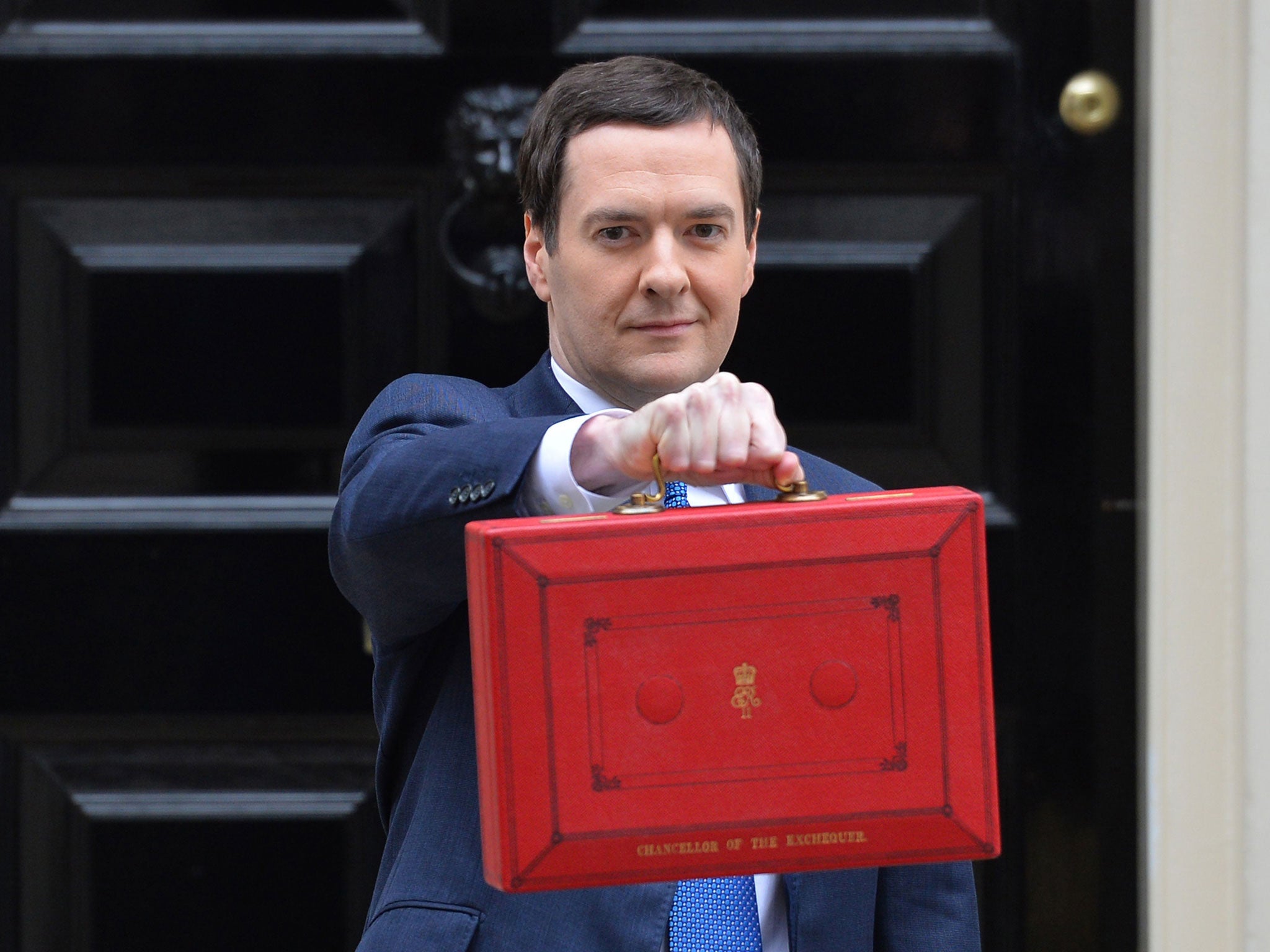

Budget 2014: At a glance - the key announcements

George Osborne said his Budget would boost “makers, doers and savers”. But it was far broader than that...

PERSONAL TAX

* Personal tax allowance to be raised to £10,500 next year; £800 average savings

* Higher rate threshold for 40p income tax to rise from £41,450 to £41,865 next month and then by further 1 per cent to £42,285 next year

* Transferable tax allowance for married couples to rise to £1,050

TAX

* 15 per cent stamp duty on homes worth more than £500,000 bought through companies

* Scrapping inheritance tax for members of the emergency services who "give their lives protecting us"

* Inheritance tax waived for emergency services personnel who "give their lives protecting us"

* VAT waived on fuel for air ambulances and inshore rescue boats

* Fuel duty rise planned for September cancelled

* Stamp duty on homes worth more £500,000 to rise to 15 per cent for those bought by companies, as part of tax avoidance measures

PENSIONS AND SAVINGS

* All tax restrictions on pensioners' access to pension pots removed and tax on cash removed on retirement cut from 55 per cent to 20 per cent

* Reform of taxation of defined contribution pensions to help 13 million people from March 27

* :Abolition of 10p starting rate of tax on income from savings

ECONOMY

* GDP growth forecast to be 2.7 per cent this year, then 2.3 per cent, 2.6 per cent, 2.6 per cent and 2.5 per cent in following years - making UK economy £16 billion bigger than predicted.

* Deficit revised down to 6.6 per cent this year, and forecast to fall in following years before going into surplus of 0.2 per cent in 2018/19

* Borrowing expected to be £108 billion this year - £12 billion less than forecast

* Debt revised down to 74.5 per cent of GDP this year; then predicted to peak at 78.7 per cent in 2015/16 and fall to 74.2 per cent by 2018

JOBS

* OBR forecasts 1.5 million more jobs over the next five years and earnings to grow faster than inflation

* Welfare cap set at £119 billion for 2015/16, rising to £127 billion by 2018/19, only state pension and cyclical unemployment benefits excluded

ENERGY

* £7 billion package to cut energy bills includes £18 per ton cap on carbon price support, saving medium-sized manufacturers £50,000 and families £15 a year

* Compensation scheme for energy intensive industries extended four years to 2019/20; £1 billion to protect manufacturers from cost of green levies

LEISURE

* Tobacco duty to rise by 2 per cent above inflation

* Alcohol duty escalator scrapped

* Duty on spirits and ordinary cider frozen. Beer duty cut by 1p a pint

* Duty on fixed-odds betting terminals increased to 25 per cent

* Bingo duty halved to 10 per cent.

* 20 per cent tax relief for theatre productions

INVESTMENT

* £270 million guarantee approved for the Mersey Gateway bridge.

* Support to build 200,000 homes.

* Additional £140 million made available for repairs and maintenance to flood defences

BUSINESS

* Business rate discounts and enhanced capital allowances in enterprise zones extended for three more years

* Research and development tax credit for loss-making small businesses raised from 11 per cent to 14.5 per cent

* Annual investment allowance doubled to £500,000 and extended to the end of 2015

GENERAL

* A scheme to boost exports - doubling the amount of finance available to £3bn

* An extra £140m for repairs and maintenance to flood defences and £200m for potholes

* Scrapping VAT on air ambulance services and inshore rescue boats

* A five-year cap on structural welfare spending from 2015, starting at £119bn and rising in line with inflation. It excludes pensions and Job Seekers Allowance

* Reform of air passenger duty so all long haul flights carry the same tax rate as currently charged for flights to USA.

* A new "garden city" at Ebbsfleet in addition to plans for 200,000 new homes

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks